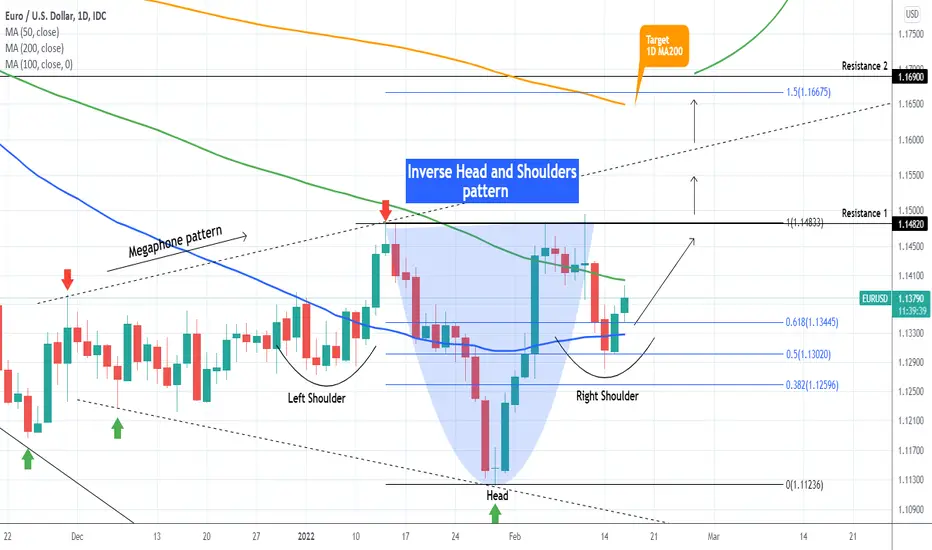

EURUSD got rejected last Thursday exactly on the 1.14820 Resistance following the U.S. CPI report and after escalation in the Ukraine - U.S. conflict, it pulled back aggressively below the 1D MA50 (blue trend-line) again on Monday.

That short-term fundamental bearish news may have a very bullish effect on the long-term as the pair formed an Inverse Head and Shoulders pattern on the 1D time-frame, which is a pattern technically formed on market bottoms. If that is the case, and of course the conflict on the Ukrainian border doesn't escalate any further, then we should see EURUSD back above its 1D MA100 (green trend-line) targeting another test (the 3rd) of the 1.14820 Resistance. If it closes a 1D candle above, I expect it to extend first to the Higher Highs (top) trend-line of the Megaphone pattern that started after the November 24 market low, where by the time it should meet with the 1D MA200 (orange trend-line). Technically the extension should be as high as the 1.5 Fibonacci extension level (1.16675).

After that, and always from a technical perspective (don't know how the fundamentals will be at the time), we can stay bullish only if the 1.16900 Resistance breaks. Until then, a pull-back to the 1D MA50 again will be more likely but of course I will be updating based on the price action on a weekly basis.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

That short-term fundamental bearish news may have a very bullish effect on the long-term as the pair formed an Inverse Head and Shoulders pattern on the 1D time-frame, which is a pattern technically formed on market bottoms. If that is the case, and of course the conflict on the Ukrainian border doesn't escalate any further, then we should see EURUSD back above its 1D MA100 (green trend-line) targeting another test (the 3rd) of the 1.14820 Resistance. If it closes a 1D candle above, I expect it to extend first to the Higher Highs (top) trend-line of the Megaphone pattern that started after the November 24 market low, where by the time it should meet with the 1D MA200 (orange trend-line). Technically the extension should be as high as the 1.5 Fibonacci extension level (1.16675).

After that, and always from a technical perspective (don't know how the fundamentals will be at the time), we can stay bullish only if the 1.16900 Resistance breaks. Until then, a pull-back to the 1D MA50 again will be more likely but of course I will be updating based on the price action on a weekly basis.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.