Since last week, the act of war on Ukrainian soil hasn't left EURUSD unaffected, as the geopolitical conflict has caused a strong rise on the USD (as a safe haven) and devaluation of the EUR (which is affected the most with the war being on European territory). That has completely reversed the bullish sentiment a week before caused by the hawkish stance of the ECB.

However, technically the pair remains within the wider look of the Megaphone pattern that started after the November 24 2021 low. Yesterday its Lower Lows trend-line (bottom), marginally broke but the day managed to close back above it and within the pattern. So far this has managed to hold another 2 times in a week. It becomes obvious that the market participants need to pay close attention to the closings of 1D candles. As long as they do close above the Lower Lows trend-line, we have the conditions for another run and test of the 1.14850 Resistance. A closing below the Lower Lows trend-line would set in motion the test of the 1.5 Fibonacci extension below at 1.09400.

Keep in mind that starting today, the markets will be under the added pressure and volatility cause by the Initial Jobless Claims, Jerome Powell's Testimony and Friday's Nonfarm Payrolls.

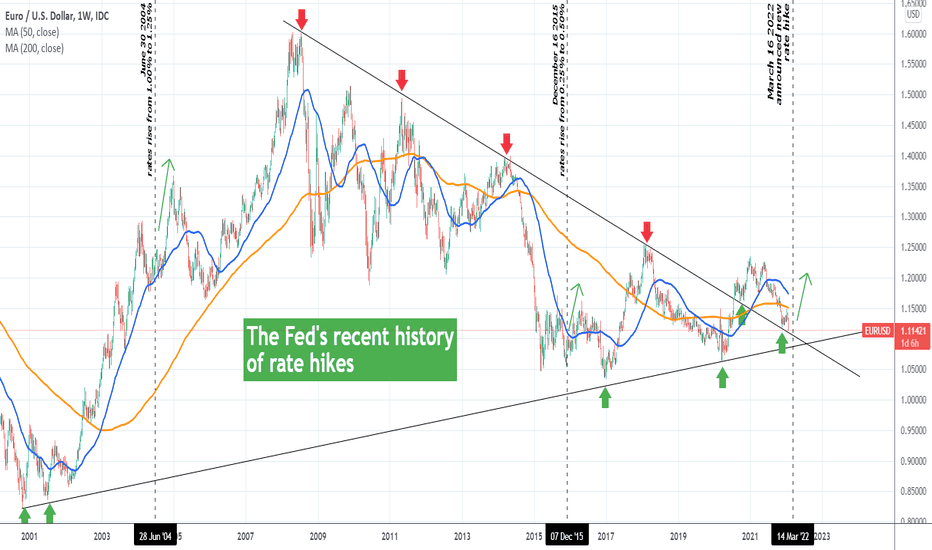

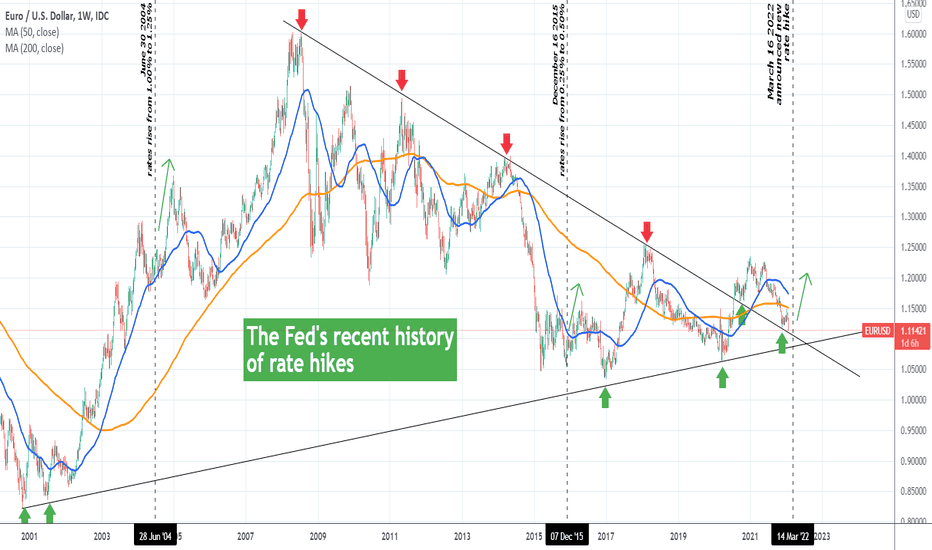

P.S. As the 1W chart below shows, always keep a long-term perspective as an investor:

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

However, technically the pair remains within the wider look of the Megaphone pattern that started after the November 24 2021 low. Yesterday its Lower Lows trend-line (bottom), marginally broke but the day managed to close back above it and within the pattern. So far this has managed to hold another 2 times in a week. It becomes obvious that the market participants need to pay close attention to the closings of 1D candles. As long as they do close above the Lower Lows trend-line, we have the conditions for another run and test of the 1.14850 Resistance. A closing below the Lower Lows trend-line would set in motion the test of the 1.5 Fibonacci extension below at 1.09400.

Keep in mind that starting today, the markets will be under the added pressure and volatility cause by the Initial Jobless Claims, Jerome Powell's Testimony and Friday's Nonfarm Payrolls.

P.S. As the 1W chart below shows, always keep a long-term perspective as an investor:

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.