📌 Market Structure & Setup Summary

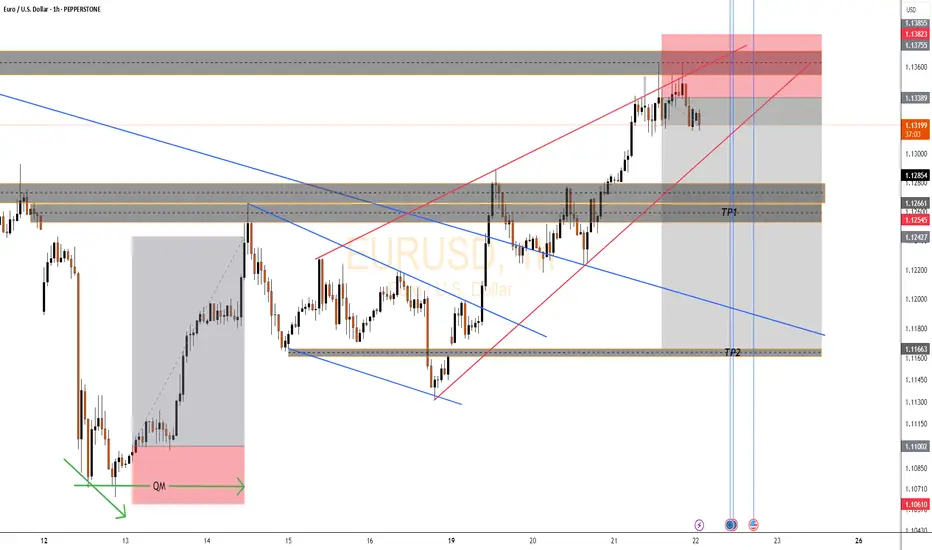

Major Supply Zone Rejection (Red Zone at Top):

Price tapped into higher timeframe supply zone at 1.13755 (red box).

This was a buy-side liquidity grab just above the previous high → textbook distribution zone.

Now price is respecting that zone and rejecting it with bearish momentum.

Bearish Rising Channel Broken:

Red trendlines show a rising wedge → often leads to a bearish breakout.

Price is currently breaking out of that wedge to the downside.

Premium Pricing Confirmed:

Price was pushed into the premium zone (above equilibrium), inducing buy orders → now being reversed.

🔄 Trade Plan (Short Bias)

✅ Entry: Activated inside the red supply zone after confirming wick rejections and structure shift.

🛑 Stop Loss: Above the red supply zone (above 1.13755).

🎯 Targets:

TP1 → 1.12545: Structure support and breaker block.

TP2 → 1.11663: Previous demand zone and trendline intersection.

TP3 (Optional) → 1.11002 – 1.10610: External liquidity + trendline + FVG zone.

📉 RR Ratio: Estimated 1:4 to 1:5+ if TP2/TP3 hits.

⚠️ Key Confluences

🔹 Bearish break of rising wedge = structural shift.

🔹 Rejection wick inside red supply + BOS.

🔹 TP zones aligned with previous OB, breaker blocks, and liquidity pools.

🔹 News/volatility likely during the double blue vertical lines, so expect reaction spikes.

🚫 Invalidation Criteria

If price closes above 1.13755, the idea is invalid.

Watch for manipulation or false breakouts during high-impact news.

🔮 Market Forecast

If current rejection holds, expecting price to seek sell-side liquidity from 1.12545, then 1.11663, and possibly lower. This is a classic distribution > BOS > retrace > expansion sequence.

Major Supply Zone Rejection (Red Zone at Top):

Price tapped into higher timeframe supply zone at 1.13755 (red box).

This was a buy-side liquidity grab just above the previous high → textbook distribution zone.

Now price is respecting that zone and rejecting it with bearish momentum.

Bearish Rising Channel Broken:

Red trendlines show a rising wedge → often leads to a bearish breakout.

Price is currently breaking out of that wedge to the downside.

Premium Pricing Confirmed:

Price was pushed into the premium zone (above equilibrium), inducing buy orders → now being reversed.

🔄 Trade Plan (Short Bias)

✅ Entry: Activated inside the red supply zone after confirming wick rejections and structure shift.

🛑 Stop Loss: Above the red supply zone (above 1.13755).

🎯 Targets:

TP1 → 1.12545: Structure support and breaker block.

TP2 → 1.11663: Previous demand zone and trendline intersection.

TP3 (Optional) → 1.11002 – 1.10610: External liquidity + trendline + FVG zone.

📉 RR Ratio: Estimated 1:4 to 1:5+ if TP2/TP3 hits.

⚠️ Key Confluences

🔹 Bearish break of rising wedge = structural shift.

🔹 Rejection wick inside red supply + BOS.

🔹 TP zones aligned with previous OB, breaker blocks, and liquidity pools.

🔹 News/volatility likely during the double blue vertical lines, so expect reaction spikes.

🚫 Invalidation Criteria

If price closes above 1.13755, the idea is invalid.

Watch for manipulation or false breakouts during high-impact news.

🔮 Market Forecast

If current rejection holds, expecting price to seek sell-side liquidity from 1.12545, then 1.11663, and possibly lower. This is a classic distribution > BOS > retrace > expansion sequence.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.