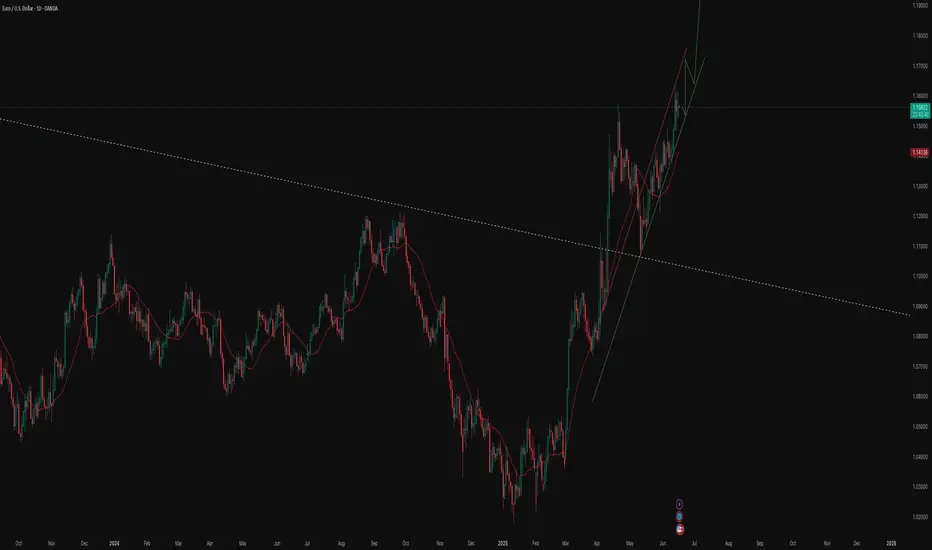

The pair has recently completed a major technical breakout by moving above a long standing trendline that dates back to the 2008 high. For more than 15 yearsthis trendline acted as strong resistance, repeatedly rejecting bullish attempts. The latest move did not just break through this resistance. It returned to retest the level around the 1.1450 to 1.1500 area and held with near perfect precision. This successful retest signaled a structural shift, turning former resistance into solid support. Since then, the pair has remained within a steep upward channel, forming higher lows and maintaining strong upside momentum. This momentum appears to be backed by real macro flows rather than just short-term speculation.

The euro’s recent strength is not being driven by strong economic performance in the Eurozone. Instead, it reflects a broader shift in global capital allocation and diverging monetary policy expectations. The Federal Reserve began easing policy in late 2024 with a series of rate cuts aimed at responding to softening inflation and slowing labor market conditions. By early 2025, the Fed had completed a handful of cuts before entering a pause. That pause remains in effect for now but markets are increasingly expecting the Fed to resume cutting later this year, with 2 to 3 additional cuts projected for the second half of 2025. These expectations have weakened the dollar as traders anticipate a return to more accommodative policy. (This is known as pricing in or speculative markets)

On the European side, the European Central Bank began cutting rates in late 2024 (Duh we all know this by now) and is now widely seen as operating in neutral territory. The ECB has taken a careful and measured approach to easing, avoiding any aggressive dovish turn and instead emphasizing a data dependent path. With limited room to cut further and no urgent economic pressure to do so, the euro has maintained a relative yield advantage compared to the dollar, even in a context of muted growth.

Another important driver of euro strength has been the rotation of capital into U.S. equities, particularly in the technology and large cap sectors. As investors allocate more capital into risk assets, the dollar tends to weaken in FX terms, as funding shifts out of USD and into growth exposures (aka emerging markets) This type of flow indirectly benefits the euro. At the same time the dollar is no longer acting as a dominant safe haven for now. Despite the presence of global uncertainty, low market volatility and return focused positioning have reduced the appeal of defensive USD flows. This has allowed the euro to benefit from repositioning, not because of its own economic strength, but because the dollar is no longer absorbing global liquidity the way it once did.

From a technical standpoint, the breakout above the 2008 trendline marks a significant structural change. As long as the 1.1500 area holds as support, the trend remains intact. The next major upside target is around 1.20, which aligns with the top of the rising price channel and represents a likely area for medium term profit taking by larger market participants.

However, risks to the upside scenario remain. Because this rally is being driven by capital flows and positioning rather than Eurozone fundamentals, it is highly sensitive to shifts in sentiment and data. A stronger than expected U.S economic report, such as an upside surprise in CPI, employment or consumer spending, could quickly change the market’s view on the Fed’s rate path and trigger a resurgence in dollar strength. Similarly, any signal from the ECB that suggests renewed dovishness or further deterioration in European economic data, could weigh heavily on the euro. In addition, if a geopolitical shock or a sharp decline in risk appetite occurs, safe haven flows could return to the dollar and result in a fast reversal in EUR/USD. We saw a warning of this past weekend with Israel and Iran attacking each other.

all in all, the euro has made a technically sound and macro supported breakout, driven by diverging rate cycles, capital rotation and the evolving role of the U.S dollar in global flows. The move toward 1.20 remains a valid target as long as 1.1500 holds as support. But this is not a fundamentally bullish euro story. It is a positioning driven move based on relative rate expectations and macro sentiment. If those expectations shift, the rally could unwind quickly. Active risk management remains essential. I hope this helps you all, Cheers!

Chart

White dashed line - 2008 Resistance

Red and Blue Ascending channel (Bullish on Daily)

Red is 1.19-1.20 AOI TP

The euro’s recent strength is not being driven by strong economic performance in the Eurozone. Instead, it reflects a broader shift in global capital allocation and diverging monetary policy expectations. The Federal Reserve began easing policy in late 2024 with a series of rate cuts aimed at responding to softening inflation and slowing labor market conditions. By early 2025, the Fed had completed a handful of cuts before entering a pause. That pause remains in effect for now but markets are increasingly expecting the Fed to resume cutting later this year, with 2 to 3 additional cuts projected for the second half of 2025. These expectations have weakened the dollar as traders anticipate a return to more accommodative policy. (This is known as pricing in or speculative markets)

On the European side, the European Central Bank began cutting rates in late 2024 (Duh we all know this by now) and is now widely seen as operating in neutral territory. The ECB has taken a careful and measured approach to easing, avoiding any aggressive dovish turn and instead emphasizing a data dependent path. With limited room to cut further and no urgent economic pressure to do so, the euro has maintained a relative yield advantage compared to the dollar, even in a context of muted growth.

Another important driver of euro strength has been the rotation of capital into U.S. equities, particularly in the technology and large cap sectors. As investors allocate more capital into risk assets, the dollar tends to weaken in FX terms, as funding shifts out of USD and into growth exposures (aka emerging markets) This type of flow indirectly benefits the euro. At the same time the dollar is no longer acting as a dominant safe haven for now. Despite the presence of global uncertainty, low market volatility and return focused positioning have reduced the appeal of defensive USD flows. This has allowed the euro to benefit from repositioning, not because of its own economic strength, but because the dollar is no longer absorbing global liquidity the way it once did.

From a technical standpoint, the breakout above the 2008 trendline marks a significant structural change. As long as the 1.1500 area holds as support, the trend remains intact. The next major upside target is around 1.20, which aligns with the top of the rising price channel and represents a likely area for medium term profit taking by larger market participants.

However, risks to the upside scenario remain. Because this rally is being driven by capital flows and positioning rather than Eurozone fundamentals, it is highly sensitive to shifts in sentiment and data. A stronger than expected U.S economic report, such as an upside surprise in CPI, employment or consumer spending, could quickly change the market’s view on the Fed’s rate path and trigger a resurgence in dollar strength. Similarly, any signal from the ECB that suggests renewed dovishness or further deterioration in European economic data, could weigh heavily on the euro. In addition, if a geopolitical shock or a sharp decline in risk appetite occurs, safe haven flows could return to the dollar and result in a fast reversal in EUR/USD. We saw a warning of this past weekend with Israel and Iran attacking each other.

all in all, the euro has made a technically sound and macro supported breakout, driven by diverging rate cycles, capital rotation and the evolving role of the U.S dollar in global flows. The move toward 1.20 remains a valid target as long as 1.1500 holds as support. But this is not a fundamentally bullish euro story. It is a positioning driven move based on relative rate expectations and macro sentiment. If those expectations shift, the rally could unwind quickly. Active risk management remains essential. I hope this helps you all, Cheers!

Chart

White dashed line - 2008 Resistance

Red and Blue Ascending channel (Bullish on Daily)

Red is 1.19-1.20 AOI TP

I post weekly on macro drivers, capital flows, technical structure and the key forces shaping today’s financial markets, from FX to equities and everything in between in my community. Check the website!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I post weekly on macro drivers, capital flows, technical structure and the key forces shaping today’s financial markets, from FX to equities and everything in between in my community. Check the website!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.