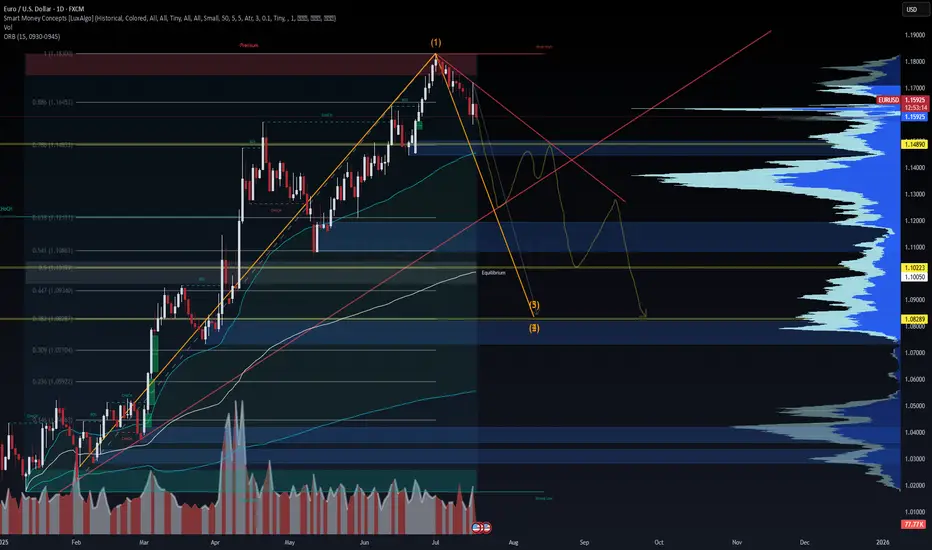

EUR/USD Bearish Wave Outlook Into September 2025

Technical + Elliott Wave + Macro View

EUR/USD has likely completed a major top at 1.18300, which aligns with the 1.0 Fibonacci extension. This level acted as a liquidity sweep before reversing sharply, marking the top of Wave (1) in the current Elliott sequence. We're now entering Wave (3) to the downside—a high-momentum leg often driven by macro confirmation.

Price has broken the ascending channel and rejected the 0.786 and 0.886 retracement zones. With lower highs forming, the structure is weakening. The next likely target sits around 1.10223, a key Fibonacci and order block confluence. If momentum accelerates, EUR/USD could continue toward 1.08289, completing the full Wave (2).

From a macro lens, the divergence between the Fed and ECB continues to widen. The U.S. economy remains resilient with sticky inflation and strong yields supporting the dollar. In contrast, Europe is showing signs of stagnation, with Germany and France struggling to post meaningful growth. This favors continued downside on the pair.

Expect potential relief rallies into 1.1400–1.1550, but these are likely to be sold unless a fundamental catalyst shifts sentiment.

Bias: Bearish

Targets: 1.1022 > 1.0828

Invalidation: Clean break and close above 1.1700

—

🔔 Watch for volume spikes and failed reclaims of structure as confirmation. DSS signals aligned.

#EURUSD #Forex #ElliottWave #SmartMoneyConcepts #MacroTrading #WaverVanir #VolanX #DollarStrength #FXForecast #TechnicalAnalysis

Technical + Elliott Wave + Macro View

EUR/USD has likely completed a major top at 1.18300, which aligns with the 1.0 Fibonacci extension. This level acted as a liquidity sweep before reversing sharply, marking the top of Wave (1) in the current Elliott sequence. We're now entering Wave (3) to the downside—a high-momentum leg often driven by macro confirmation.

Price has broken the ascending channel and rejected the 0.786 and 0.886 retracement zones. With lower highs forming, the structure is weakening. The next likely target sits around 1.10223, a key Fibonacci and order block confluence. If momentum accelerates, EUR/USD could continue toward 1.08289, completing the full Wave (2).

From a macro lens, the divergence between the Fed and ECB continues to widen. The U.S. economy remains resilient with sticky inflation and strong yields supporting the dollar. In contrast, Europe is showing signs of stagnation, with Germany and France struggling to post meaningful growth. This favors continued downside on the pair.

Expect potential relief rallies into 1.1400–1.1550, but these are likely to be sold unless a fundamental catalyst shifts sentiment.

Bias: Bearish

Targets: 1.1022 > 1.0828

Invalidation: Clean break and close above 1.1700

—

🔔 Watch for volume spikes and failed reclaims of structure as confirmation. DSS signals aligned.

#EURUSD #Forex #ElliottWave #SmartMoneyConcepts #MacroTrading #WaverVanir #VolanX #DollarStrength #FXForecast #TechnicalAnalysis

Trade active

📉 EUR/USD Forecast | VolanX Predictive Model Signals Bearish Path Into SeptemberWaverVanir Protocol Alignment – AI-Guided Macro and Price Action Convergence

Our latest run of the VolanX Hybrid Predictor—powered by a dual LSTM-GRU architecture with sentiment weighting—projects a clear directional drift lower in EUR/USD (symbol: EURUSD=X) over the coming month.

After peaking above 1.18 in early July, the model anticipates a persistent decline through August, targeting sub-1.07 levels by early September. The sentiment input remains weak at 0.40, confirming institutional disinterest and aligning with our DSS macro thesis of continued USD strength driven by real yield spreads, policy divergence, and Eurozone stagnation.

The VolanX AI stack uses:

512 LSTM units

256 GRU units

Dropout of 0.40 (for generalization)

Trained over 200 epochs on price, volume, and sentiment features

This model output is consistent with both our Smart Money Concepts framework and Elliott Wave projection, where Wave (3) accelerates into the 1.1022 → 1.0828 target zones.

📌 Strategic Signal: Macro + AI consensus remains short-biased into Q3 close. VolanX will continue monitoring re-entry levels via OB sweeps and VWAP deviations.

🔐 Powered by the VolanX Protocol

🧠 Structured by WaverVanir DSS

—

#EURUSD #ForexAI #VolanX #WaverVanir #MachineLearning #LSTM #QuantFinance #MacroStrategy #SmartMoneyConcepts #ForexPrediction

Note

✅ Verdict:EUR/USD is bearish into September 2025, with 1.1022 and 1.0828 as high-probability downside targets. Any rallies into 1.1400–1.1550 are likely to be sold unless macro sentiment changes dramatically.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.