Here is a professional TradingView publish description for your EUR/USD Weekly Butterfly Pattern Analysis:

---

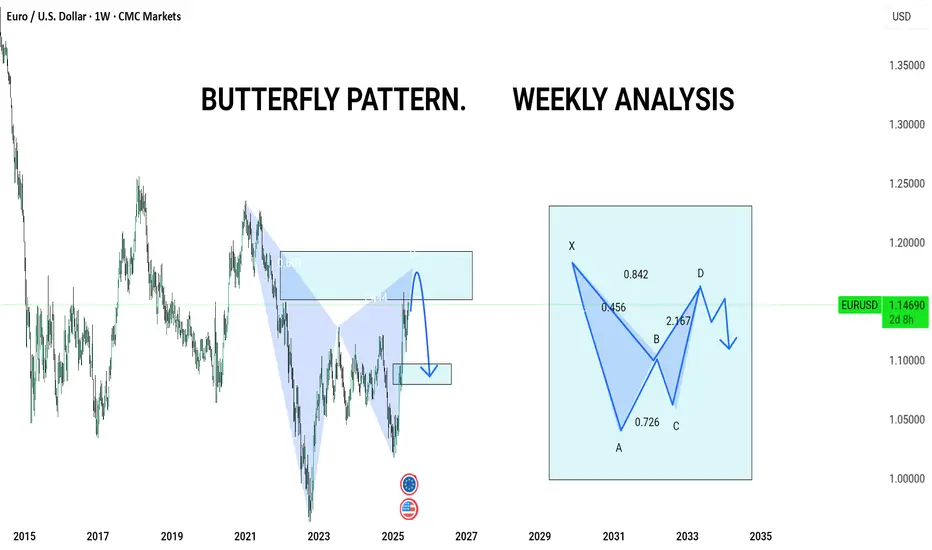

🦋 EUR/USD Weekly Outlook | Harmonic Butterfly Pattern

Pair: EUR/USD

Timeframe: 1W (Weekly)

Strategy: Harmonic Pattern Recognition – Butterfly Pattern

Bias: Bearish Reversal Setup

---

🔍 Pattern Analysis:

Butterfly Harmonic Pattern completed with precision at the 1.272–1.414 extension zone, forming the critical D-point near 1.14700.

Price has reacted sharply from the PRZ (Potential Reversal Zone), aligning with a historical supply zone.

Confluence from Fibonacci extensions:

AB = 0.786 retracement

BC = 0.382 to 0.886 retracement

CD = 1.618 to 2.618 extension

📉 Bearish rejection expected from this high-probability reversal zone.

---

📌 Key Levels:

PRZ (Potential Reversal Zone): 1.14500 – 1.15000

First Target Zone (Support Block): 1.11500 – 1.10500

Invalidation (Pattern Failure): Close above 1.15500

---

📅 Projection: This weekly harmonic butterfly suggests a potential trend reversal or deep pullback. We may see EUR/USD targeting lower support as D-point gets respected. Watch for signs of weakness such as long-wick rejections, bearish engulfing patterns, or RSI divergence confirmation.

---

💡 Conclusion: EUR/USD is at a critical juncture. If the butterfly holds, this could be a high RR short opportunity for swing traders. Patience is key—confirmation on lower timeframes will validate entry.

---

📊 #EURUSD #ButterflyPattern #HarmonicTrading #ForexAnalysis #TechnicalAnalysis #SwingTradeSetup

---

🦋 EUR/USD Weekly Outlook | Harmonic Butterfly Pattern

Pair: EUR/USD

Timeframe: 1W (Weekly)

Strategy: Harmonic Pattern Recognition – Butterfly Pattern

Bias: Bearish Reversal Setup

---

🔍 Pattern Analysis:

Butterfly Harmonic Pattern completed with precision at the 1.272–1.414 extension zone, forming the critical D-point near 1.14700.

Price has reacted sharply from the PRZ (Potential Reversal Zone), aligning with a historical supply zone.

Confluence from Fibonacci extensions:

AB = 0.786 retracement

BC = 0.382 to 0.886 retracement

CD = 1.618 to 2.618 extension

📉 Bearish rejection expected from this high-probability reversal zone.

---

📌 Key Levels:

PRZ (Potential Reversal Zone): 1.14500 – 1.15000

First Target Zone (Support Block): 1.11500 – 1.10500

Invalidation (Pattern Failure): Close above 1.15500

---

📅 Projection: This weekly harmonic butterfly suggests a potential trend reversal or deep pullback. We may see EUR/USD targeting lower support as D-point gets respected. Watch for signs of weakness such as long-wick rejections, bearish engulfing patterns, or RSI divergence confirmation.

---

💡 Conclusion: EUR/USD is at a critical juncture. If the butterfly holds, this could be a high RR short opportunity for swing traders. Patience is key—confirmation on lower timeframes will validate entry.

---

📊 #EURUSD #ButterflyPattern #HarmonicTrading #ForexAnalysis #TechnicalAnalysis #SwingTradeSetup

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.