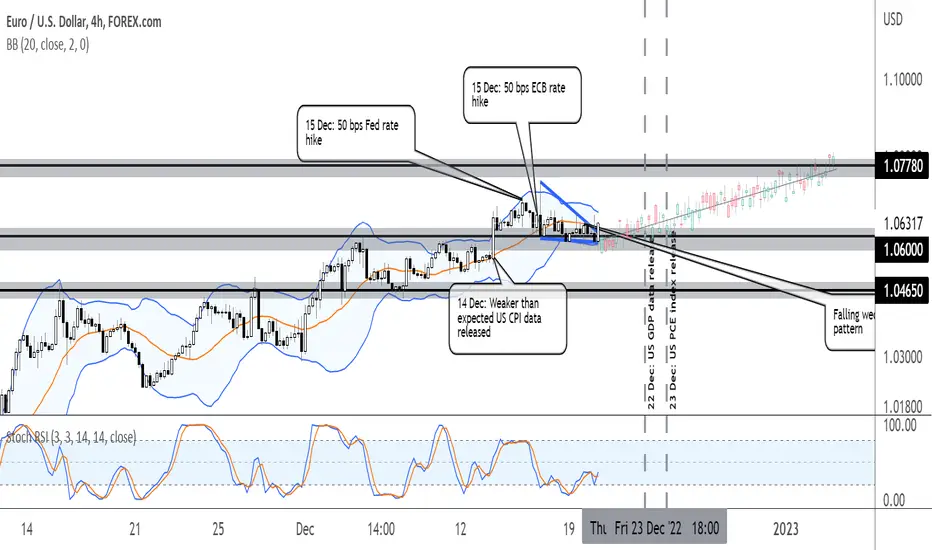

On the H4 timeframe, EURUSD came to test the historic 1.06000 resistance level twice, before softer than expected US CPI data released on 14 December weakened the prospect of future Fed rate hikes and caused the Dollar to plummet. This gave EURUSD the bullish fuel to break above the 1.06000 resistance turned support level. After the initial breakout, price came back down to approach the new support level multiple times. The 50 bps rate hike by both the Fed and ECB on the same day had little effect on price action, as the announcement had already been long expected by the market and came as no surprise.

Price is consolidating in a falling wedge pattern, where we forecast a subsequent bullish breakout to the next historic resistance level at 1.07780, where we will take profit. Given that price has touched the lower bound of the Bollinger band and Stochastic RSI indicates a dip into the oversold region, technicals are in support of our bullish bias.

However, US GDP and US PCE Index data are due to be released on back to back days on 22 and 23 December next week, representing a point for volatile price action. If poor GDP performance confirms previous indicators of the worsening economic outlook, and the PCE Index shows that inflation is on its way to being controlled, then we could see a rapid ascent to the 1.07780 take profit level. However if the reverse is true, price could potentially break below the support level to our stop loss level of 1.04650.

Price is consolidating in a falling wedge pattern, where we forecast a subsequent bullish breakout to the next historic resistance level at 1.07780, where we will take profit. Given that price has touched the lower bound of the Bollinger band and Stochastic RSI indicates a dip into the oversold region, technicals are in support of our bullish bias.

However, US GDP and US PCE Index data are due to be released on back to back days on 22 and 23 December next week, representing a point for volatile price action. If poor GDP performance confirms previous indicators of the worsening economic outlook, and the PCE Index shows that inflation is on its way to being controlled, then we could see a rapid ascent to the 1.07780 take profit level. However if the reverse is true, price could potentially break below the support level to our stop loss level of 1.04650.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.