EURUSD is trying to hold steady, supported by strong enough PMI data. The Eurozone composite PMI rose to 50.4 from 50.1. While the increase is modest, it is still important amid ongoing tariff-related turmoil.

However, political risks that were believed to be easing now appear to be intensifying. In Romania, first-round election results showed anti-EU candidate Simion securing around 40% of the vote. This could create problems for both the EU and Ukraine.

Meanwhile, today’s vote in Germany is raising concerns. Merz received only 310 of the 316 votes required from parliament. Given that the coalition holds 328 seats, this outcome sends a troubling signal about the coalition’s stability. If Germany’s government proves unstable, it may further weigh on the euro.

Both developments are negative for the euro. Combined with the recent momentum shift in EURUSD after its strong surge from around 1.04, a correction may be on the horizon.

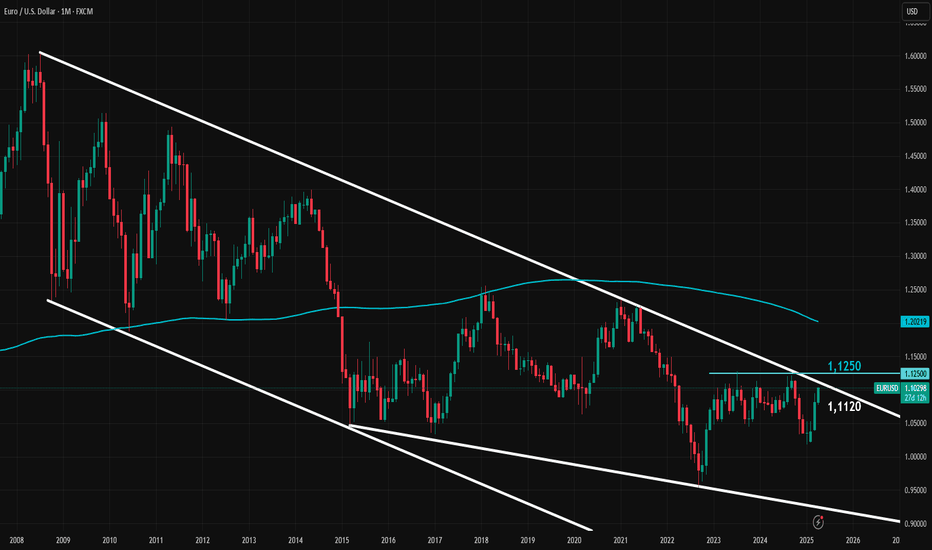

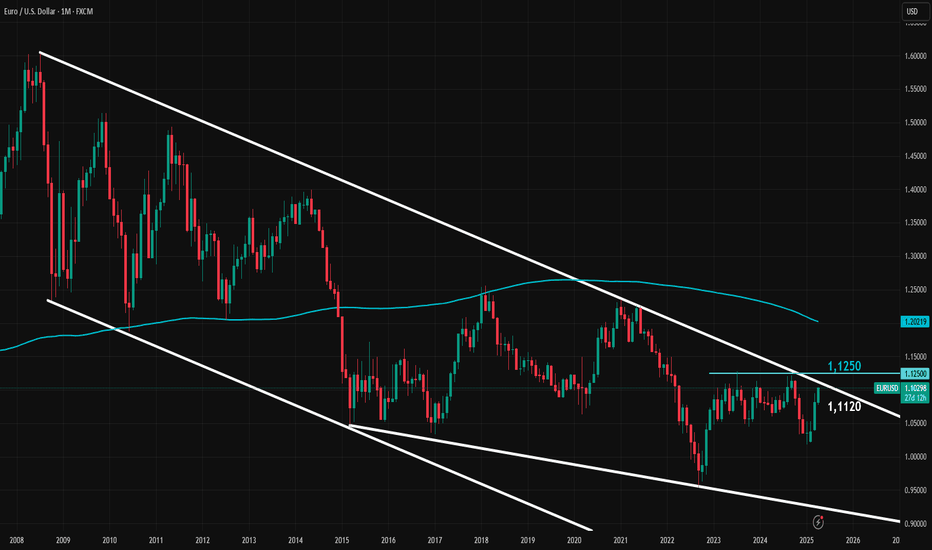

The 1.1260–1.1275 area is a key support zone. It includes a major trendline and an important horizontal support level. If this zone fails, EURUSD could quickly retreat toward the white trendline around 1.11. That trendline, which broke in April, dates back to the 2008 top and represents a long-term structural level.

More details on this trend can be found below:

However, political risks that were believed to be easing now appear to be intensifying. In Romania, first-round election results showed anti-EU candidate Simion securing around 40% of the vote. This could create problems for both the EU and Ukraine.

Meanwhile, today’s vote in Germany is raising concerns. Merz received only 310 of the 316 votes required from parliament. Given that the coalition holds 328 seats, this outcome sends a troubling signal about the coalition’s stability. If Germany’s government proves unstable, it may further weigh on the euro.

Both developments are negative for the euro. Combined with the recent momentum shift in EURUSD after its strong surge from around 1.04, a correction may be on the horizon.

The 1.1260–1.1275 area is a key support zone. It includes a major trendline and an important horizontal support level. If this zone fails, EURUSD could quickly retreat toward the white trendline around 1.11. That trendline, which broke in April, dates back to the 2008 top and represents a long-term structural level.

More details on this trend can be found below:

Trade active

1.1275 is now broken. Upward moves might create selling oppurtunites.Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.