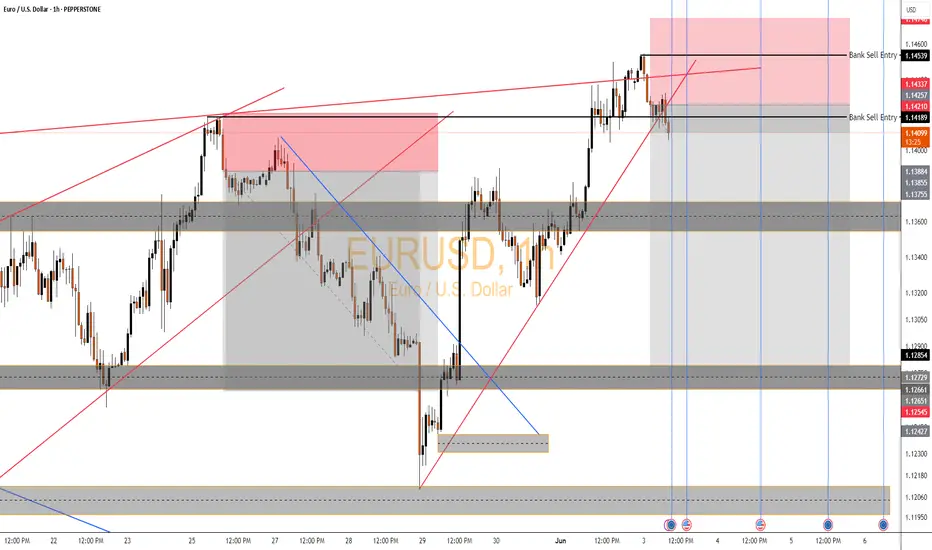

EURUSD – Institutional Short Setup 🔻

Timeframe: 1H

Date: June 3, 2025

Strategy: OdinVerse HP – Bank Entry Trap + Supply Stack Breakdown

🧠 Smart Money Logic

🔍 Key Zone Details

🔴 Upper Bank Sell Entry (1.14539 – 1.14337) Final liquidity sweep into major HTF supply – fakeout push before drop.

🔴 Lower Bank Sell Entry (1.14210 – 1.14127) True institutional entry zone. Price retested this zone before rejection.

🔻 Current Reaction Zone Price is rejecting the lower zone with bearish follow-through and structure shift.

🔑 Key Confluences

Fakeout Above Trendline → Trap breakouts at the top of rising wedge.

Double Bank Sell Zones → Clear signs of institutional order stacking.

Market Structure Shift → Clean BOS (break of structure) after retest of lower zone.

Mitigation Complete → Last bullish OB fully mitigated, turning supply active.

Daily EQM Sweep → Targeting imbalance & unfilled FVGs below (1.1285 to 1.1200).

🎯 Targets

🎯 TP Levels Zone/Logic

1.13884 Prior demand base / FVG top

1.12854 Major imbalance completion

1.12545 – 1.1200 Liquidity grab + OB tap zone

⚔️ Execution Plan

In Position? Hold – structure confirms clean sell trap.

Missed Entry? Wait for M5–M15 OB retest or mitigation around 1.1415.

Reversal Risk? Only invalid if 1.1454 breaks with close above.

🔥 OdinVerse Grade: A+ Setup

✔ HTF Supply Confluence

✔ Dual Bank Entry Zones

✔ Structure Shift

✔ Clean Downside Liquidity Targets

Timeframe: 1H

Date: June 3, 2025

Strategy: OdinVerse HP – Bank Entry Trap + Supply Stack Breakdown

🧠 Smart Money Logic

🔍 Key Zone Details

🔴 Upper Bank Sell Entry (1.14539 – 1.14337) Final liquidity sweep into major HTF supply – fakeout push before drop.

🔴 Lower Bank Sell Entry (1.14210 – 1.14127) True institutional entry zone. Price retested this zone before rejection.

🔻 Current Reaction Zone Price is rejecting the lower zone with bearish follow-through and structure shift.

🔑 Key Confluences

Fakeout Above Trendline → Trap breakouts at the top of rising wedge.

Double Bank Sell Zones → Clear signs of institutional order stacking.

Market Structure Shift → Clean BOS (break of structure) after retest of lower zone.

Mitigation Complete → Last bullish OB fully mitigated, turning supply active.

Daily EQM Sweep → Targeting imbalance & unfilled FVGs below (1.1285 to 1.1200).

🎯 Targets

🎯 TP Levels Zone/Logic

1.13884 Prior demand base / FVG top

1.12854 Major imbalance completion

1.12545 – 1.1200 Liquidity grab + OB tap zone

⚔️ Execution Plan

In Position? Hold – structure confirms clean sell trap.

Missed Entry? Wait for M5–M15 OB retest or mitigation around 1.1415.

Reversal Risk? Only invalid if 1.1454 breaks with close above.

🔥 OdinVerse Grade: A+ Setup

✔ HTF Supply Confluence

✔ Dual Bank Entry Zones

✔ Structure Shift

✔ Clean Downside Liquidity Targets

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.