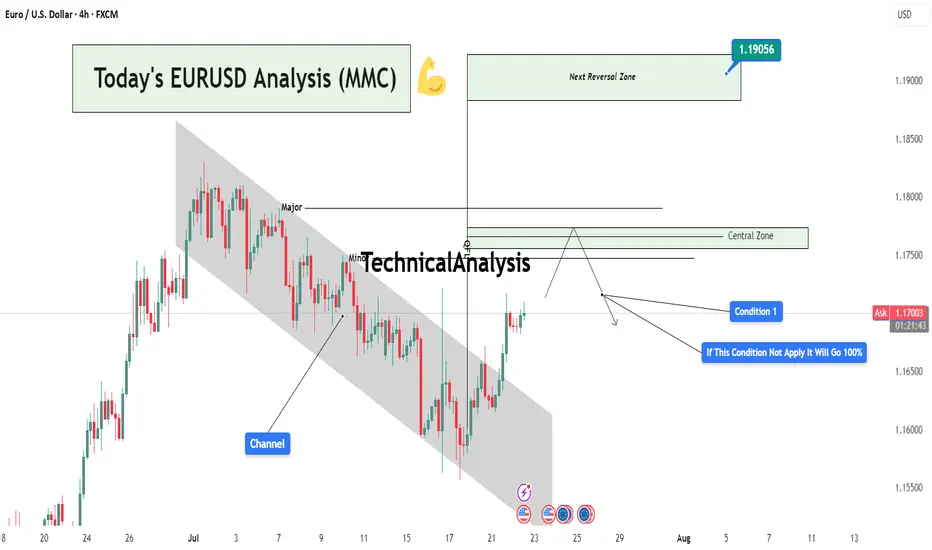

Chart Overview:

The EURUSD pair has broken out of a well-defined descending channel, indicating a potential shift in momentum. Price has now approached a critical Central Zone that acts as a probable reaction or reversal area. This zone lies between minor and major supply levels.

🔍 Key Technical Highlights:

Descending Channel:

Price was previously trapped in a bearish channel. This channel was respected with multiple touches on both upper and lower bounds, showing controlled bearish structure.

Breakout & Momentum Shift:

The recent bullish breakout above the channel suggests buyers are gaining control. A strong candle has closed outside the structure, confirming the breakout.

Major & Minor Zones:

Two levels are marked just above the breakout:

Minor Resistance: First possible supply zone where price may pause.

Major Resistance: A stronger historical level and the top of the Central Zone.

Central Zone Reaction Area (CZRA):

This is the MMC's focus area — price is expected to react here. Either we see a rejection that could confirm a reversal setup, or price slices through, opening the door to the Next Reversal Zone around 1.19056.

📌 Strategic Condition (MMC Logic):

Condition 1:

If price respects the Central Zone and shows bearish signs (e.g., wick rejections, engulfing candles, divergence), we expect a strong pullback or reversal toward previous demand levels.

If Condition 1 Fails:

The annotation clearly states: “If this condition not apply, it will go 100%.”

Meaning: If price breaks and holds above the Central Zone, it confirms bullish strength, targeting 1.19056 — the Next Reversal Zone (NRZ).

📊 Trader's Mindset (MMC Application):

This setup is a classic MMC structure trap-break scenario:

The channel traps sellers,

The breakout invites buyers,

And the Central Zone becomes the battlefield.

Wait for confirmation, not assumption. Whether it's rejection or breakout, risk management and reaction-based trading are key.

The EURUSD pair has broken out of a well-defined descending channel, indicating a potential shift in momentum. Price has now approached a critical Central Zone that acts as a probable reaction or reversal area. This zone lies between minor and major supply levels.

🔍 Key Technical Highlights:

Descending Channel:

Price was previously trapped in a bearish channel. This channel was respected with multiple touches on both upper and lower bounds, showing controlled bearish structure.

Breakout & Momentum Shift:

The recent bullish breakout above the channel suggests buyers are gaining control. A strong candle has closed outside the structure, confirming the breakout.

Major & Minor Zones:

Two levels are marked just above the breakout:

Minor Resistance: First possible supply zone where price may pause.

Major Resistance: A stronger historical level and the top of the Central Zone.

Central Zone Reaction Area (CZRA):

This is the MMC's focus area — price is expected to react here. Either we see a rejection that could confirm a reversal setup, or price slices through, opening the door to the Next Reversal Zone around 1.19056.

📌 Strategic Condition (MMC Logic):

Condition 1:

If price respects the Central Zone and shows bearish signs (e.g., wick rejections, engulfing candles, divergence), we expect a strong pullback or reversal toward previous demand levels.

If Condition 1 Fails:

The annotation clearly states: “If this condition not apply, it will go 100%.”

Meaning: If price breaks and holds above the Central Zone, it confirms bullish strength, targeting 1.19056 — the Next Reversal Zone (NRZ).

📊 Trader's Mindset (MMC Application):

This setup is a classic MMC structure trap-break scenario:

The channel traps sellers,

The breakout invites buyers,

And the Central Zone becomes the battlefield.

Wait for confirmation, not assumption. Whether it's rejection or breakout, risk management and reaction-based trading are key.

For Daily Trade Setups and Forecast: 📈 t.me/xauusdoptimizer

Premium Signals Fr33: 💯 t.me/xauusdoptimizer

🥰🥳🤩

Premium Signals Fr33: 💯 t.me/xauusdoptimizer

🥰🥳🤩

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

For Daily Trade Setups and Forecast: 📈 t.me/xauusdoptimizer

Premium Signals Fr33: 💯 t.me/xauusdoptimizer

🥰🥳🤩

Premium Signals Fr33: 💯 t.me/xauusdoptimizer

🥰🥳🤩

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.