All beginner traders, having received their first losses in the market, start to scramble in search of "golden rules" of trading or proven solutions from recognized gurus of financial markets. Basically, having received basic knowledge of trading and having traded for a few days on a demo account, they open a real account and deposit, sometimes, quite large sums of money into it. In most cases, the money is either partially or completely lost in a short period of time. It should be understood that trading is a serious work. It requires not only desire, but also free time and emotional expenditures.

As in any job, young specialists turn to the experience of their professional colleagues, studying their experience and various effective techniques. Trading is no exception, where there are also plenty of professionals and real gurus whose experience should be studied. We will look at rules from world-famous traders.

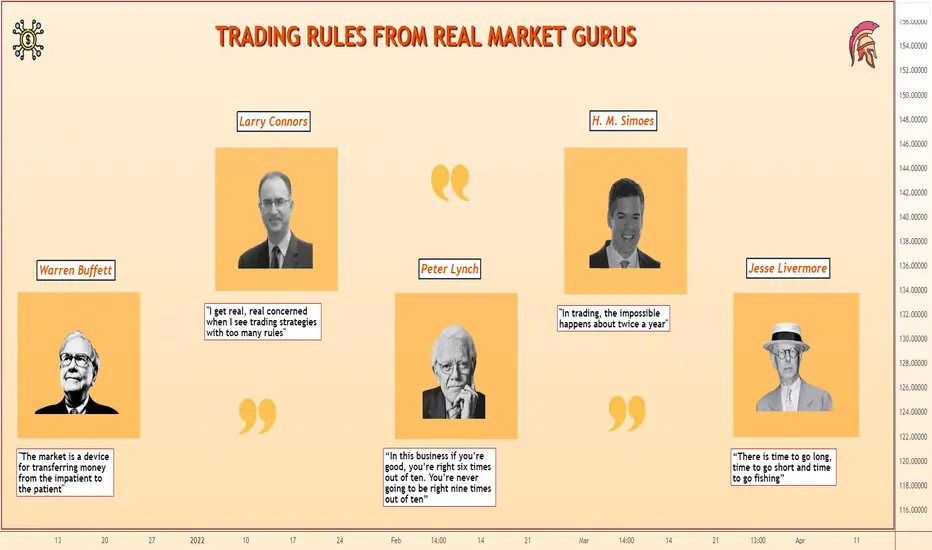

Rule #1 from Warren Buffett

"The market is a device for transferring money from the impatient to the patient"

Great words, aren't they? In the market with profit remains the one who knows how to wait patiently. Before you open a trade, you need to do a thorough analysis. Study all the factors that influence the trading instrument at the current moment of time, what will influence in the short and medium term. Calculate the support and resistance levels, etc. Only after that, start searching for the most promising point of entry into a trade. Do not rush to open a trade if there is no signal to open a trade. Patience is also necessary when fixing profits. "Let profits grow" thee say.

Wait until the dynamics of movement does not begin to decrease, and the strategy does not begin to signal a change of trend. Only in this way you will be able to earn the maximum on each price movement. After making a profitable trade, take a break for rest. Those who rush in the market, sooner or later lose their capital.

Rule #2 from Larry Connors

"I get real, real concerned when I see trading strategies with too many rules"

Everything brilliant is simple! Each of us is probably familiar with this expression. It is also applicable to trading on financial markets. If, again, we pay attention to trading gurus, we can see an interesting fact - all of them mostly use very simple trading systems (TS). Some of them use their own author's TS, some of them use existing ones that have been tested for years. Take Alexander Elder, who is the author of the "Three Screens" strategy. His system is as simple as possible and uses several standard technical indicators built into any trading platform. Anyone can master Alexander Elder's system, and due to its effectiveness, the TS is used by tens of thousands of traders around the world.

Do not try to find or independently develop a mega-complex trading system. The more "elements", indicators, etc. in it, the more false signals it will produce. It will be quite difficult to find the only true signal among them. Your system should produce one or more signals, when they coincide, you open a trade. It is very important, as we pointed out in the first rule, to be patient and wait.

Rule #3 from Peter Lynch

“In this business if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.”

Peter Lynch, a world-famous American investor, was also a follower of simple trading and market analysis techniques. What did the guru wanted to emphasize in his statement? First of all, a large number of beginner traders stay in a delusion for a long time. They think that it is possible to achieve such a level of analysis that will allow them to make 100% forecasts all the time. The market is volatile. Sometimes there are trading situations when the market goes against technical and fundamental analysis. It is impossible to predict such market behavior. Secondly, because of this misconception newbies try to achieve only profitable trades on the market. So that there was not a single losing one in their account history. As a result, they try different strategies, read tons of books on market analysis, but still lose money. As a result, someone "gets an idea" and starts to understand what Lynch was talking about, and someone just quits the market.

Rule #4 from Henrique M. Simoes

"In trading, the impossible happens about twice a year"

In the fourth rule, we will focus on market volatility. These market "impossible" situations do occur periodically. For example, a trading instrument has been growing for a long time, and analyses signal us about the trend reversal. However, the instrument is still growing, breaking all levels. It happens that even some fundamental event, which 100% should lead to a trend reversal, on the contrary, accelerates the current trend even more. There are also more unpredictable situations, when the currency can rise in price twice within a few seconds.

An example is the situation with the Swiss franc, which at the beginning of 2015 strengthened against the U.S. dollar by almost 3000 points. On that day, not only a large number of traders around the world went bankrupt, but also several large Western brokers. Yes, such situations are very rare, once in 5-10 years, but they happen. How to protect against them? If we consider the example with the Swiss franc, a stop-loss would not have saved you, because the price changed at once. The only thing that could really help is to open trades with a small volume that can withstand such a strong movement.

Rule #5 from Jesse Livermore

“There is time to go long, time to go short and time to go fishing”

If you don't enjoy fishing, play a sport or make a field trip outdoors. You should definitely take a break from the market. Especially if you have a series of losing trades. Beginners are not ready for such psychological pressure, so regular breaks should be mandatory. The market will not go anywhere and will not run away, you can always return to it and continue trading. Large and experienced investors are well aware of this, so they do not forget to allocate enough time for rest. The situation is completely different for beginner traders. These two categories of traders mainly trade intraday or use scalping, so they have to constantly monitor the market sitting behind the monitor. As a result, psychological fatigue accumulates, the trader's eye gets tired and he starts to make mistakes that lead to losses. Be sure to rest, it is a guarantee not only of your health, but also of potential profit in the future.

It is extremely important to study the experience of professional traders who have achieved outstanding success in the financial markets. As you can see, many quotes hide not only the entire trading experience collected in one phrase, but sometimes the entire life of the author.

As in any job, young specialists turn to the experience of their professional colleagues, studying their experience and various effective techniques. Trading is no exception, where there are also plenty of professionals and real gurus whose experience should be studied. We will look at rules from world-famous traders.

Rule #1 from Warren Buffett

"The market is a device for transferring money from the impatient to the patient"

Great words, aren't they? In the market with profit remains the one who knows how to wait patiently. Before you open a trade, you need to do a thorough analysis. Study all the factors that influence the trading instrument at the current moment of time, what will influence in the short and medium term. Calculate the support and resistance levels, etc. Only after that, start searching for the most promising point of entry into a trade. Do not rush to open a trade if there is no signal to open a trade. Patience is also necessary when fixing profits. "Let profits grow" thee say.

Wait until the dynamics of movement does not begin to decrease, and the strategy does not begin to signal a change of trend. Only in this way you will be able to earn the maximum on each price movement. After making a profitable trade, take a break for rest. Those who rush in the market, sooner or later lose their capital.

Rule #2 from Larry Connors

"I get real, real concerned when I see trading strategies with too many rules"

Everything brilliant is simple! Each of us is probably familiar with this expression. It is also applicable to trading on financial markets. If, again, we pay attention to trading gurus, we can see an interesting fact - all of them mostly use very simple trading systems (TS). Some of them use their own author's TS, some of them use existing ones that have been tested for years. Take Alexander Elder, who is the author of the "Three Screens" strategy. His system is as simple as possible and uses several standard technical indicators built into any trading platform. Anyone can master Alexander Elder's system, and due to its effectiveness, the TS is used by tens of thousands of traders around the world.

Do not try to find or independently develop a mega-complex trading system. The more "elements", indicators, etc. in it, the more false signals it will produce. It will be quite difficult to find the only true signal among them. Your system should produce one or more signals, when they coincide, you open a trade. It is very important, as we pointed out in the first rule, to be patient and wait.

Rule #3 from Peter Lynch

“In this business if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.”

Peter Lynch, a world-famous American investor, was also a follower of simple trading and market analysis techniques. What did the guru wanted to emphasize in his statement? First of all, a large number of beginner traders stay in a delusion for a long time. They think that it is possible to achieve such a level of analysis that will allow them to make 100% forecasts all the time. The market is volatile. Sometimes there are trading situations when the market goes against technical and fundamental analysis. It is impossible to predict such market behavior. Secondly, because of this misconception newbies try to achieve only profitable trades on the market. So that there was not a single losing one in their account history. As a result, they try different strategies, read tons of books on market analysis, but still lose money. As a result, someone "gets an idea" and starts to understand what Lynch was talking about, and someone just quits the market.

Rule #4 from Henrique M. Simoes

"In trading, the impossible happens about twice a year"

In the fourth rule, we will focus on market volatility. These market "impossible" situations do occur periodically. For example, a trading instrument has been growing for a long time, and analyses signal us about the trend reversal. However, the instrument is still growing, breaking all levels. It happens that even some fundamental event, which 100% should lead to a trend reversal, on the contrary, accelerates the current trend even more. There are also more unpredictable situations, when the currency can rise in price twice within a few seconds.

An example is the situation with the Swiss franc, which at the beginning of 2015 strengthened against the U.S. dollar by almost 3000 points. On that day, not only a large number of traders around the world went bankrupt, but also several large Western brokers. Yes, such situations are very rare, once in 5-10 years, but they happen. How to protect against them? If we consider the example with the Swiss franc, a stop-loss would not have saved you, because the price changed at once. The only thing that could really help is to open trades with a small volume that can withstand such a strong movement.

Rule #5 from Jesse Livermore

“There is time to go long, time to go short and time to go fishing”

If you don't enjoy fishing, play a sport or make a field trip outdoors. You should definitely take a break from the market. Especially if you have a series of losing trades. Beginners are not ready for such psychological pressure, so regular breaks should be mandatory. The market will not go anywhere and will not run away, you can always return to it and continue trading. Large and experienced investors are well aware of this, so they do not forget to allocate enough time for rest. The situation is completely different for beginner traders. These two categories of traders mainly trade intraday or use scalping, so they have to constantly monitor the market sitting behind the monitor. As a result, psychological fatigue accumulates, the trader's eye gets tired and he starts to make mistakes that lead to losses. Be sure to rest, it is a guarantee not only of your health, but also of potential profit in the future.

It is extremely important to study the experience of professional traders who have achieved outstanding success in the financial markets. As you can see, many quotes hide not only the entire trading experience collected in one phrase, but sometimes the entire life of the author.

90% accuracy in telegram

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

90% accuracy in telegram

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.