Today, the EUR/USD pair is under pressure, having failed to consolidate above the 1.1447 level and showing intraday declines toward the psychological level of 1.1415 and below, amid U.S. dollar strength.

The main drive of the dollar's rise was Friday's strong U.S. Non-Farm Payrolls (NFP) report, which reduced expectations for an imminent rate cut by the Federal Reserve this year. In addition, optimism surrounding the potential resumption of U.S. -China trade talks is dampening bearish sentiment toward the dollar, thereby adding further pressure on EU/USD.

Nevertheless. ongoing negotiation in London and the upcoming key U.S. inflation data later this week are prompting traders to remain cautious and refrain from opening aggressive positions. The market still considers a September Fed rate cut likely, and concerns about the U.S. government's fiscal position are limiting the dollar's upside potential, which in turn lends some support to the euro.

On the other hand, the European Central Bank signaled at its latest meeting that the current rate-cutting cycle may be nearing an end. This also supports the euro and helps limit EUR/USD losses. In the absence of significant economic releases from the eurozone or the U.S. today, the pair's movement is mainly driven by dollar dynamics.

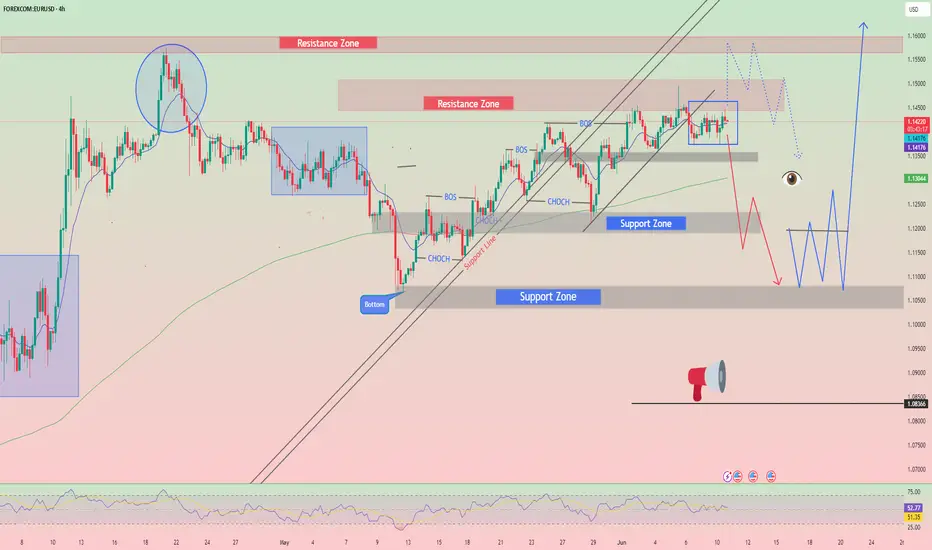

Technically, in order to resume upward movement, EUR/USD needs to break through resistance in the 1.1450-1.1460 level, which could open the path toward the psychological level of 1.1500. A break above that could lead to a retest of late-April highs. Otherwise, the risk of further decline toward the 1.1370 support level remains. However, oscillators on the daily chart are still in positive territory, indicating a generally constructive outlook for the pair.

In the short term, caution advised, with focus on signals from the trade negotiations and upcoming economic data.

The main drive of the dollar's rise was Friday's strong U.S. Non-Farm Payrolls (NFP) report, which reduced expectations for an imminent rate cut by the Federal Reserve this year. In addition, optimism surrounding the potential resumption of U.S. -China trade talks is dampening bearish sentiment toward the dollar, thereby adding further pressure on EU/USD.

Nevertheless. ongoing negotiation in London and the upcoming key U.S. inflation data later this week are prompting traders to remain cautious and refrain from opening aggressive positions. The market still considers a September Fed rate cut likely, and concerns about the U.S. government's fiscal position are limiting the dollar's upside potential, which in turn lends some support to the euro.

On the other hand, the European Central Bank signaled at its latest meeting that the current rate-cutting cycle may be nearing an end. This also supports the euro and helps limit EUR/USD losses. In the absence of significant economic releases from the eurozone or the U.S. today, the pair's movement is mainly driven by dollar dynamics.

Technically, in order to resume upward movement, EUR/USD needs to break through resistance in the 1.1450-1.1460 level, which could open the path toward the psychological level of 1.1500. A break above that could lead to a retest of late-April highs. Otherwise, the risk of further decline toward the 1.1370 support level remains. However, oscillators on the daily chart are still in positive territory, indicating a generally constructive outlook for the pair.

In the short term, caution advised, with focus on signals from the trade negotiations and upcoming economic data.

Trade active

As of June 16, the EUR/USD pair's average volatility over the past five trading days is 99 pips-considered "moderate. " We expect the pair to move between 1.1452 and 1.1650 on Monday. The long-term regression channel is pointing upward, still indicating a bullish trend. The CCI indicator had entered the oversold zone, forming a bullish divergence that triggered a renewed upward trend - undoubtedly helped by Trump.DAILY FREE SIGNAL. FREE SIGNAL (95% accuracy) TP AND SL PROVIDED

In This Channel, i Will Provide you a profitable Scalping And Swing Trade Follow My Signals

PUBLIC TELEGRAM CHANNEL

t.me/CEO_PREMIUM_ANALYSIS

In This Channel, i Will Provide you a profitable Scalping And Swing Trade Follow My Signals

PUBLIC TELEGRAM CHANNEL

t.me/CEO_PREMIUM_ANALYSIS

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

DAILY FREE SIGNAL. FREE SIGNAL (95% accuracy) TP AND SL PROVIDED

In This Channel, i Will Provide you a profitable Scalping And Swing Trade Follow My Signals

PUBLIC TELEGRAM CHANNEL

t.me/CEO_PREMIUM_ANALYSIS

In This Channel, i Will Provide you a profitable Scalping And Swing Trade Follow My Signals

PUBLIC TELEGRAM CHANNEL

t.me/CEO_PREMIUM_ANALYSIS

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.