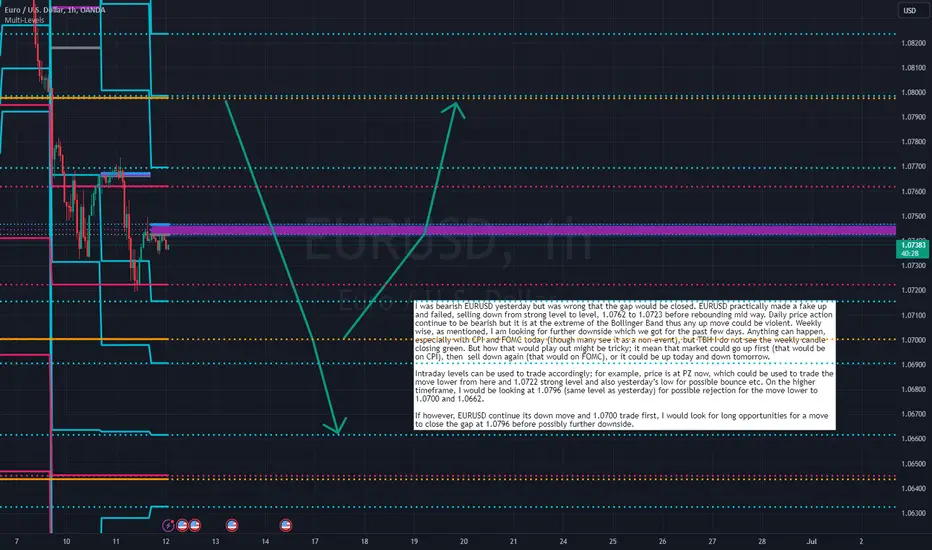

I was bearish EURUSD yesterday but was wrong that the gap would be closed. EURUSD practically made a fake up and failed, selling down from strong level to level, 1.0762 to 1.0723 before rebounding mid way. Daily price action continue to be bearish but it is at the extreme of the Bollinger Band thus any up move could be violent. Weekly wise, as mentioned, I am looking for further downside which we got for the past few days. Anything can happen, especially with CPI and FOMC today (though many see it as a non-event), but TBH I do not see the weekly candle closing green. But how that would play out might be tricky; it mean that market could go up first (that would be on CPI), then sell down again (that would on FOMC), or it could be up today and down tomorrow.

Intraday levels can be used to trade accordingly; for example, price is at PZ now, which could be used to trade the move lower from here and 1.0722 strong level and also yesterday’s low for possible bounce etc. On the higher timeframe, I would be looking at 1.0796 (same level as yesterday) for possible rejection for the move lower to 1.0700 and 1.0662.

If however, EURUSD continue its down move and 1.0700 trade first, I would look for long opportunities for a move to close the gap at 1.0796 before possibly further downside.

Intraday levels can be used to trade accordingly; for example, price is at PZ now, which could be used to trade the move lower from here and 1.0722 strong level and also yesterday’s low for possible bounce etc. On the higher timeframe, I would be looking at 1.0796 (same level as yesterday) for possible rejection for the move lower to 1.0700 and 1.0662.

If however, EURUSD continue its down move and 1.0700 trade first, I would look for long opportunities for a move to close the gap at 1.0796 before possibly further downside.

Join me for free on Patreon (patreon.com/fademeifyoucan) to receive my daily FX and indices trading plan. DM me to join my new group to learn all my trading levels and to trade together.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join me for free on Patreon (patreon.com/fademeifyoucan) to receive my daily FX and indices trading plan. DM me to join my new group to learn all my trading levels and to trade together.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.