🟢 LONG BIAS

📅 Updated: July 16

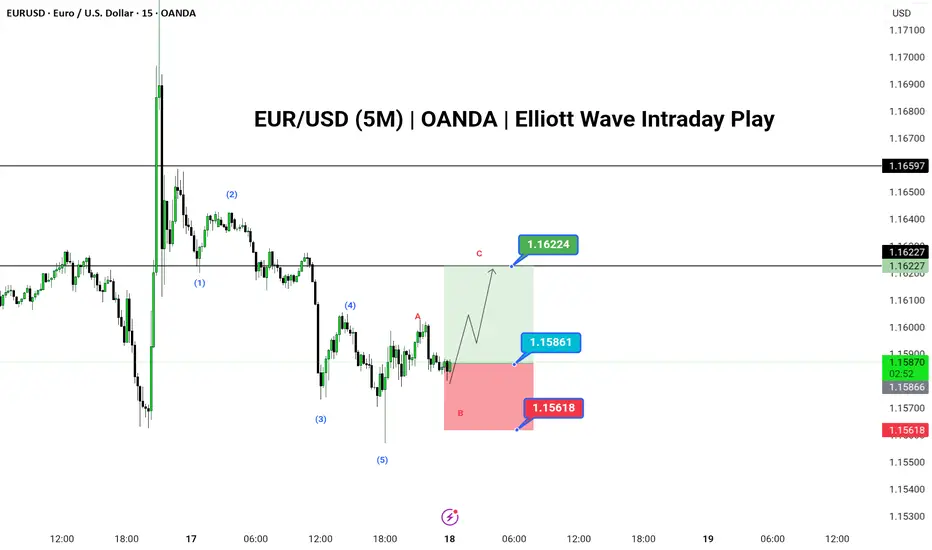

EUR/USD has completed a clean 5-wave impulse structure to the downside, followed by an unfolding ABC corrective pattern on the 5-minute chart. With Wave A and the ongoing B leg nearing completion, bulls may look to capitalize on a Wave C rally toward the 1.1622 resistance zone.

The structure suggests a temporary bullish move within a broader correction. Entry near the 1.1586 level offers a solid R:R setup, with invalidation below 1.1561. This setup is ideal for short-term intraday traders using Elliott Wave theory and expecting a 3-wave corrective rally.

---

📊 Technical Structure (5M)

✅ 5-wave bearish impulse labeled (1)-(5) complete

✅ ABC correction developing (currently in Wave B)

✅ Potential for bullish continuation via Wave C

📌 Upside Target

✅ Final: 1.16224

🔻 Risk Zone

❌ Invalidation: Below 1.15618

---

📈 Market Context

USD Consolidation: Dollar index pauses after strong rally, offering intraday relief to majors.

Euro Support: Mild bid across EUR crosses, offering stability in low-timeframe setups.

No High-Impact News: Ideal technical environment for short-term wave trading.

---

⚠️ Risks to Watch

Breakdown below 1.1561 would invalidate the structure.

Sudden volatility from unscheduled news.

Failure of Wave C to reach projected resistance.

---

🧭 Summary: Bias and Watchpoints

EUR/USD is setting up for a potential Wave C move toward 1.1622 as the ABC corrective structure plays out. Bullish bias holds above 1.1561 with a high-probability setup unfolding for short-term wave traders. Watch for price reaction near 1.1586 and use tight risk control.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.