EURUSD: Euro's Surge on USD Weakness – Is 1.20 the Next Stop?

Hello TradingView Community!

The EURUSD pair is currently commanding significant attention with its strong upward momentum.

🌍 Fundamental Highlights: Euro's Tailwinds & USD's Headwinds

The Euro has demonstrated notable strength, recently breaching the 1.17 mark to hit its highest level in over 3.5 years. According to ING, if this momentum holds, the next target could be 1.20, contingent on continued USD weakness.

The US Dollar faces considerable pressure following news that President Trump intends to name a successor to Fed Chair Powell soon, sparking concerns about the Fed's independence. Such speculation often leads to expectations of a more 'dovish' monetary policy, weakening the USD.

Adding to the Euro's support are the NATO agreement to increase defense spending targets to 5% and President Trump's seemingly "less aggressive" stance towards the EU.

In summary: Should USD depreciation persist, not only the Euro but other asset classes might also attract capital inflows, particularly given the ongoing uncertainties surrounding inflation risks and monetary policy.

📊 EURUSD Technical Outlook (H4/M30 Chart):

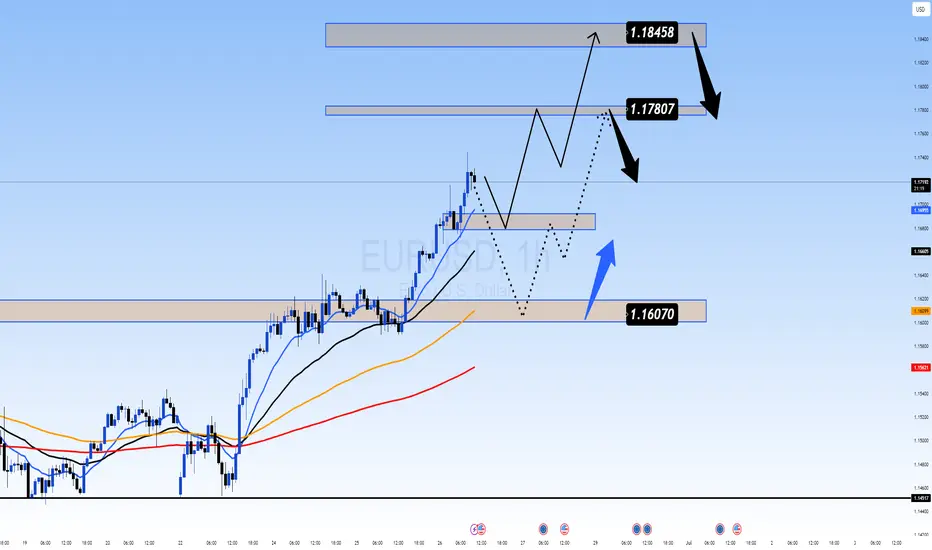

Our technical analysis of the EURUSD chart (image_b73298.png) confirms a clear and robust uptrend, characterized by successive higher highs and higher lows. The EMAs are in a bullish alignment, reinforcing this upward trajectory.

Upside Targets (Potential BUY Zones):

1.17807: The initial potential target if the bullish momentum continues.

1.18458: A higher target representing the next potential resistance zone.

Key Support Levels (Potential BUY Zones for pullbacks):

1.16070: A strong support level where demand could emerge after a correction.

An implied intermediate support around 1.166xx (visually suggested by price action between current levels and 1.16070) could also offer buying opportunities after minor pullbacks.

🎯 EURUSD Trading Plan:

BUY Zone 1 (Intermediate Pullback):

Entry: 1.16600 - 1.16700

SL: 1.16450

TP: 1.16800 - 1.17000 - 1.17200 - 1.17500 - 1.17807 - 1.18000 - 1.18300 - 1.18458

BUY Zone 2 (Strong Support):

Entry: 1.16070

SL: 1.15900

TP: 1.16200 - 1.16400 - 1.16600 - 1.16800 - 1.17000 - 1.17300 - 1.17600 - 1.17807 - 1.18458

SELL Zone (Consider only at upside targets with clear reversal signals):

Entry: 1.18458 (This is an upside target, but also a potential resistance for selling if strong reversal signals appear).

SL: 1.18600

TP: 1.18300 - 1.18000 - 1.17807 - 1.17500 - 1.17200 - 1.17000 - 1.16800

⚠️ Key Factors to Monitor:

Fed Leadership News: Any official announcements regarding the Fed Chair succession will trigger significant USD volatility.

Eurozone Economic Data: Upcoming inflation, GDP, and employment reports.

ECB Statements: The European Central Bank's stance on monetary policy.

Geopolitical Developments: Major tensions or agreements can influence market sentiment.

Trade smart and always manage your risk effectively! Wishing everyone a profitable trading day!

Hello TradingView Community!

The EURUSD pair is currently commanding significant attention with its strong upward momentum.

🌍 Fundamental Highlights: Euro's Tailwinds & USD's Headwinds

The Euro has demonstrated notable strength, recently breaching the 1.17 mark to hit its highest level in over 3.5 years. According to ING, if this momentum holds, the next target could be 1.20, contingent on continued USD weakness.

The US Dollar faces considerable pressure following news that President Trump intends to name a successor to Fed Chair Powell soon, sparking concerns about the Fed's independence. Such speculation often leads to expectations of a more 'dovish' monetary policy, weakening the USD.

Adding to the Euro's support are the NATO agreement to increase defense spending targets to 5% and President Trump's seemingly "less aggressive" stance towards the EU.

In summary: Should USD depreciation persist, not only the Euro but other asset classes might also attract capital inflows, particularly given the ongoing uncertainties surrounding inflation risks and monetary policy.

📊 EURUSD Technical Outlook (H4/M30 Chart):

Our technical analysis of the EURUSD chart (image_b73298.png) confirms a clear and robust uptrend, characterized by successive higher highs and higher lows. The EMAs are in a bullish alignment, reinforcing this upward trajectory.

Upside Targets (Potential BUY Zones):

1.17807: The initial potential target if the bullish momentum continues.

1.18458: A higher target representing the next potential resistance zone.

Key Support Levels (Potential BUY Zones for pullbacks):

1.16070: A strong support level where demand could emerge after a correction.

An implied intermediate support around 1.166xx (visually suggested by price action between current levels and 1.16070) could also offer buying opportunities after minor pullbacks.

🎯 EURUSD Trading Plan:

BUY Zone 1 (Intermediate Pullback):

Entry: 1.16600 - 1.16700

SL: 1.16450

TP: 1.16800 - 1.17000 - 1.17200 - 1.17500 - 1.17807 - 1.18000 - 1.18300 - 1.18458

BUY Zone 2 (Strong Support):

Entry: 1.16070

SL: 1.15900

TP: 1.16200 - 1.16400 - 1.16600 - 1.16800 - 1.17000 - 1.17300 - 1.17600 - 1.17807 - 1.18458

SELL Zone (Consider only at upside targets with clear reversal signals):

Entry: 1.18458 (This is an upside target, but also a potential resistance for selling if strong reversal signals appear).

SL: 1.18600

TP: 1.18300 - 1.18000 - 1.17807 - 1.17500 - 1.17200 - 1.17000 - 1.16800

⚠️ Key Factors to Monitor:

Fed Leadership News: Any official announcements regarding the Fed Chair succession will trigger significant USD volatility.

Eurozone Economic Data: Upcoming inflation, GDP, and employment reports.

ECB Statements: The European Central Bank's stance on monetary policy.

Geopolitical Developments: Major tensions or agreements can influence market sentiment.

Trade smart and always manage your risk effectively! Wishing everyone a profitable trading day!

⚜️ Trade with Money Market Flow, logic, Price action 📉📈

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

byvn.net/t06K

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

byvn.net/t06K

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️ Trade with Money Market Flow, logic, Price action 📉📈

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

byvn.net/t06K

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

byvn.net/t06K

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.