EUR/USD Weekly Outlook – May 15, 2025

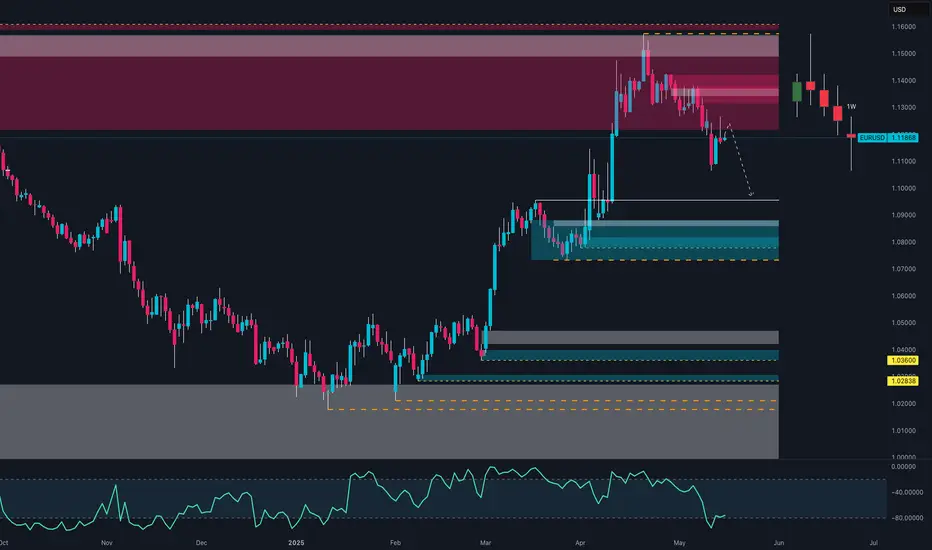

EUR/USD is showing clear signs of weakness after a sharp rejection from the key supply zone between 1.1450 and 1.1600. Last week’s candle closed decisively below the 1.1250–1.1300 structure, confirming the failure to sustain bullish momentum. The RSI has also dropped below the 40 level, signaling strong downside pressure.

From an institutional positioning standpoint, non-commercial traders are rebalancing: both longs and shorts on the euro have decreased, while spread positions have increased—suggesting hesitation and a lack of clear conviction. On the other hand, commercials remain heavily long on the euro, but this appears to be more of a hedging move than a directional bias. The US dollar is regaining strength, with new long positions added by speculative traders, aligning with the recent EUR/USD decline.

Retail sentiment shows that a majority of traders are short, but not in extreme proportions. There’s a heavy cluster of long orders between 1.1100 and 1.1050, likely serving as liquidity targets for further downside movement.

From a seasonal perspective, May is historically bearish for EUR/USD. All major seasonal timeframes (5y, 10y, 15y, 20y) point to consistent average negative performance in this month. The current 2025 trend aligns perfectly with this historical pattern, providing a statistical tailwind to the bearish thesis.

Macro-wise, today’s key US data releases—PPI and Retail Sales—could significantly impact the USD. A positive surprise would further strengthen the dollar, adding downward pressure on the pair. Market attention is also focused on Fed Chair Powell's speech later today, which could add fuel to the current move.

Conclusion: The macro, technical, sentiment, and seasonal frameworks all converge on a bearish continuation for EUR/USD. A weekly close below 1.1175 would confirm the downside extension, targeting the 1.0850–1.0700 demand zone. A break above 1.1330 would temporarily invalidate the bearish setup.

EUR/USD is showing clear signs of weakness after a sharp rejection from the key supply zone between 1.1450 and 1.1600. Last week’s candle closed decisively below the 1.1250–1.1300 structure, confirming the failure to sustain bullish momentum. The RSI has also dropped below the 40 level, signaling strong downside pressure.

From an institutional positioning standpoint, non-commercial traders are rebalancing: both longs and shorts on the euro have decreased, while spread positions have increased—suggesting hesitation and a lack of clear conviction. On the other hand, commercials remain heavily long on the euro, but this appears to be more of a hedging move than a directional bias. The US dollar is regaining strength, with new long positions added by speculative traders, aligning with the recent EUR/USD decline.

Retail sentiment shows that a majority of traders are short, but not in extreme proportions. There’s a heavy cluster of long orders between 1.1100 and 1.1050, likely serving as liquidity targets for further downside movement.

From a seasonal perspective, May is historically bearish for EUR/USD. All major seasonal timeframes (5y, 10y, 15y, 20y) point to consistent average negative performance in this month. The current 2025 trend aligns perfectly with this historical pattern, providing a statistical tailwind to the bearish thesis.

Macro-wise, today’s key US data releases—PPI and Retail Sales—could significantly impact the USD. A positive surprise would further strengthen the dollar, adding downward pressure on the pair. Market attention is also focused on Fed Chair Powell's speech later today, which could add fuel to the current move.

Conclusion: The macro, technical, sentiment, and seasonal frameworks all converge on a bearish continuation for EUR/USD. A weekly close below 1.1175 would confirm the downside extension, targeting the 1.0850–1.0700 demand zone. A break above 1.1330 would temporarily invalidate the bearish setup.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.