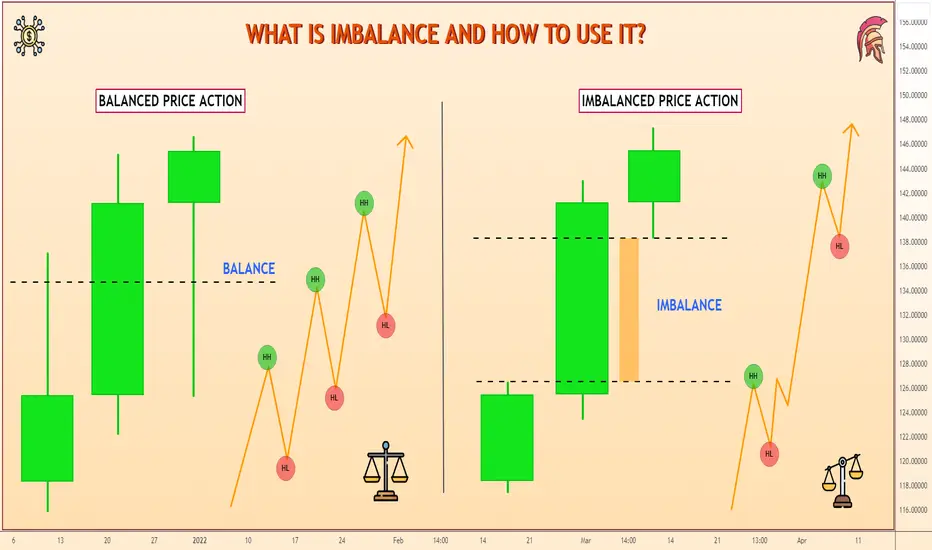

Imbalance is a market phenomenon that can lead a trader to significant profits or losses. Imbalance (IMB) is a gap in fair value during moments of inefficient pricing. The trading volume is tilted towards the bid or ask side, but too quickly, so there are still unexecuted orders in the market.

Simply put, imbalance occurs when there are many orders of the same type (buy, sell, limit) and a lack of liquidity (counter orders) in the market. For example, if there are many more buyers of a currency or stock than sellers, the balance tilts in favor of buyers. On the chart, imbalance looks like a price gap, within which only a part of the volume has been traded. The flow of new orders can be seen by the directional movement of long candles of the same color.

Imbalance is indicated on a long candlestick as a gap between the wicks of neighboring candlesticks. Very often the gap occurs on the candlestick pattern "Marubozu" candlestick with a long body, without shadows or with short wicks.

The IMB gap between the wicks of neighboring candles acts as a price magnet. It means that as liquidity fills, the price will close the imbalance. The speed of gap filling depends on the market makers, large traders and market factors. Market makers are organizations that maintain market liquidity by buying and selling currencies, securities.

There is partial and full IMB fill in the market. A partial fill of up to 50% means that interested bidders were unable to push the price to fill.

Full IMB fill is a rebalancing to 100%. Full filling indicates that buyers and sellers are ready to trade actively at an effective price.

✴️ Why do market imbalances occur?

The emergence of persistent imbalances after long periods of stable pricing in one direction indicates that institutions are accumulating a position. These institutions can be funds, banks and other financial institutions (so-called "smart money").

The market is influenced not only by institutions, but also by market makers, investors, and traders with large capitals. For example, market makers place many orders and then modify or cancel them to bring the market back to equilibrium. Market makers, smart money and investors can both oppose each other and act in the same direction.

Imbalance in Forex can occur after the release of economic and geopolitical news. Imbalances are seen when some countries run surpluses in their trade accounts while others run large external deficits. Imbalance in a security's exchange rate usually follows a dramatic event or publication. The news changes the market perception of the stock and causes a shift in the equilibrium price. This can be news affecting a single company or the economy as a whole.

• Publication of financial statements. For example, a positive quarterly report can lead to an imbalance toward buyers.

• Corporate announcements of bankruptcy, management changes, takeovers, business purchases, etc.

• Government and regulatory actions. U.S. Federal Reserve rate hike contributes to the fall of indices and securities.

• Geopolitical problems, natural disasters, etc.

As the price moves from the old equilibrium level to the new equilibrium level, order imbalances can occur.

✴️ How to use imbalance to make trading decisions?

Imbalance is a type of trading opportunity for intraday and swing traders. In trading, Imbalance is used to identify zones of interest. The zone from which the imbalance originated is characterized by a higher level of probability. The zone is suitable for analyzing and identifying entry points. Entry points are selected with the help of technical analysis within the selected trading methodology. In this case IMB acts as an additional factor.

Most imbalances represent price inefficiencies. Therefore, there is a high probability that the market will come back to fill the IMB. For example, if a large bidder manipulated the market, a correction occurs afterward. Typically, price tends to mitigate the imbalance or the area from which it originated. Therefore, traders trade in the direction of the imbalance to profit from the price movement. However, sometimes price continues to push back against IMBs that are forming in the market. Here recent example of using imbalance on EURUSD

✴️ Conclusion

Imbalances create "fuel" for trend price movement. However, you should not mindlessly enter a trade in any imbalance zone. It is necessary to monitor the context (economic news, indicators, patterns) and make decisions based on it.

Simply put, imbalance occurs when there are many orders of the same type (buy, sell, limit) and a lack of liquidity (counter orders) in the market. For example, if there are many more buyers of a currency or stock than sellers, the balance tilts in favor of buyers. On the chart, imbalance looks like a price gap, within which only a part of the volume has been traded. The flow of new orders can be seen by the directional movement of long candles of the same color.

Imbalance is indicated on a long candlestick as a gap between the wicks of neighboring candlesticks. Very often the gap occurs on the candlestick pattern "Marubozu" candlestick with a long body, without shadows or with short wicks.

The IMB gap between the wicks of neighboring candles acts as a price magnet. It means that as liquidity fills, the price will close the imbalance. The speed of gap filling depends on the market makers, large traders and market factors. Market makers are organizations that maintain market liquidity by buying and selling currencies, securities.

There is partial and full IMB fill in the market. A partial fill of up to 50% means that interested bidders were unable to push the price to fill.

Full IMB fill is a rebalancing to 100%. Full filling indicates that buyers and sellers are ready to trade actively at an effective price.

✴️ Why do market imbalances occur?

The emergence of persistent imbalances after long periods of stable pricing in one direction indicates that institutions are accumulating a position. These institutions can be funds, banks and other financial institutions (so-called "smart money").

The market is influenced not only by institutions, but also by market makers, investors, and traders with large capitals. For example, market makers place many orders and then modify or cancel them to bring the market back to equilibrium. Market makers, smart money and investors can both oppose each other and act in the same direction.

Imbalance in Forex can occur after the release of economic and geopolitical news. Imbalances are seen when some countries run surpluses in their trade accounts while others run large external deficits. Imbalance in a security's exchange rate usually follows a dramatic event or publication. The news changes the market perception of the stock and causes a shift in the equilibrium price. This can be news affecting a single company or the economy as a whole.

• Publication of financial statements. For example, a positive quarterly report can lead to an imbalance toward buyers.

• Corporate announcements of bankruptcy, management changes, takeovers, business purchases, etc.

• Government and regulatory actions. U.S. Federal Reserve rate hike contributes to the fall of indices and securities.

• Geopolitical problems, natural disasters, etc.

As the price moves from the old equilibrium level to the new equilibrium level, order imbalances can occur.

✴️ How to use imbalance to make trading decisions?

Imbalance is a type of trading opportunity for intraday and swing traders. In trading, Imbalance is used to identify zones of interest. The zone from which the imbalance originated is characterized by a higher level of probability. The zone is suitable for analyzing and identifying entry points. Entry points are selected with the help of technical analysis within the selected trading methodology. In this case IMB acts as an additional factor.

Most imbalances represent price inefficiencies. Therefore, there is a high probability that the market will come back to fill the IMB. For example, if a large bidder manipulated the market, a correction occurs afterward. Typically, price tends to mitigate the imbalance or the area from which it originated. Therefore, traders trade in the direction of the imbalance to profit from the price movement. However, sometimes price continues to push back against IMBs that are forming in the market. Here recent example of using imbalance on EURUSD

✴️ Conclusion

Imbalances create "fuel" for trend price movement. However, you should not mindlessly enter a trade in any imbalance zone. It is necessary to monitor the context (economic news, indicators, patterns) and make decisions based on it.

90% accuracy in telegram

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

90% accuracy in telegram

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.