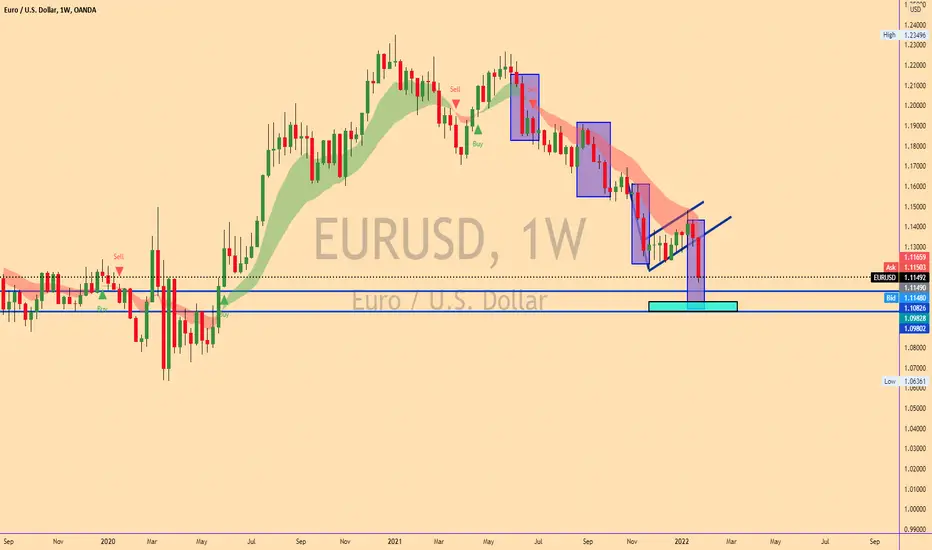

The euro had been weak for a long time, causing this currency pair to continue in its relatively bearish consolidation pattern over recent months. Last week’s release from the Federal Reserve created a strong surge in the dollar, and due to the continuing weakness of the euro, we saw the price of this currency pair fall unusually sharply to end the week at an 18-month low on above-average volatility.

A bearish retracement will quite possibly happen, but there is a good chance that we are going to see the bearish momentum continue over the next few days, due to the above-average volatility and fundamental factor behind the price’s fall.

For these reasons, I see this currency pair as an attractive short trade.

A bearish retracement will quite possibly happen, but there is a good chance that we are going to see the bearish momentum continue over the next few days, due to the above-average volatility and fundamental factor behind the price’s fall.

For these reasons, I see this currency pair as an attractive short trade.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.