Hello everyone , as we all know the market action discounts everything :)

I've posted a couple of ideas about the EUR/USD analysis and today we see that the market moved exactly how we thought it was gonna move .

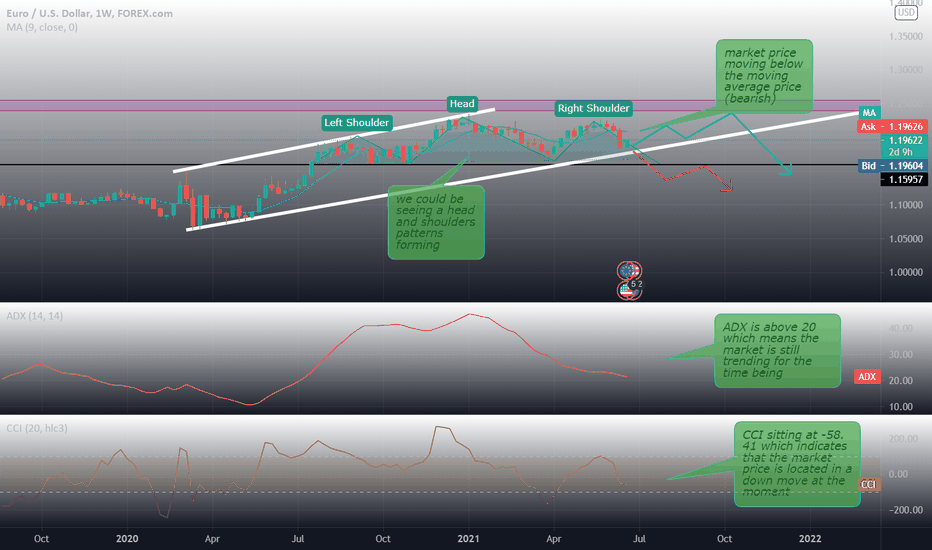

first one on jun 25th :

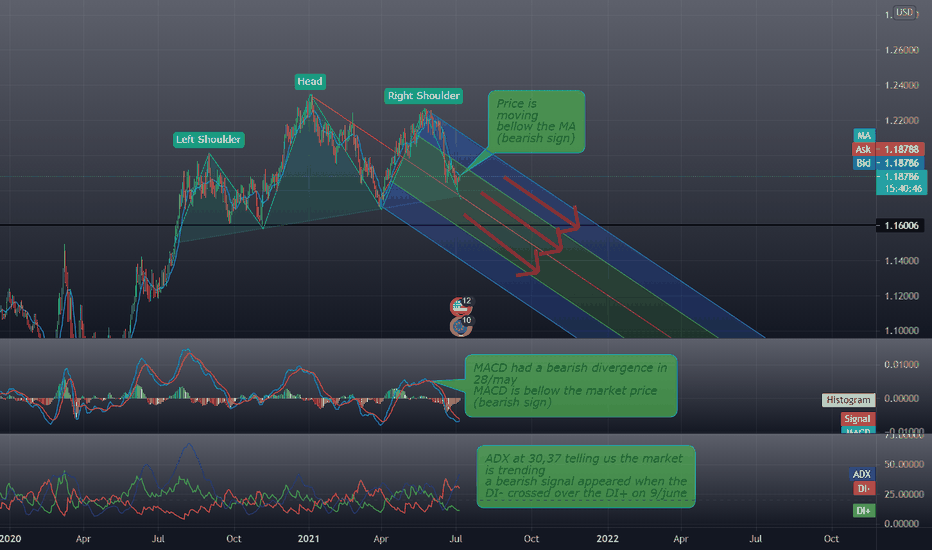

second on july 6th

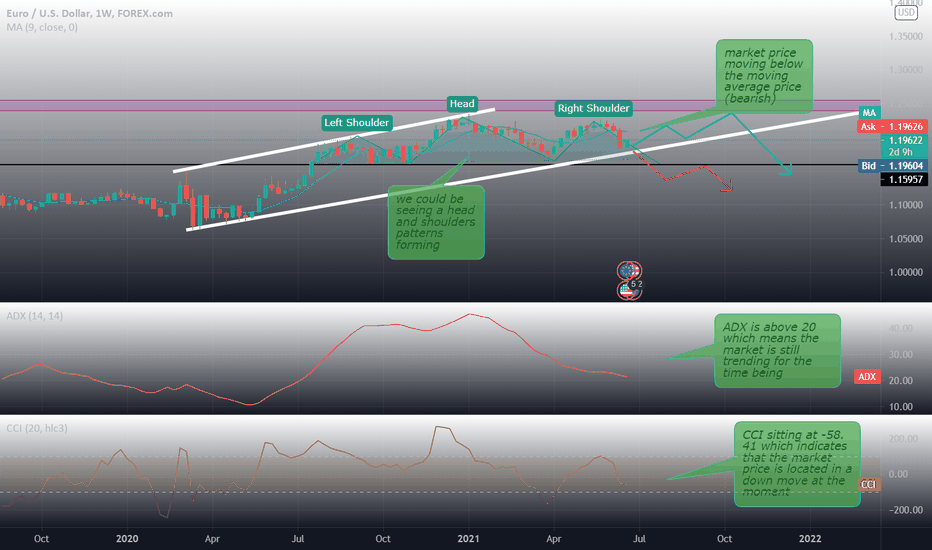

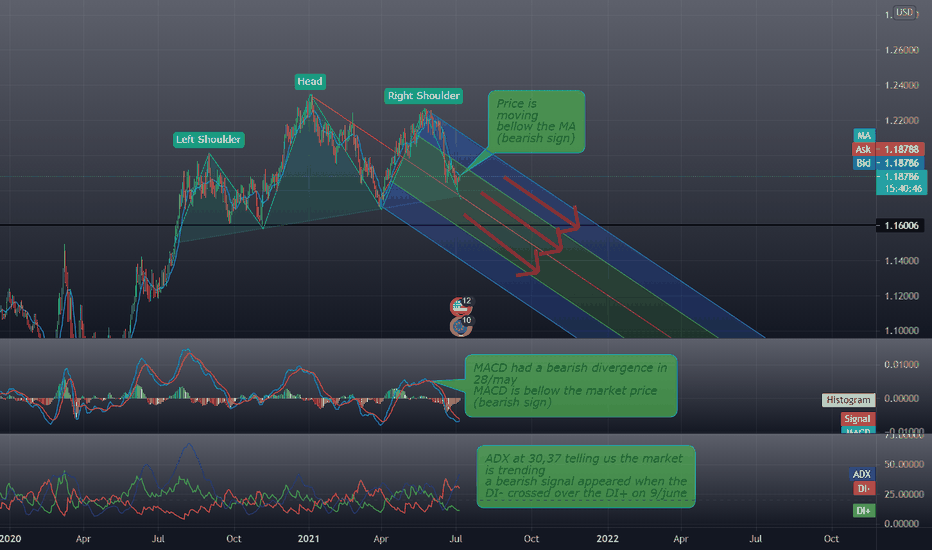

we are still waiting on the breakout of the neckline of the head and shoulders around the 1.17635 area , no reversal sign to be found yet on the chart and the major trend still seems to be in the hands of the bears .

indicators confirming this where :

1_The market price moving below the MA and the EMA (bearish sign)

2_Stochastic oscillator is in oversold zone with %D at 20.55 above %K at 5.96 (bearish sign)

3_Williams %R is in oversold zone at -94.06 showing the weakness of the market (bearish sign)

Support & Resistance points :

support Resistance

1_ 1.1835 1_ 1.1919

2_ 1.1763 2_ 1.2005

3_ 1.1695 3_ 1.2032

Fundamental point of view :

According to DailyFX:

Following Tuesday’s sharp selloff to the sub-1.1800 levels, EUR/USD now looks to attract dip-buyers and retake, initially, the 1.1800 hurdle amidst some cautious mood ahead of Powell’s semiannual testimony to the Congress.

Spot lost nearly a cent on Tuesday after US inflation figures surprised to the upside in June, noting that headline consumer prices rose 5.4% YoY (highest since 2008) and the core CPI gained 4.5% YoY (highest since 1991).

In addition, pressure for an earlier-than-expected tapering of the US QE programme continue to build up , in stark contrast to the ECB stance. On the latter, ECB’s De Guindos said earlier in the week that the Council will discuss the bank’s forward guidance next week. It is worth recalling that the ECB event is due on July 22.

In the euro data space, Industrial Production in the broader Euroland contracted 1.0% MoM in May and expanded at an annualized 20.5%, both prints coming in short of estimates. In addition, final Spanish CPI rose 0.5% MoM in June and 2.7% over the last twelve months.

EUR/USD returns to the area of recent lows near 1.1780, just above the key 2020-2021 support line. Price action around spot, in the meantime, is expected to exclusively hinge on dollar dynamics, particularly as investors continue to adjust to the Fed’s hawkish message, prospects of higher inflation in the US and potential QE tapering earlier than anticipated. On the euro side of the equation, support for the European currency in the form of auspicious results from fundamentals in the bloc now appears somewhat mitigated considering recent data, although the investors’ morale remains high amidst the persistent optimism surrounding a strong rebound in the economic activity in the second half of the year.

Make sure to Follow and Like for more content

This is my personal opinion done with technical analysis of the market price and research online from fundamental analysts for The Fundamental point of view , not financial advice.

If you have any questions please ask

Thank you for reading.

I've posted a couple of ideas about the EUR/USD analysis and today we see that the market moved exactly how we thought it was gonna move .

first one on jun 25th :

second on july 6th

we are still waiting on the breakout of the neckline of the head and shoulders around the 1.17635 area , no reversal sign to be found yet on the chart and the major trend still seems to be in the hands of the bears .

indicators confirming this where :

1_The market price moving below the MA and the EMA (bearish sign)

2_Stochastic oscillator is in oversold zone with %D at 20.55 above %K at 5.96 (bearish sign)

3_Williams %R is in oversold zone at -94.06 showing the weakness of the market (bearish sign)

Support & Resistance points :

support Resistance

1_ 1.1835 1_ 1.1919

2_ 1.1763 2_ 1.2005

3_ 1.1695 3_ 1.2032

Fundamental point of view :

According to DailyFX:

Following Tuesday’s sharp selloff to the sub-1.1800 levels, EUR/USD now looks to attract dip-buyers and retake, initially, the 1.1800 hurdle amidst some cautious mood ahead of Powell’s semiannual testimony to the Congress.

Spot lost nearly a cent on Tuesday after US inflation figures surprised to the upside in June, noting that headline consumer prices rose 5.4% YoY (highest since 2008) and the core CPI gained 4.5% YoY (highest since 1991).

In addition, pressure for an earlier-than-expected tapering of the US QE programme continue to build up , in stark contrast to the ECB stance. On the latter, ECB’s De Guindos said earlier in the week that the Council will discuss the bank’s forward guidance next week. It is worth recalling that the ECB event is due on July 22.

In the euro data space, Industrial Production in the broader Euroland contracted 1.0% MoM in May and expanded at an annualized 20.5%, both prints coming in short of estimates. In addition, final Spanish CPI rose 0.5% MoM in June and 2.7% over the last twelve months.

EUR/USD returns to the area of recent lows near 1.1780, just above the key 2020-2021 support line. Price action around spot, in the meantime, is expected to exclusively hinge on dollar dynamics, particularly as investors continue to adjust to the Fed’s hawkish message, prospects of higher inflation in the US and potential QE tapering earlier than anticipated. On the euro side of the equation, support for the European currency in the form of auspicious results from fundamentals in the bloc now appears somewhat mitigated considering recent data, although the investors’ morale remains high amidst the persistent optimism surrounding a strong rebound in the economic activity in the second half of the year.

Make sure to Follow and Like for more content

This is my personal opinion done with technical analysis of the market price and research online from fundamental analysts for The Fundamental point of view , not financial advice.

If you have any questions please ask

Thank you for reading.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.