In parallel, Trump’s announcement to double tariffs on steel and aluminum has reignited trade war concerns. Markets are also watching for a potential Trump–Xi call later this week.

Meanwhile, the Euro lost ground after May HICP inflation in the Eurozone fell to 1.9%, below the ECB’s 2% target. With core inflation slowing as well, markets have priced in a 25 bps rate cut at Thursday’s ECB meeting.

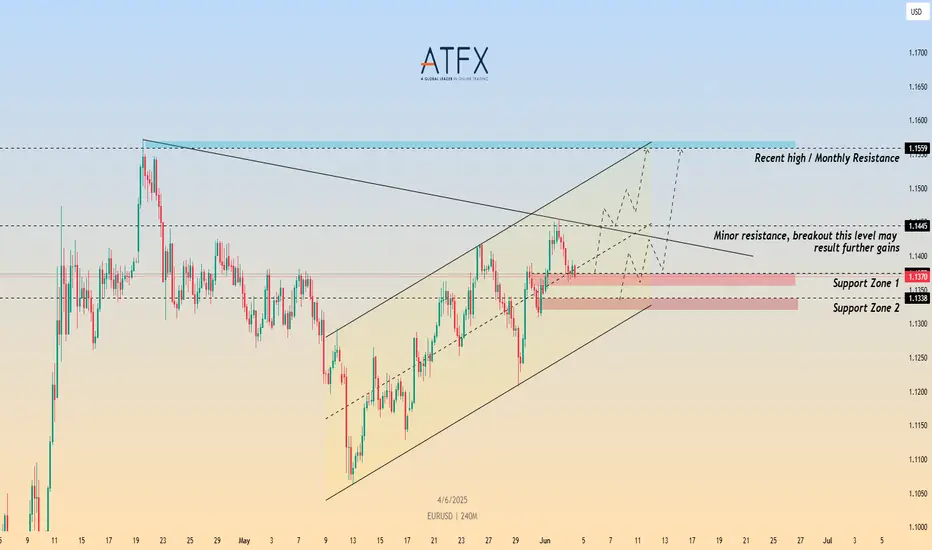

Technically,

- Resistance : 1.1445 , 1.1559

- Support : 1.1375 , 1.1338

ATFX is a globally regulated, award-winning fintech broker offering customer support in 20 languages.

👉🏼Start your trading journey with ATFX: bit.ly/3mLMPHz

👉🏼Start your trading journey with ATFX: bit.ly/3mLMPHz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

ATFX is a globally regulated, award-winning fintech broker offering customer support in 20 languages.

👉🏼Start your trading journey with ATFX: bit.ly/3mLMPHz

👉🏼Start your trading journey with ATFX: bit.ly/3mLMPHz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.