📉 Trade Thesis

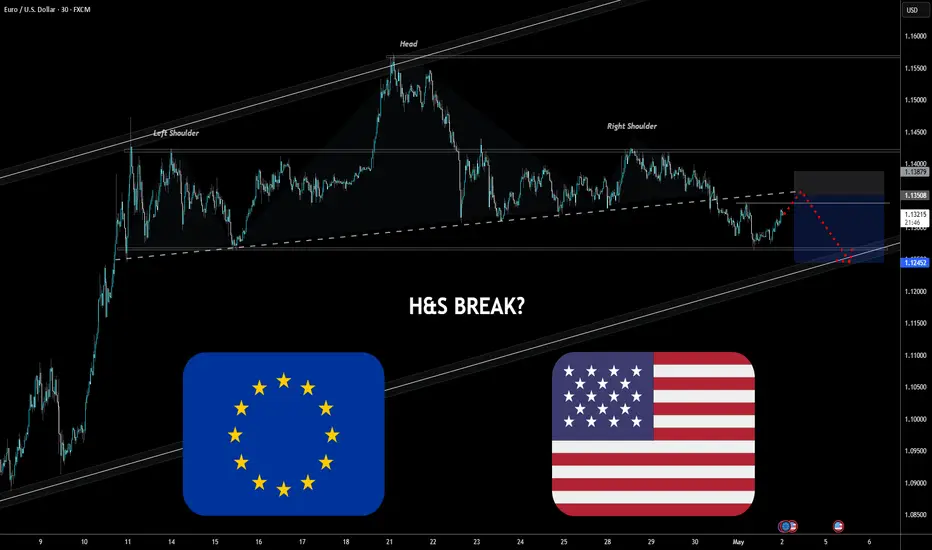

A textbook Head‑and‑Shoulders has completed on the 30‑min EURUSD chart. Price is now testing the rising neckline drawn from mid‑April swing lows. A clean close and retest beneath that trendline opens room toward the next demand shelf and the lower boundary of the broader ascending channel.

🎯 Execution Plan

🧩 Confluence Factors

⚠️ Risk Management

Macro data can produce whipsaws—size positions accordingly and stick to the plan. Move stops to breakeven once price pushes convincingly away from the neckline.

For educational purposes only. Trade your own strategy & manage risk.

A textbook Head‑and‑Shoulders has completed on the 30‑min EURUSD chart. Price is now testing the rising neckline drawn from mid‑April swing lows. A clean close and retest beneath that trendline opens room toward the next demand shelf and the lower boundary of the broader ascending channel.

🎯 Execution Plan

- Entry: wait for a decisive candle close below the neckline, then look to short on a minor pull‑back into that broken support.

- Stop: just above the right‑shoulder high to keep risk tight.

- Target: the measured‑move objective sits near the channel median/support cluster highlighted on the chart; scale out as price approaches that zone.

🧩 Confluence Factors

- Momentum loss: RSI made a lower peak on the “head” versus the prior thrust, signalling fading upside energy.

- Event risk: upcoming NFP/ISM releases may fuel USD volatility, providing the catalyst for a break.

- Structure: the right shoulder’s supply shelf has capped every rally since late April, reinforcing bearish pressure.

⚠️ Risk Management

Macro data can produce whipsaws—size positions accordingly and stick to the plan. Move stops to breakeven once price pushes convincingly away from the neckline.

For educational purposes only. Trade your own strategy & manage risk.

Trade active

🔥 ACTIVE TRADE 🔥💰 Half Off • Stop Locked @ 1.1330 • Neckline Obliterated 💰

🎬 Setup Recap

⏰ 05:00 NFP = whipsaw city, sat on hands 👐

🕒 ~08:00: 5‑min momentum flat‑lined, support cracked, price staying below session VWAP (🔴 red ribbon)

🚀 Shorted the break + retest of that micro shelf

⚙️ Management Moves

🎯 Took 50 % profit at the daily pivot – pay‑day before the weekend

🔒 Stop now hard‑trailed @ 1.1330 (just above breakdown candle) – risk‑free ride

✂️ Price has sliced the white‑dashed neckline → 30‑min H&S confirmed

📈 Why I’m Holding the Runner

🧲 VWAP overhead = bears in control

🔄 Old neckline flipping to resistance – every bounce sold

📉 Post‑NFP flow: sellers stomping bids, momentum pointing toward lower channel rail

🚦 Next Steps

🏹 Let the runner hunt the measured‑move zone near channel support

🛡️ Spike & hold above 1.1330 → flat, reassess Monday

📉 Accelerate into 1.127‑ish → tighten stop again to guard against weekend gaps

💬 Caught the neckline dump too?

Flex your entry/exit below – iron sharpens iron! ⚔️👇

✅ Discord: discord.gg/qZx4vMcchy

✅ My Site: natronfx.com

✅ Twitter: twitter.com/natronfx

✅ YouTube: youtube.com/@natronfx

✅ TikTok: tiktok.com/@natronfx

✅ My Site: natronfx.com

✅ Twitter: twitter.com/natronfx

✅ YouTube: youtube.com/@natronfx

✅ TikTok: tiktok.com/@natronfx

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ Discord: discord.gg/qZx4vMcchy

✅ My Site: natronfx.com

✅ Twitter: twitter.com/natronfx

✅ YouTube: youtube.com/@natronfx

✅ TikTok: tiktok.com/@natronfx

✅ My Site: natronfx.com

✅ Twitter: twitter.com/natronfx

✅ YouTube: youtube.com/@natronfx

✅ TikTok: tiktok.com/@natronfx

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.