Today's U.S. data showed strong GDP growth (2.4%), but lower inflation (2.3% Final GDP Price Index) and a weaker trade balance (-147.9B) suggest the Fed may remain cautious on rate hikes. This limits USD's strength, supporting a potential EURUSD rebound.

EURUSD(

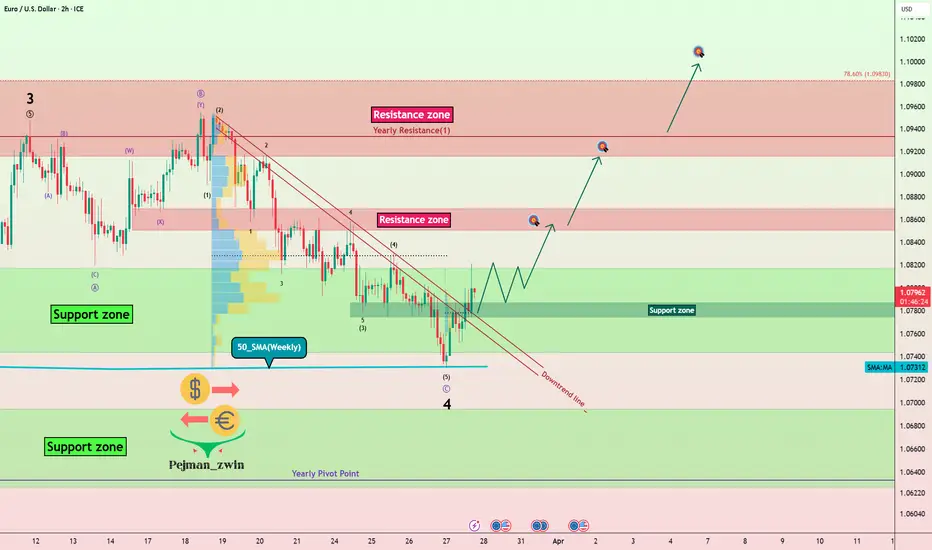

EURUSD) is moving in the Support zone($1.08180-$1.0745) and has also managed to break the Downtrend line. 50_SMA(Weekly) plays a good role of support for EURUSD.

EURUSD) is moving in the Support zone($1.08180-$1.0745) and has also managed to break the Downtrend line. 50_SMA(Weekly) plays a good role of support for EURUSD.

In terms of Classic Technical Analysis and Price Action, there is also a possibility that EURUSD will return to an uptrend with Inverse Head and Shoulders and Bullish Quasimodo Patterns.

Regarding Elliott Wave theory, it seems that EURUSD has managed to complete the main wave 4. The main wave 4 structure is an Expanding Flat Correction(ABC/3-3-5).

I expect EURUSD to trend higher in the coming hours and rise to at least $1.0855, and if the Resistance zone($1.0867-$1.0850) is broken, we should expect more pumping.

Note: If EURUSD breaks below the 50_SMA(Weekly), we expect further declines. The worst Stop Loss(SL) could be $1.072.

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S. Dollar Analyze (EURUSD), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

EURUSD(

In terms of Classic Technical Analysis and Price Action, there is also a possibility that EURUSD will return to an uptrend with Inverse Head and Shoulders and Bullish Quasimodo Patterns.

Regarding Elliott Wave theory, it seems that EURUSD has managed to complete the main wave 4. The main wave 4 structure is an Expanding Flat Correction(ABC/3-3-5).

I expect EURUSD to trend higher in the coming hours and rise to at least $1.0855, and if the Resistance zone($1.0867-$1.0850) is broken, we should expect more pumping.

Note: If EURUSD breaks below the 50_SMA(Weekly), we expect further declines. The worst Stop Loss(SL) could be $1.072.

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S. Dollar Analyze (EURUSD), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Trade active

Trade was activated🎁Welcome than a 50% bonus(Low Spread)👉vtm.pro/Y3AV7r

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🎁Welcome than a 50% bonus(Low Spread)👉vtm.pro/Y3AV7r

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.