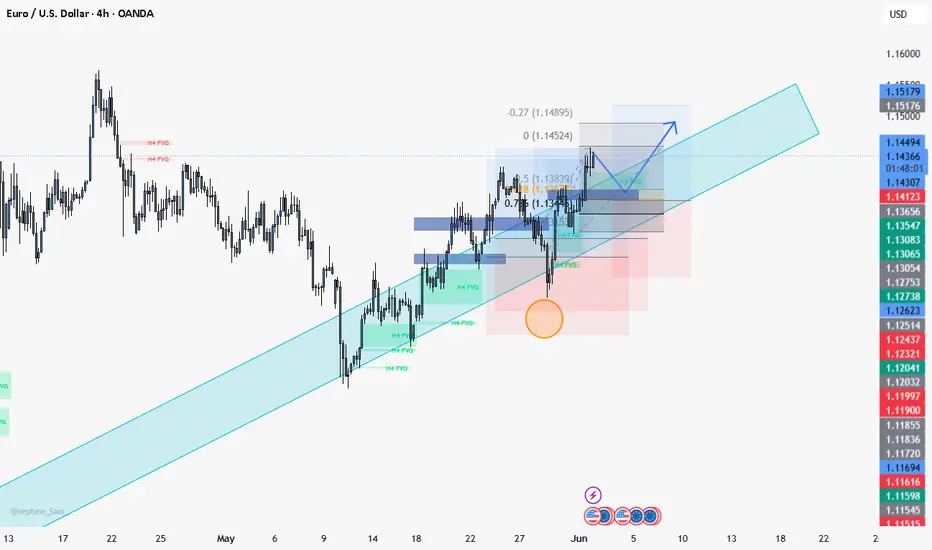

EUR/USD Long Continuation Trade Setup (4H Chart)

Using Fibonacci Retracement, FVGs, and Bullish Channel Structure

📈 Bias: Bullish continuation within a rising trend channel

1. Market Structure:

The pair has formed a strong higher low (orange zone) and broken structure to the upside, confirming bullish intent. Price is now forming a bullish flag within an ascending channel, respecting trendline support.

2. Fibonacci Retracement Confluence:

Price is currently hovering near the 0.5–0.618 retracement zone from the previous bullish impulse:

This zone aligns with the lower boundary of the channel, forming a potential buy zone for continuation.

3. Fair Value Gaps (FVGs):

Several FVGs (highlighted in green) provide high-probability liquidity zones. Price may revisit the FVGs around 1.136xx–1.134xx to fill imbalances before continuing higher.

Confluence between the Fib retracement and H4 FVG enhances the setup.

4. Trendline & Channel:

Price is respecting the lower boundary of the channel and is projected to bounce off support, forming a higher low before pushing upward. This aligns with institutional accumulation zones.

5. Projected Move:

Potential for continuation toward 1.15179–1.16797 in an extended bullish leg

6. Entry & Risk Management:

Entry Zone: Between 1.1365–1.1340 (retracement + FVG + trendline)

Stop Loss: Below 1.1251

Target: 1.1517+ for extended move

🧠 Trade Idea Summary:

This is a high-confluence long continuation setup within a bullish channel, leveraging Fib retracement levels and unfilled FVGs. Look for signs of bullish rejection or confirmation within the 1.1340–1.1360 zone.

Using Fibonacci Retracement, FVGs, and Bullish Channel Structure

📈 Bias: Bullish continuation within a rising trend channel

1. Market Structure:

The pair has formed a strong higher low (orange zone) and broken structure to the upside, confirming bullish intent. Price is now forming a bullish flag within an ascending channel, respecting trendline support.

2. Fibonacci Retracement Confluence:

Price is currently hovering near the 0.5–0.618 retracement zone from the previous bullish impulse:

This zone aligns with the lower boundary of the channel, forming a potential buy zone for continuation.

3. Fair Value Gaps (FVGs):

Several FVGs (highlighted in green) provide high-probability liquidity zones. Price may revisit the FVGs around 1.136xx–1.134xx to fill imbalances before continuing higher.

Confluence between the Fib retracement and H4 FVG enhances the setup.

4. Trendline & Channel:

Price is respecting the lower boundary of the channel and is projected to bounce off support, forming a higher low before pushing upward. This aligns with institutional accumulation zones.

5. Projected Move:

Potential for continuation toward 1.15179–1.16797 in an extended bullish leg

6. Entry & Risk Management:

Entry Zone: Between 1.1365–1.1340 (retracement + FVG + trendline)

Stop Loss: Below 1.1251

Target: 1.1517+ for extended move

🧠 Trade Idea Summary:

This is a high-confluence long continuation setup within a bullish channel, leveraging Fib retracement levels and unfilled FVGs. Look for signs of bullish rejection or confirmation within the 1.1340–1.1360 zone.

Trade active

My Limit order was hit and I got in the trade June 3rd. So far so good- not expecting to hit any traction until the news release this Wednesday. Still long until the trend tells me otherwise!Trade closed: target reached

So this hit take profit! Sorry EU Bears :pDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.