A Russia-Ukraine peace deal making headlines right now is historic news — politically and emotionally.

But for the forex and commodities markets?

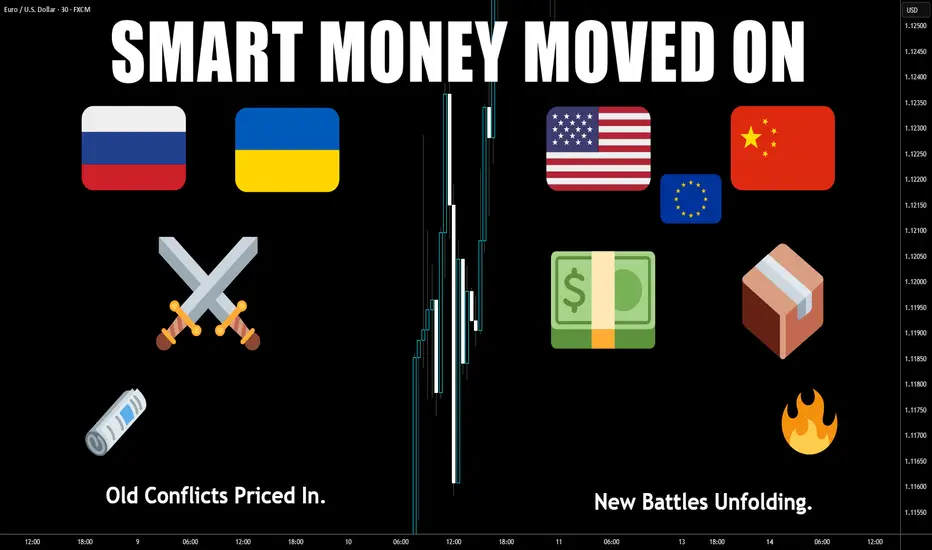

The real money already left this story behind months ago.

🧠 Smart Money Knows: Markets Price in the Future, Not the Past

The market already priced in a future where this conflict would eventually fade — peace or no peace.

📊 What Actually Drives Forex Now

While peace headlines grab attention, the real macro drivers today are:

This is where new money is flowing.

Not into a two-year-old headline finally catching up.

🛡️ "Buy the Rumor, Sell the Fact" in Action

→ It confirms expectations, not shocks them.

→ It may trigger a short-lived risk-on pop (EUR, AUD, NZD up, gold down) —

→ But unless it unleashes massive new money flows (unlikely), that pop gets sold.

🔥 Final Thought:

If you're still trading the last war, you're already late.

The next major moves won't come from peace headlines — they'll come from tariff escalations, inflation battles, and central bank pivots.

Focus forward.

That's where opportunity lives.

💬 Question for Serious Traders:

Which macro theme are you really watching into summer 2025?

Peace headlines... or the new fires already burning?

Drop your insights below. 👇

But for the forex and commodities markets?

The real money already left this story behind months ago.

🧠 Smart Money Knows: Markets Price in the Future, Not the Past

- Two years ago, the war sent shockwaves through oil, gas, wheat, and risk currencies.

- By late 2023, price action had already normalized — the "war premium" faded out quietly.

- Commodities stabilized. Forex volatility shifted. Safe havens lost their edge.

- Traders adapted, recalibrated, and moved on to new battlegrounds.

- Bottom Line:

The market already priced in a future where this conflict would eventually fade — peace or no peace.

📊 What Actually Drives Forex Now

While peace headlines grab attention, the real macro drivers today are:

- 🔥 Tariff escalation and global trade wars

- 🔥 Sticky inflation battles (core services inflation still high)

- 🔥 Central bank pivot games (Fed, ECB, BoJ)

- 🔥 Global growth fears (China slowdown, EU stagnation)

This is where new money is flowing.

Not into a two-year-old headline finally catching up.

🛡️ "Buy the Rumor, Sell the Fact" in Action

- For two years, markets have priced in an eventual end (or fade) to the Ukraine conflict.

- A peace agreement now?

→ It confirms expectations, not shocks them.

→ It may trigger a short-lived risk-on pop (EUR, AUD, NZD up, gold down) —

→ But unless it unleashes massive new money flows (unlikely), that pop gets sold.

🔥 Final Thought:

If you're still trading the last war, you're already late.

The next major moves won't come from peace headlines — they'll come from tariff escalations, inflation battles, and central bank pivots.

Focus forward.

That's where opportunity lives.

💬 Question for Serious Traders:

Which macro theme are you really watching into summer 2025?

Peace headlines... or the new fires already burning?

Drop your insights below. 👇

✅ Discord: discord.gg/qZx4vMcchy

✅ My Site: natronfx.com

✅ Twitter: twitter.com/natronfx

✅ YouTube: youtube.com/@natronfx

✅ TikTok: tiktok.com/@natronfx

✅ My Site: natronfx.com

✅ Twitter: twitter.com/natronfx

✅ YouTube: youtube.com/@natronfx

✅ TikTok: tiktok.com/@natronfx

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ Discord: discord.gg/qZx4vMcchy

✅ My Site: natronfx.com

✅ Twitter: twitter.com/natronfx

✅ YouTube: youtube.com/@natronfx

✅ TikTok: tiktok.com/@natronfx

✅ My Site: natronfx.com

✅ Twitter: twitter.com/natronfx

✅ YouTube: youtube.com/@natronfx

✅ TikTok: tiktok.com/@natronfx

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.