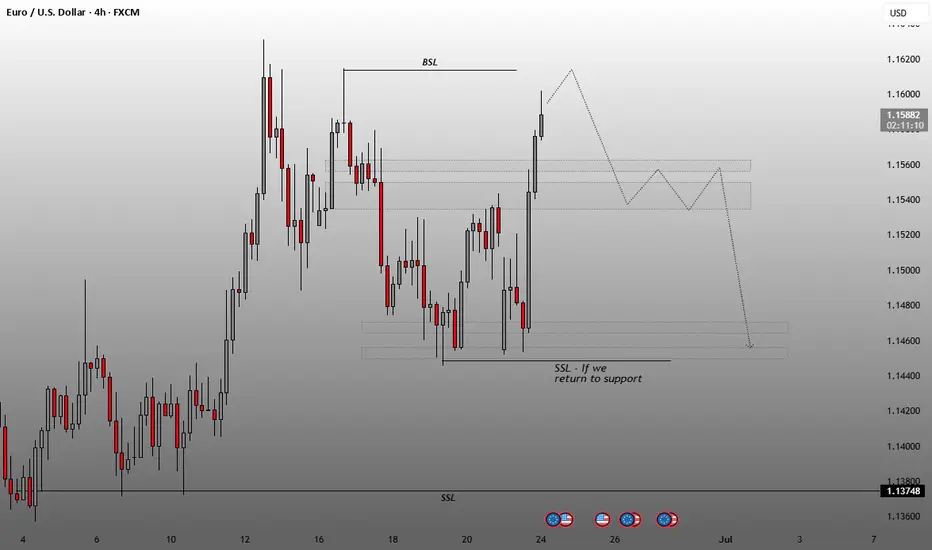

Key Zones & Markings:

SSL (Sell Side Liquidity) - "True return to support" (bottom horizontal line around 1.13700):

Indicates that price has swept the sell-side liquidity, grabbing stop-losses below previous lows.

This often precedes a reversal if it aligns with a key support zone.

FVG (Fair Value Gap) or Imbalance Zones (grey boxes):

Price is expected to retrace back into these imbalanced zones.

These zones act as magnet areas where price might rebalance before further continuation.

Target Zone (Top Horizontal Line at ~1.16200):

Marked as the bullish target, likely aligning with buy-side liquidity (BSL) or unfilled imbalances.

Potential take profit area for long entries from the support zone.

📈 Market Structure:

Price made a lower low, swept liquidity (SSL), and is now showing potential bullish intent.

Anticipated move:

Reversal from support

A clean bullish move toward FVGs

Final target near 1.16200

🎯 Strategy Idea:

Long Entry Zone: Near 1.137–1.140 (liquidity sweep + support).

Target: 1.15500 (intermediate) and 1.16200 (final).

SL (Stop Loss): Could be below the most recent low (if re-entry needed).

🧠 Concept Used:

Liquidity sweep (SSL)

Return to support

Fair Value Gap (FVG) fill

Smart Money long setup

SSL (Sell Side Liquidity) - "True return to support" (bottom horizontal line around 1.13700):

Indicates that price has swept the sell-side liquidity, grabbing stop-losses below previous lows.

This often precedes a reversal if it aligns with a key support zone.

FVG (Fair Value Gap) or Imbalance Zones (grey boxes):

Price is expected to retrace back into these imbalanced zones.

These zones act as magnet areas where price might rebalance before further continuation.

Target Zone (Top Horizontal Line at ~1.16200):

Marked as the bullish target, likely aligning with buy-side liquidity (BSL) or unfilled imbalances.

Potential take profit area for long entries from the support zone.

📈 Market Structure:

Price made a lower low, swept liquidity (SSL), and is now showing potential bullish intent.

Anticipated move:

Reversal from support

A clean bullish move toward FVGs

Final target near 1.16200

🎯 Strategy Idea:

Long Entry Zone: Near 1.137–1.140 (liquidity sweep + support).

Target: 1.15500 (intermediate) and 1.16200 (final).

SL (Stop Loss): Could be below the most recent low (if re-entry needed).

🧠 Concept Used:

Liquidity sweep (SSL)

Return to support

Fair Value Gap (FVG) fill

Smart Money long setup

Trade active

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.