This analysis is an update on the 1D time-frame idea I posted 20 days ago:

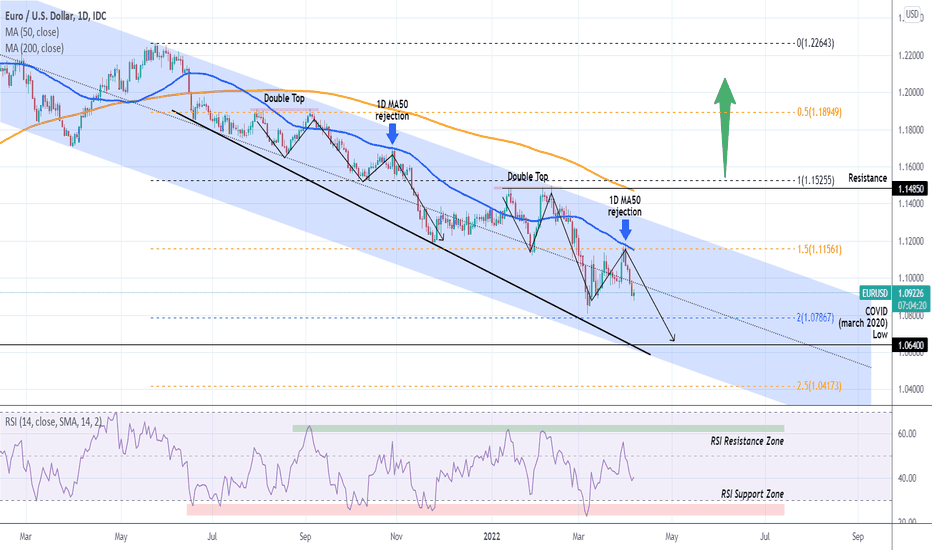

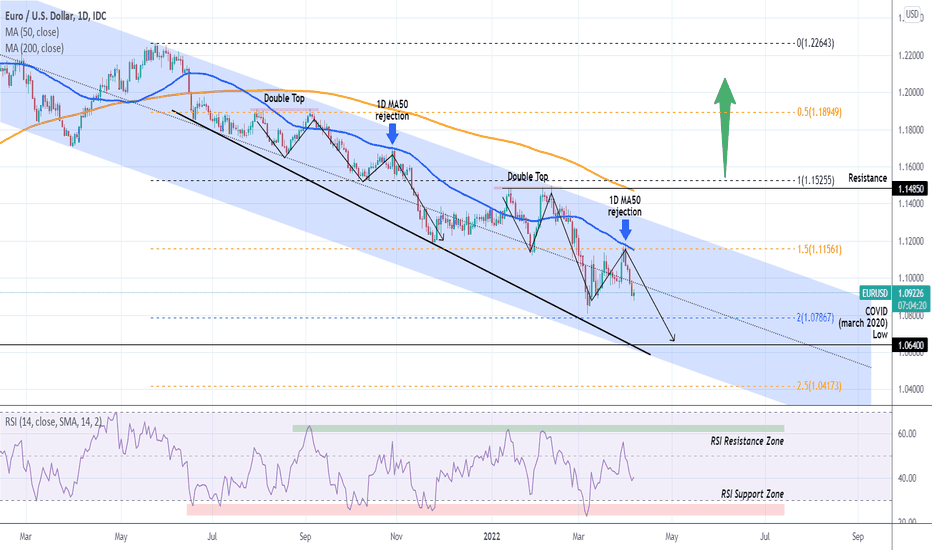

The price, always trading within a +1 year Channel Down pattern, is very close to the 1.06400 low that made the bottom during the COVID market crash in March 2020. Even though both the Diverging Lower Lows trend-line and the Lower Lows trend-line of the Channel Down are slightly lower at around 1.05500, the risk/ reward ratio is turning to the buyers favor, on the medium-term only, for a number of reasons:

1) Since the June 16 2021 break, the pair has always rebounded towards the 1D MA100 (green trend-line) where either marginally below or just above it, got rejected towards a new Channel Down Lower Low. The 1D MA100 is currently at 1.1166 and declining.

2) The Fibonacci extension levels have quite accurately marked Lower Lows within the Channel: November 24 2021 and March 07 2022. Even though the next extension is the 2.5 at 1.04170, the 1D MA100 is much higher, making a potential trade here on roughly a 2.5 Risk/ Reward Ratio.

3) The 1D RSI is approaching the 1 year Support Zone, which has also very accurately marked Lower Lows inside the Channel Down.

We are going long on EURUSD but only on the medium-term, aiming at taking profit on the 1D MA100.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

The price, always trading within a +1 year Channel Down pattern, is very close to the 1.06400 low that made the bottom during the COVID market crash in March 2020. Even though both the Diverging Lower Lows trend-line and the Lower Lows trend-line of the Channel Down are slightly lower at around 1.05500, the risk/ reward ratio is turning to the buyers favor, on the medium-term only, for a number of reasons:

1) Since the June 16 2021 break, the pair has always rebounded towards the 1D MA100 (green trend-line) where either marginally below or just above it, got rejected towards a new Channel Down Lower Low. The 1D MA100 is currently at 1.1166 and declining.

2) The Fibonacci extension levels have quite accurately marked Lower Lows within the Channel: November 24 2021 and March 07 2022. Even though the next extension is the 2.5 at 1.04170, the 1D MA100 is much higher, making a potential trade here on roughly a 2.5 Risk/ Reward Ratio.

3) The 1D RSI is approaching the 1 year Support Zone, which has also very accurately marked Lower Lows inside the Channel Down.

We are going long on EURUSD but only on the medium-term, aiming at taking profit on the 1D MA100.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.