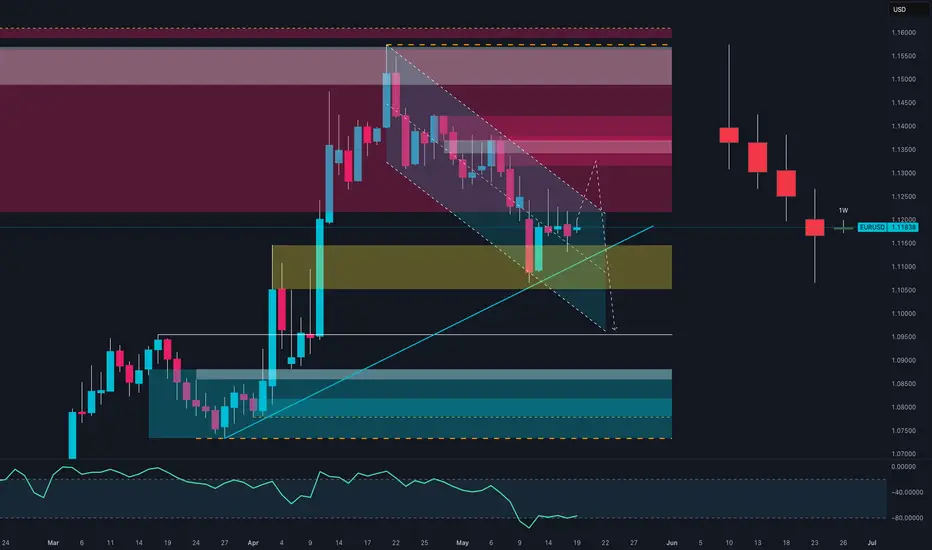

EUR/USD has posted an interesting bullish reaction following a controlled descent within a descending channel.

After a brief break below a long-term ascending trendline, price established support within a clear demand zone between 1.1130 and 1.1170, closing the daily candle back above the key area.

This structure suggests a possible phase of accumulation, especially given the presence of a strong lower wick and the defense of the highlighted yellow zone. Still, the pair remains within the descending channel, and the squeeze between the trendline and resistance at 1.1280 could become a decision zone. A daily close above 1.1280 would support bullish continuation and open the way to 1.1450.

🧠 Institutional Positioning (COT):

Large speculators continue to favor the long side on the euro, with a noticeable increase in net long exposure. This confirms the accumulation narrative visible on the chart.

Meanwhile, the USD shows a consistent decline in bullish positioning, adding weight to the case for a softer dollar — supportive of a potential EUR breakout.

📊 Retail Sentiment:

Retail traders are slightly skewed to the short side (52% short), which is not extreme but does act as a contrarian input favoring bullish continuation — especially if the price breaks above dynamic resistance.

📅 Seasonality (May):

Historically, May tends to be a weak-to-neutral month for EUR/USD over the 10–20Y horizon. However, recent years (last 2Y) show a bullish deviation from that trend, supporting the idea that any dips could offer opportunity rather than signal trend reversals.

🧭 Summary

📈 Directional Bias: Moderately Bullish

❌ Invalidation: Daily close below 1.1130

🎯 Target Levels:

• Key Resistance: 1.1280

• Extension Zone: 1.1450

🧠 Key Takeaway:

EUR/USD is showing early signs of bullish reversal within a still-constrained technical structure. Demand rejection, institutional long bias, and retail short pressure all align for a potential continuation higher. However, a confirmed breakout above 1.1280 is crucial to validate the scenario.

After a brief break below a long-term ascending trendline, price established support within a clear demand zone between 1.1130 and 1.1170, closing the daily candle back above the key area.

This structure suggests a possible phase of accumulation, especially given the presence of a strong lower wick and the defense of the highlighted yellow zone. Still, the pair remains within the descending channel, and the squeeze between the trendline and resistance at 1.1280 could become a decision zone. A daily close above 1.1280 would support bullish continuation and open the way to 1.1450.

🧠 Institutional Positioning (COT):

Large speculators continue to favor the long side on the euro, with a noticeable increase in net long exposure. This confirms the accumulation narrative visible on the chart.

Meanwhile, the USD shows a consistent decline in bullish positioning, adding weight to the case for a softer dollar — supportive of a potential EUR breakout.

📊 Retail Sentiment:

Retail traders are slightly skewed to the short side (52% short), which is not extreme but does act as a contrarian input favoring bullish continuation — especially if the price breaks above dynamic resistance.

📅 Seasonality (May):

Historically, May tends to be a weak-to-neutral month for EUR/USD over the 10–20Y horizon. However, recent years (last 2Y) show a bullish deviation from that trend, supporting the idea that any dips could offer opportunity rather than signal trend reversals.

🧭 Summary

📈 Directional Bias: Moderately Bullish

❌ Invalidation: Daily close below 1.1130

🎯 Target Levels:

• Key Resistance: 1.1280

• Extension Zone: 1.1450

🧠 Key Takeaway:

EUR/USD is showing early signs of bullish reversal within a still-constrained technical structure. Demand rejection, institutional long bias, and retail short pressure all align for a potential continuation higher. However, a confirmed breakout above 1.1280 is crucial to validate the scenario.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.