Hi everyone,

In today’s post, let’s break down the current market structure and potential opportunities in the EUR/USD pair.

🔍 Market Context

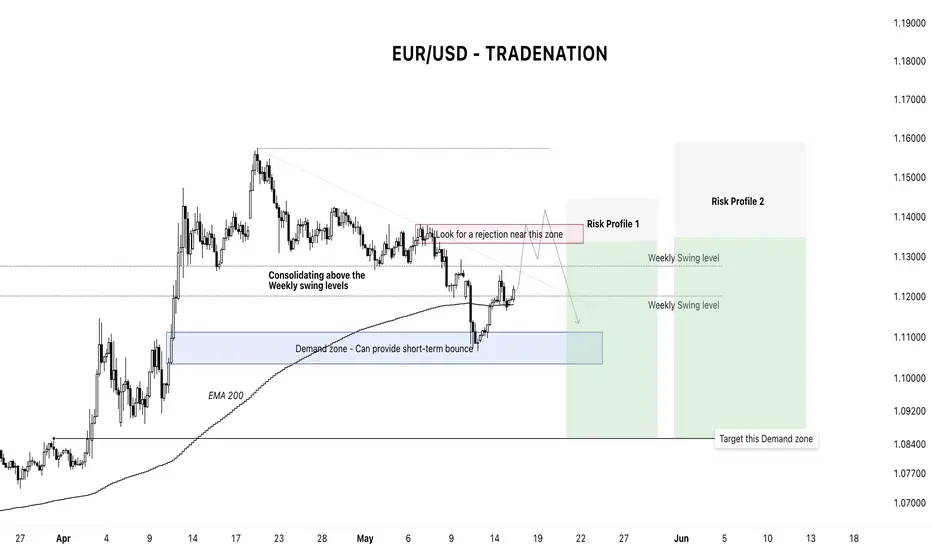

After nearly a month of consolidation, EUR/USD appears to have stalled around the previous weekly swing highs. Despite several attempts to hold above this level, the price eventually broke down, signalling a shift in structure on the 4-hour (4H) timeframe.

This short-term breakdown could be an early sign of a larger structural shift on the daily chart, and it’s something I’m keeping a close eye on.

🧭 Key Levels & Price Behaviour

At the moment, price action is bouncing from a demand zone, which might provide a short-lived relief rally. However, this bounce may only be temporary.

In my humble opinion, bullish momentum is fading, and we could be entering a trap zone for late buyers. I’m watching the 1.132–1.138 region, just above the short-term downtrend line, as a potential resistance zone and an ideal area to consider shorts.

🎯 Trade Ideas

I’ve marked two trade setups on the chart, catering to different risk profiles:

1. Aggressive Trade – For traders willing to enter closer to resistance with tighter stop losses.

2. Conservative Trade – For those who prefer more confirmation before entry.

You can treat these setups independently or combine them into a single strategy depending on your trading style and risk tolerance.

⚠️ Disclaimer

This post is purely for educational purposes. I am not a financial advisor, and nothing here should be taken as financial advice. Always consult your financial advisor before making any investment or trading decisions.

In today’s post, let’s break down the current market structure and potential opportunities in the EUR/USD pair.

🔍 Market Context

After nearly a month of consolidation, EUR/USD appears to have stalled around the previous weekly swing highs. Despite several attempts to hold above this level, the price eventually broke down, signalling a shift in structure on the 4-hour (4H) timeframe.

This short-term breakdown could be an early sign of a larger structural shift on the daily chart, and it’s something I’m keeping a close eye on.

🧭 Key Levels & Price Behaviour

At the moment, price action is bouncing from a demand zone, which might provide a short-lived relief rally. However, this bounce may only be temporary.

In my humble opinion, bullish momentum is fading, and we could be entering a trap zone for late buyers. I’m watching the 1.132–1.138 region, just above the short-term downtrend line, as a potential resistance zone and an ideal area to consider shorts.

🎯 Trade Ideas

I’ve marked two trade setups on the chart, catering to different risk profiles:

1. Aggressive Trade – For traders willing to enter closer to resistance with tighter stop losses.

2. Conservative Trade – For those who prefer more confirmation before entry.

You can treat these setups independently or combine them into a single strategy depending on your trading style and risk tolerance.

⚠️ Disclaimer

This post is purely for educational purposes. I am not a financial advisor, and nothing here should be taken as financial advice. Always consult your financial advisor before making any investment or trading decisions.

Global Community Manager,

TradingView

TradingView

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Global Community Manager,

TradingView

TradingView

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.