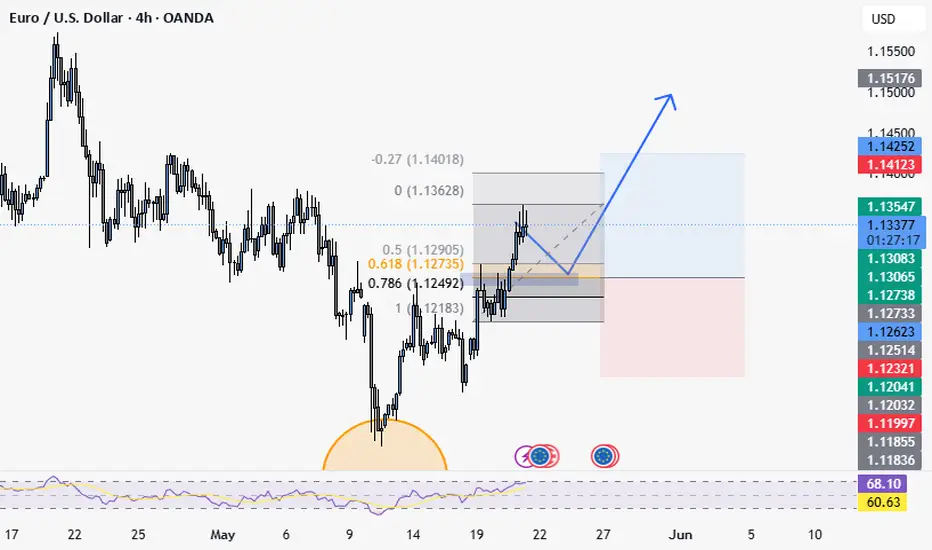

EUR/USD Long Continuation Trade Setup (4H Chart)

Using Fibonacci Retracement & FVG Confluence

📈 Bias: Bullish continuation after clear market structure shift and higher low formation.

Trend Context: After forming a significant swing low (highlighted by the orange zone), EUR/USD broke structure to the upside, suggesting potential trend reversal or at least a deeper retracement upward.

Fibonacci Retracement:

Price is currently approaching a key Fib retracement zone.

0.618 retracement at 1.1273

0.786 retracement at 1.1249

This zone acts as a key area of interest for long re-entry.

Fair Value Gap (FVG):

There’s a visible FVG just above the 0.618-0.786 Fib zone, which could act as a liquidity pocket or mitigation zone. This enhances the validity of the buy-side setup, as price may revisit this imbalance before continuing higher.

Confluence Zone:

The overlapping of:

FVG

0.618–0.786 Fibonacci

Minor support from previous structure (around 1.1273–1.1249)

makes this a strong long entry area.

Projected Move:

If the retracement plays out, we could see price push up toward the 1.1400 zone (Fib extension -0.27), and possibly the 1.1517 area as a full bullish extension.

Entry & Risk Management:

Entry: Around 1.1270–1.1250 (inside FVG + Fib zone)

Stop Loss: Below swing low or invalidation level (~1.1218)

Target: First TP at 1.1400, extended TP at 1.1517

📊 RSI Confirmation: RSI remains above 60, supporting continued bullish momentum and confluence with structure.

Using Fibonacci Retracement & FVG Confluence

📈 Bias: Bullish continuation after clear market structure shift and higher low formation.

Trend Context: After forming a significant swing low (highlighted by the orange zone), EUR/USD broke structure to the upside, suggesting potential trend reversal or at least a deeper retracement upward.

Fibonacci Retracement:

Price is currently approaching a key Fib retracement zone.

0.618 retracement at 1.1273

0.786 retracement at 1.1249

This zone acts as a key area of interest for long re-entry.

Fair Value Gap (FVG):

There’s a visible FVG just above the 0.618-0.786 Fib zone, which could act as a liquidity pocket or mitigation zone. This enhances the validity of the buy-side setup, as price may revisit this imbalance before continuing higher.

Confluence Zone:

The overlapping of:

FVG

0.618–0.786 Fibonacci

Minor support from previous structure (around 1.1273–1.1249)

makes this a strong long entry area.

Projected Move:

If the retracement plays out, we could see price push up toward the 1.1400 zone (Fib extension -0.27), and possibly the 1.1517 area as a full bullish extension.

Entry & Risk Management:

Entry: Around 1.1270–1.1250 (inside FVG + Fib zone)

Stop Loss: Below swing low or invalidation level (~1.1218)

Target: First TP at 1.1400, extended TP at 1.1517

📊 RSI Confirmation: RSI remains above 60, supporting continued bullish momentum and confluence with structure.

Trade active

hit my entry and got in yesterday :)Trade closed: target reached

Hit TP! This is why I like a wider stop... there was a false breakdown but our SL kept us in it!Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.