Multi-Timeframe Structural Outlook:

Higher Timeframes (Monthly, Weekly, Daily):

Market structure remains in a clear Ascend Sequence, reflecting an intact Buy-Side Bias Environment (BBE). Price action continues to build bullish structure, supporting an overall upward lean.

Lower Timeframe Technical Snapshot:

4H & 1H:

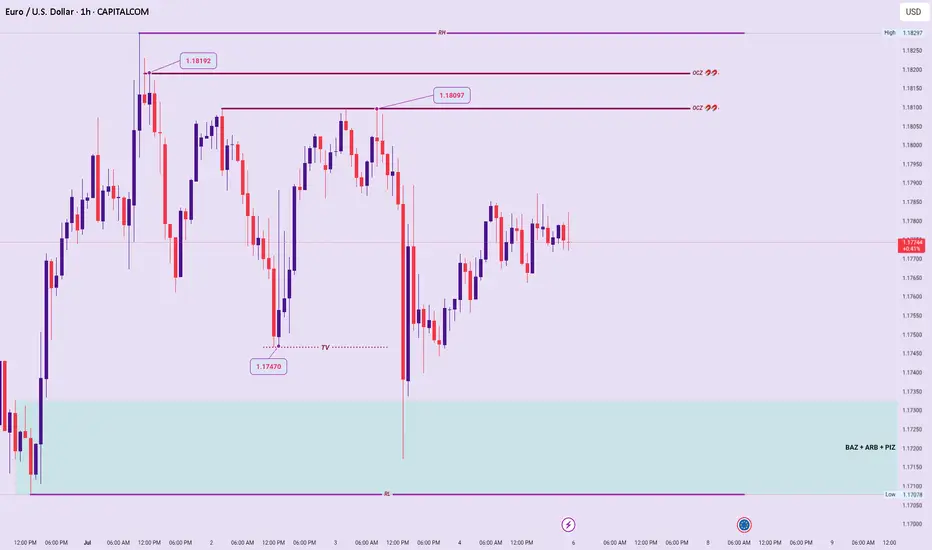

Current price consolidates within a well-defined Value Compression Phase (VCP) between 1.8297 – 1.7078, signaling temporary indecision and mixed short-term directional clarity.

Liquidity Mechanics & Trap Dynamics:

Recent Sweep Event targeting 1.7470 exploited a Trap Vector (TV), drawing price below perceived support to tap into underlying liquidity pockets within both a Price Inefficiency Zone (PIZ) and Bid Accumulation Zone (BAZ). Following this engineered sweep, price reversed, validating hidden bullish intent beneath the range.

Order Clustering Targets:

Expect clustered liquidity and potential price magnet zones at 1.8097 and 1.8192, representing logical upside attractions aligned with orderflow objectives.

Reaction Points:

VCP High (1.8297):

Break and sustained acceptance above signals potential Ascend Sequence continuation and broader bullish resumption.

VCP Low (1.7078):

Breakdown with intent below increases probability of a Trend Signature Shift (TSS), signaling bearish structure vulnerability and potential trend deterioration.

Summary:

Bullish on HT structures remains valid, but short-term bias is mixed pending confirmed resolution of the VCP range boundaries. Price behavior at the highs/lows of the compression zone will dictate next directional conviction.

Higher Timeframes (Monthly, Weekly, Daily):

Market structure remains in a clear Ascend Sequence, reflecting an intact Buy-Side Bias Environment (BBE). Price action continues to build bullish structure, supporting an overall upward lean.

Lower Timeframe Technical Snapshot:

4H & 1H:

Current price consolidates within a well-defined Value Compression Phase (VCP) between 1.8297 – 1.7078, signaling temporary indecision and mixed short-term directional clarity.

Liquidity Mechanics & Trap Dynamics:

Recent Sweep Event targeting 1.7470 exploited a Trap Vector (TV), drawing price below perceived support to tap into underlying liquidity pockets within both a Price Inefficiency Zone (PIZ) and Bid Accumulation Zone (BAZ). Following this engineered sweep, price reversed, validating hidden bullish intent beneath the range.

Order Clustering Targets:

Expect clustered liquidity and potential price magnet zones at 1.8097 and 1.8192, representing logical upside attractions aligned with orderflow objectives.

Reaction Points:

VCP High (1.8297):

Break and sustained acceptance above signals potential Ascend Sequence continuation and broader bullish resumption.

VCP Low (1.7078):

Breakdown with intent below increases probability of a Trend Signature Shift (TSS), signaling bearish structure vulnerability and potential trend deterioration.

Summary:

Bullish on HT structures remains valid, but short-term bias is mixed pending confirmed resolution of the VCP range boundaries. Price behavior at the highs/lows of the compression zone will dictate next directional conviction.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.