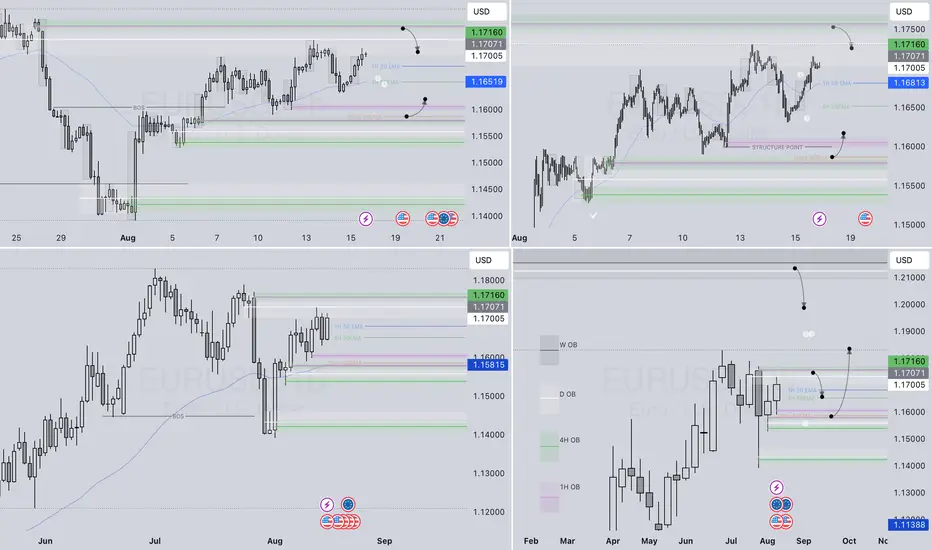

📊 EURUSD – WEEKLY FORECAST

Q3 | W34 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

https://tradingview.sweetlogin.com/x/drRPIfLh/

EURUSD

EURUSD

Q3 | W34 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

https://tradingview.sweetlogin.com/x/drRPIfLh/

Note

📊 EURUSD Weekly ForecastQ3 | Week 34 | Year 2025

This week on EURUSD, the key focus is on 15-minute breaks of structure, as price is currently sitting between conflicting signals from higher and lower time frames.

We have multiple zones on the LTF (Lower Time Frame) where entries may make sense — but caution is essential due to mixed higher time frame signals.

🟢 Bullish Outlook – Daily Bias

A positive daily close above the 50 EMA signals continuation to the upside, aligning with a bullish HTF (Higher Time Frame) bias.

However, price is significantly extended above the weekly 50 EMA, suggesting that at some point, a gravitational pull back toward that average is likely. That’s just market rhythm.

On the daily chart, we’ve seen a subtle break of structure, potentially indicating that a new low has been formed.

The next step? Either a lower high or double top formation — that’s the conflict.

So, while the market remains uncertain, I’ll stay flexible, with a preference for bullish opportunities from the daily 50 EMA, if structure confirms.

🔴 Bearish Outlook – Caution Required

I’ll approach shorts carefully, but I'm watching for price to potentially reach into the May 2025 weekly POI (Point of Interest) or order block.

If price taps into that zone, I’ll look for:

✅ A LTF break of structure

🔻 Followed by shorts targeting the daily 50 EMA

If price then closes below the daily 50 EMA, that would indicate a shift in sentiment — suggesting sellers have stepped in with strength.

At that point: Longs off. Shorts on.

Target: Gap fill down to the weekly 50 EMA

🧠 Key Notes:

Bias remains fluid due to conflicting HTF signals

Longs preferred with structure from the daily 50 EMA

Shorts valid only after strong confirmations

Stay reactive to price, not predictive — structure tells the story

💬 Wishing you all a disciplined and profitable trading week ahead.

– FRGNT

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.