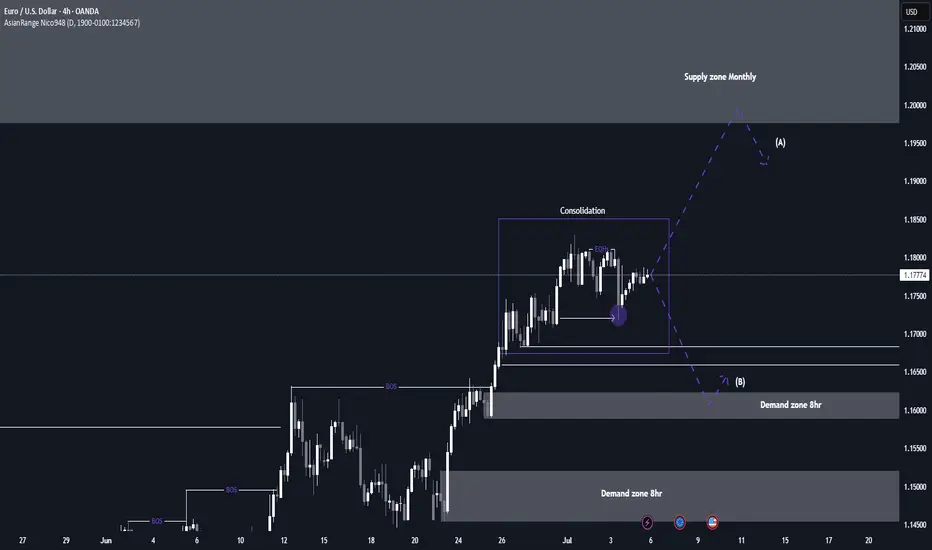

EUR/USD has not provided a clear structure over the past week or two. The pair appears to be in consolidation, building liquidity on both sides of the current range. At the moment, I’m waiting for a decisive breakout, ideally followed by distribution within the monthly supply zone, although that zone is still some distance away.

This week, my focus will be on whether a new supply zone forms, closer to current price. If price sweeps the nearby equal highs and then shows signs of reversal, this could give us a fresh supply area to work from. Alternatively, if price moves lower, I’ll be looking at the 8-hour demand zone around 1.16000 for a possible long setup.

Confluences for EUR/USD:

- Although price has been slightly bullish, the current consolidation phase suggests a potential reversal could be on the horizon.

- Liquidity is building on both sides of the range, making a reaction from the monthly supply zone increasingly probable.

- There’s significant downside liquidity still untapped, such as Asia session lows, which could serve as short-term targets.

- For clearer confirmation, we still need a decisive break in market structure to the downside.

P.S. If price sweeps the lower liquidity and moves into the 8-hour demand zone near 1.16000, I will be watching for accumulation to form and signs of bullish intent from there.

This week, my focus will be on whether a new supply zone forms, closer to current price. If price sweeps the nearby equal highs and then shows signs of reversal, this could give us a fresh supply area to work from. Alternatively, if price moves lower, I’ll be looking at the 8-hour demand zone around 1.16000 for a possible long setup.

Confluences for EUR/USD:

- Although price has been slightly bullish, the current consolidation phase suggests a potential reversal could be on the horizon.

- Liquidity is building on both sides of the range, making a reaction from the monthly supply zone increasingly probable.

- There’s significant downside liquidity still untapped, such as Asia session lows, which could serve as short-term targets.

- For clearer confirmation, we still need a decisive break in market structure to the downside.

P.S. If price sweeps the lower liquidity and moves into the 8-hour demand zone near 1.16000, I will be watching for accumulation to form and signs of bullish intent from there.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.