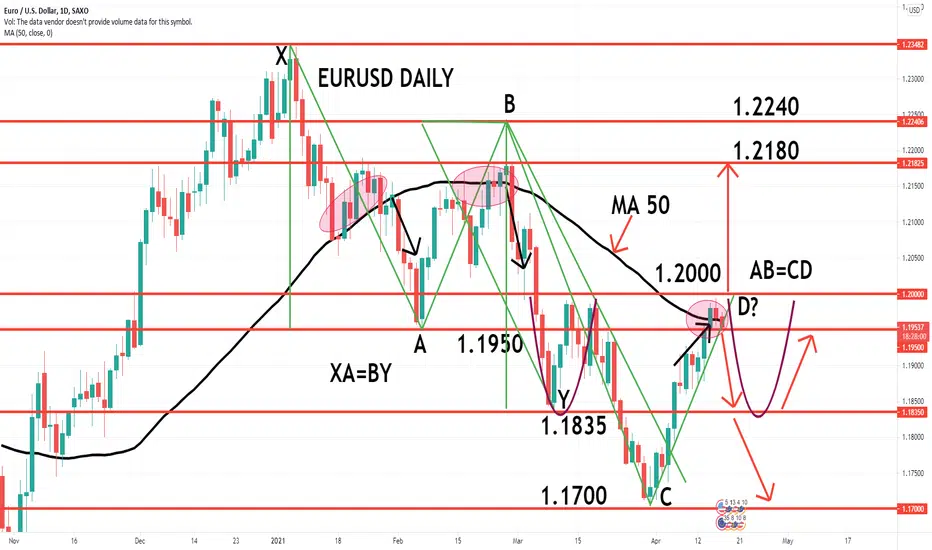

EURUSD bottomed at 1.1704 and then rebound to 1.1993, slightly above MA 50 Daily and 1.2000 level.

It likely that EURUSD would form Triple Top, as EURUSD has tested 1.2000 twice in last March.

First Scenario:

Below 1.1950 would open the way to 1.1835. IF it still continue going down below 1.1835 then the next target is 1.1700.

But IF it just stop around 1.1835 and rebound, then it possibly could form Inverted Head and Shoulder pattern by testing 1.2000 again.

Second Scenario:

A break above 1.2000 would invalidate First Scenario and EURUSD could continue its Bullish View to test 1.2180 first, then 1.2240 as next target.

Anyway, I prefer to choose The First Scenario (Bearish View).

It likely that EURUSD would form Triple Top, as EURUSD has tested 1.2000 twice in last March.

First Scenario:

Below 1.1950 would open the way to 1.1835. IF it still continue going down below 1.1835 then the next target is 1.1700.

But IF it just stop around 1.1835 and rebound, then it possibly could form Inverted Head and Shoulder pattern by testing 1.2000 again.

Second Scenario:

A break above 1.2000 would invalidate First Scenario and EURUSD could continue its Bullish View to test 1.2180 first, then 1.2240 as next target.

Anyway, I prefer to choose The First Scenario (Bearish View).

Order cancelled

EURUSD continue rebound above 1.2000, after breaking its Triple Top and beyond its MA 50 Daily.Reffering to the last Trade Ideas 16 April, EURUSD rejected First Scenario.

EURUSD as we see, then move following The Second Scenario:

A break above 1.2000 would invalidate First Scenario and EURUSD could continue its Bullish View to test 1.2180 first, then 1.2240 as next target.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.