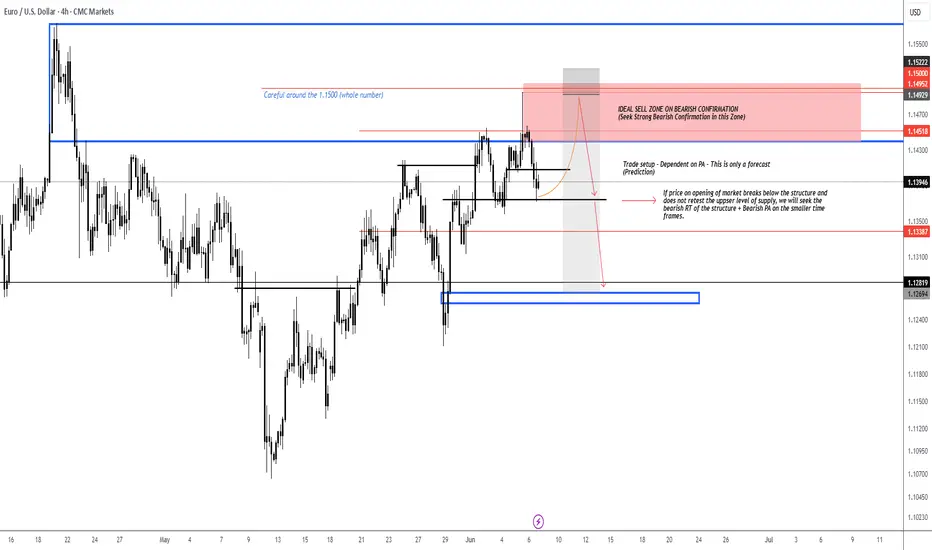

EUR/USD looking to trade around a key supply zone between 1.1450–1.1500. We’re watching for signs of bearish rejection to build a short bias from this area. No trade unless price confirms.

Main Setup:

If price retests upper zone (~1.1450–1.1500) and shows clear bearish price action, I’ll be looking to enter short.

Ideal signs: rejection wicks, SFPs, bearish engulfing, lower timeframe structure shift.

Break & Retest Option:

If price breaks below 1.1390, a clean bearish retest could offer a continuation short setup.

Structure break confirmation is key here.

This is a forecast, and trades will be dependent on live PA.

If we don’t get confirmation, we don’t force it. Patience is key.

DXY Outlook:

The Dollar Index looks bearish overall but is currently in a small corrective bounce. A short-term DXY pullback would support a push into EUR/USD’s supply zone — lining up nicely with our plan. If DXY flips back to bullish, that strengthens our short setup.

Main Setup:

If price retests upper zone (~1.1450–1.1500) and shows clear bearish price action, I’ll be looking to enter short.

Ideal signs: rejection wicks, SFPs, bearish engulfing, lower timeframe structure shift.

Break & Retest Option:

If price breaks below 1.1390, a clean bearish retest could offer a continuation short setup.

Structure break confirmation is key here.

This is a forecast, and trades will be dependent on live PA.

If we don’t get confirmation, we don’t force it. Patience is key.

DXY Outlook:

The Dollar Index looks bearish overall but is currently in a small corrective bounce. A short-term DXY pullback would support a push into EUR/USD’s supply zone — lining up nicely with our plan. If DXY flips back to bullish, that strengthens our short setup.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.