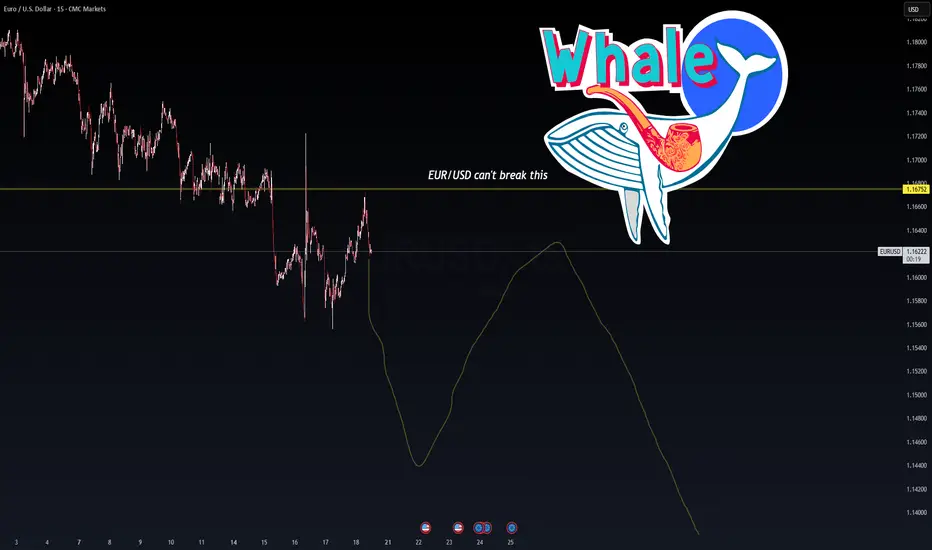

📉 EUR/USD Whale Wall – 1.1675 Rejection Zone

🐋 Smart Money is guarding 1.1675 like it’s sacred.

Every test into this level has been slapped down—likely a whale-level supply zone where institutional sell orders are stacked. VolanX projection curve suggests a macro fade into late July, aligning with DXY strength and bond volatility signals.

Outlook:

As long as 1.1675 holds, momentum favors downside toward 1.1450–1.1400. Rate divergence + weak Eurozone prints fuel the short bias. Break above 1.1675 invalidates.

📊 VolanX Protocol – Predict. React. Dominate.

#WaverVanir #VolanX #EURUSD #Forex #SmartMoney #FXStrategy #MacroTrading

🐋 Smart Money is guarding 1.1675 like it’s sacred.

Every test into this level has been slapped down—likely a whale-level supply zone where institutional sell orders are stacked. VolanX projection curve suggests a macro fade into late July, aligning with DXY strength and bond volatility signals.

Outlook:

As long as 1.1675 holds, momentum favors downside toward 1.1450–1.1400. Rate divergence + weak Eurozone prints fuel the short bias. Break above 1.1675 invalidates.

📊 VolanX Protocol – Predict. React. Dominate.

#WaverVanir #VolanX #EURUSD #Forex #SmartMoney #FXStrategy #MacroTrading

Note

🔵 Institutional Position Zones1. Premium Rejection Zone (Above 1.16500 – 1.18000)

Label: "Premium" and "Weak High"

Insight: Institutions likely distributed long positions here.

Action: This is a sell-side liquidity zone where smart money may have taken profits and flipped bias bearish.

2. Volume Imbalance Zone (~1.14500 – 1.15000)

Volume Profile: Sudden drop in volume density (low-volume node).

Insight: Acts as a magnet for price if reversion occurs; possible re-entry zone for reaccumulation or short covering.

3. Mid-Level Demand Cluster (~1.11000 – 1.12500)

Label: Strong demand block.

Insight: Institutions likely entered long positions here after March's BOS (Break of Structure).

This is a key re-entry zone if price corrects further.

4. Equilibrium Level (1.10091)

Significance: Midpoint of the entire range.

Insight: Institutions use this level to rebalance orders. Expect mean reversion plays near this area.

5. Deep Discount Buy Zone (Below 1.06000 to 1.03500)

Label: “Strong Low,” high-volume node.

Insight: Likely the true accumulation zone where institutional long bias was established.

If price revisits, it’s a prime area for institutional re-entry.

Note

Here is the context: EUR/USD Pre-FOMC Analysis: A Bearish Tilt Amidst Diverging Economic Tides

FRANKFURT & NEW YORK – As financial markets brace for the Federal Open Market Committee (FOMC) meeting on Monday, July 28, 2025, the outlook for the EUR/USD currency pair is leaning bearish. A confluence of diverging economic fundamentals, mixed market sentiment, and a more challenging macroeconomic backdrop for the Eurozone compared to the United States suggests potential downward pressure on the common currency.

Fundamental Divergence: US Resilience vs. Eurozone Fragility

The core of the bearish sentiment stems from the contrasting economic pictures on either side of the Atlantic. The U.S. economy, while navigating its own set of challenges, appears more resilient. Recent data from the Bureau of Labor Statistics indicated a relatively stable labor market, with the unemployment rate holding steady and non-farm payrolls showing modest gains. Inflation, as measured by the Consumer Price Index (CPI) and Producer Price Index (PPI), remains a key focus for the Federal Reserve. While showing some signs of moderation, inflation is still above the Fed's target, giving the central bank less room to consider imminent rate cuts. The latest Beige Book also points to a U.S. economy that is expanding, albeit at a varied pace across regions.

In contrast, the Eurozone is grappling with more significant economic headwinds. The latest inflation figures from Eurostat, while having ticked up recently, are on a broader disinflationary path. This has allowed the European Central Bank (ECB) to adopt a more dovish stance. In its recent monetary policy statements, the ECB has signaled a willingness to ease policy further if necessary to support the economy. Recent commentary from ECB governing council members has reinforced this dovish bias, with an emphasis on data-dependency and concerns over the strength of the economic recovery. GDP growth forecasts for the Eurozone in the second half of 2025 have been revised downwards by several institutions, citing the impact of geopolitical risks and slowing global demand. Retail sales in the bloc have also shown signs of weakness.

This fundamental divergence in economic performance and central bank outlook is a primary driver for the bearish EUR/USD forecast. A Federal Reserve that is likely to maintain a relatively hawkish "higher for longer" stance on interest rates, in contrast to a more accommodative ECB, creates a yield differential that favors the U.S. dollar.

Sentiment & Macroeconomic Headwinds: A Cautious Market

Market sentiment surrounding EUR/USD is currently mixed, but with a notable undercurrent of caution that could favor the dollar. Analysis of the Commitment of Traders (COT) report from the CFTC indicates that while there isn't an extreme speculative positioning, there has been a reduction in net long positions on the euro. This suggests that large speculators are becoming less bullish on the single currency.

From a technical perspective, EUR/USD has faced significant resistance at higher levels, with key moving averages starting to point towards a potential downtrend. While short-term bounces on improved risk sentiment have occurred, the broader technical picture suggests that the path of least resistance may be lower.

The macroeconomic landscape further complicates the outlook for the Eurozone. The ongoing geopolitical tensions in Eastern Europe continue to cast a long shadow, impacting energy prices and consumer confidence. Furthermore, the potential for increased trade friction with the United States remains a significant risk for the export-oriented Eurozone economy. The latest economic outlooks for the Eurozone point to a period of sluggish growth, with downside risks dominating.

While the U.S. is not immune to global challenges, its economy is generally considered to be more domestically driven and therefore less exposed to the immediate fallout from some of these external risks. The overall global macroeconomic environment, characterized by uncertainty and a potential for slowing growth, tends to favor the U.S. dollar as a safe-haven currency.

Ranking: Leaning Bearish

In conclusion, coming into the FOMC meeting on Monday, the outlook for EUR/USD is ranked as bearish. This is based on the following key factors:

Fundamental Divergence: A more resilient U.S. economy with persistent, albeit moderating, inflation compared to a more fragile Eurozone economy with a dovish central bank.

Monetary Policy Asymmetry: The Federal Reserve is expected to maintain a relatively restrictive policy stance, while the European Central Bank has signaled a greater willingness to ease.

Macroeconomic Pressures: The Eurozone faces more significant and direct headwinds from geopolitical instability and potential trade disputes.

Market Sentiment: While not decisively one-sided, the underlying sentiment and speculative positioning appear to be shifting away from a bullish euro stance.

Traders and investors will be closely scrutinizing the FOMC statement and any forward guidance from Fed Chair Jerome Powell for any shifts in the central bank's assessment of the economy and its future policy path. Any surprisingly dovish tone from the Fed could provide temporary support for EUR/USD. However, based on the current body of evidence, the fundamental and macroeconomic currents are flowing in favor of the U.S. dollar, suggesting a more likely bearish trajectory for the currency pair in the near term.

Note

Yikes! They broke it !Note

But no worries, I guess. Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.