🔍 Analysis Summary:

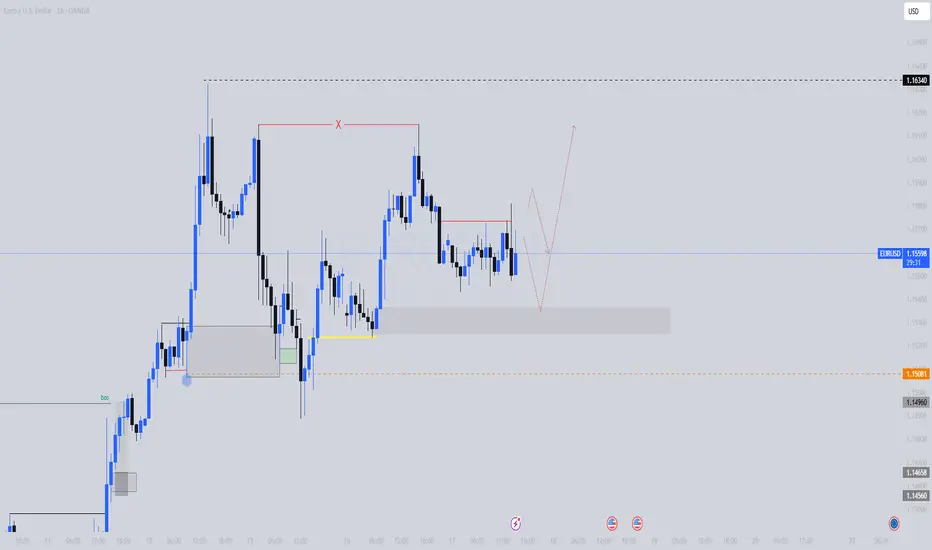

Price is consolidating above a clear demand zone after breaking previous structure to the upside.

We’ve seen liquidity engineered above the swing high (marked X), followed by internal structure developing.

I’m watching for a sweep into demand (grey zone) between 1.1520 – 1.1540, followed by a bullish reaction.

Expecting a bullish BOS (Break of Structure) on the lower timeframe to confirm continuation to 1.16340.

📌 Key Levels:

Demand Zone: 1.1520 – 1.1540

Liquidity Sweep: Above recent highs (1.1596)

Target Zone: 1.16340

Invalidation: Clean break below 1.1500

🗓️ Fundamental Drivers to Watch:

USD Weakness – Driven by:

Recent soft CPI & PPI data (cooling inflation)

Increased chances of Fed rate cuts (starting September 2025)

Risk-on market sentiment pushing money out of the USD

Upcoming News Events:

Wed 19 June – Fed Chair Powell Speaks 🗣️

→ Any dovish tone supports the bullish EUR/USD case

Thu 20 June – Initial Jobless Claims 📉

→ A higher-than-expected print could confirm labor market weakness = USD bearish

Fri 21 June – Flash Manufacturing/Services PMI (EUR & USD)

→ EUR strength + weak US data can fuel upside

🧠 My Plan:

Watch for a liquidity sweep into demand

Wait for bullish confirmation on M15 or M5

Target previous high & continuation toward 1.16340

💬 Follow for more SMC-based breakdowns. Let’s stay sharp and react, not predict.

#EURUSD #SMC #SmartMoney #LiquiditySweep #ForexTrading #OrderBlocks #sam_trades_smc #PriceAction #FOMC #Fed #USD

Price is consolidating above a clear demand zone after breaking previous structure to the upside.

We’ve seen liquidity engineered above the swing high (marked X), followed by internal structure developing.

I’m watching for a sweep into demand (grey zone) between 1.1520 – 1.1540, followed by a bullish reaction.

Expecting a bullish BOS (Break of Structure) on the lower timeframe to confirm continuation to 1.16340.

📌 Key Levels:

Demand Zone: 1.1520 – 1.1540

Liquidity Sweep: Above recent highs (1.1596)

Target Zone: 1.16340

Invalidation: Clean break below 1.1500

🗓️ Fundamental Drivers to Watch:

USD Weakness – Driven by:

Recent soft CPI & PPI data (cooling inflation)

Increased chances of Fed rate cuts (starting September 2025)

Risk-on market sentiment pushing money out of the USD

Upcoming News Events:

Wed 19 June – Fed Chair Powell Speaks 🗣️

→ Any dovish tone supports the bullish EUR/USD case

Thu 20 June – Initial Jobless Claims 📉

→ A higher-than-expected print could confirm labor market weakness = USD bearish

Fri 21 June – Flash Manufacturing/Services PMI (EUR & USD)

→ EUR strength + weak US data can fuel upside

🧠 My Plan:

Watch for a liquidity sweep into demand

Wait for bullish confirmation on M15 or M5

Target previous high & continuation toward 1.16340

💬 Follow for more SMC-based breakdowns. Let’s stay sharp and react, not predict.

#EURUSD #SMC #SmartMoney #LiquiditySweep #ForexTrading #OrderBlocks #sam_trades_smc #PriceAction #FOMC #Fed #USD

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.