EURUSD 16 June – Technical Rebound or Liquidity Trap?

The EURUSD pair has shown sharp movements after testing key resistance near 1.1607. While the price action may appear bullish at first glance, deeper analysis suggests we might be facing either a continuation of the uptrend or a strategic liquidity hunt.

🌍 Macro & Fundamental Overview

The ECB remains hawkish with rates still high, but recent commentary hints at a more dovish tone possibly leading to rate cuts in late Q3 2025.

Meanwhile, the Federal Reserve maintains its cautious stance, holding off on rate cuts due to sticky core inflation.

This divergence in policy expectations creates a neutral to slightly USD-favorable bias, depending on upcoming economic data.

⏳ Bottom line: EURUSD remains in a choppy environment with compression–expansion cycles, and no confirmed macro-driven trend yet.

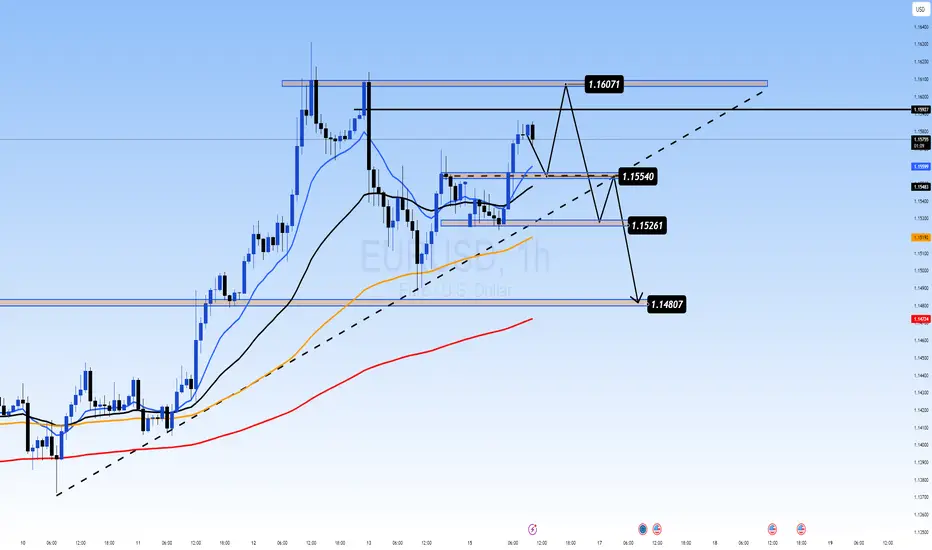

📉 Technical Outlook (H1 Chart)

Price Structure: The pair is moving within a short-term ascending channel, but current price is testing the upper boundary.

EMA Analysis (13/34/89/200): Still supports an uptrend, but flattening out — potential bearish crossover if price fails to hold.

Key Resistance:

1.1607: Major resistance and local top (double rejection zone).

Critical Support Zones:

1.15540: Minor structural support — a decisive level for intraday direction.

1.15261 & 1.14807: Unfilled FVG zones and liquidity pools that may get targeted if the price breaks lower.

🎯 Trade Setup Ideas

📘 Scenario A – BUY from 1.15540 support (bullish continuation)

Entry: 1.15540 (upon bullish candle confirmation or strong bounce)

Stop Loss: 1.15200

Take Profits: 1.15850 → 1.16070 → 1.16300+

✅ Ideal if European sentiment remains positive or if USD weakens across the board.

📕 Scenario B – SELL if price breaks and retests 1.15540

Entry: 1.15540 (after a breakdown + rejection retest)

Stop Loss: 1.15720

Take Profits: 1.15261 → 1.14807 → possibly 1.1450

✅ Best used if USD gains strength or EUR shows weakness after economic releases.

🧠 Market Psychology

The market is currently reactive to any shift in tone from ECB and Fed, causing price whipsaws near key zones.

Smart traders will avoid chasing breakouts and instead focus on reaction zones like 1.15540 for confirmation-based trades.

Watch for fakeouts, as institutional players may be hunting liquidity before choosing direction.

📌 Final Thoughts

EURUSD is in a sensitive zone, and 1.15540 is the intraday pivot. Holding above could trigger a push toward 1.1607 and higher. But failure to hold would likely attract sellers toward the 1.1480–1.1450 liquidity range.

🎯 Discipline is key. Avoid emotional entries. Let the market come to your level — and execute only with confirmation.

The EURUSD pair has shown sharp movements after testing key resistance near 1.1607. While the price action may appear bullish at first glance, deeper analysis suggests we might be facing either a continuation of the uptrend or a strategic liquidity hunt.

🌍 Macro & Fundamental Overview

The ECB remains hawkish with rates still high, but recent commentary hints at a more dovish tone possibly leading to rate cuts in late Q3 2025.

Meanwhile, the Federal Reserve maintains its cautious stance, holding off on rate cuts due to sticky core inflation.

This divergence in policy expectations creates a neutral to slightly USD-favorable bias, depending on upcoming economic data.

⏳ Bottom line: EURUSD remains in a choppy environment with compression–expansion cycles, and no confirmed macro-driven trend yet.

📉 Technical Outlook (H1 Chart)

Price Structure: The pair is moving within a short-term ascending channel, but current price is testing the upper boundary.

EMA Analysis (13/34/89/200): Still supports an uptrend, but flattening out — potential bearish crossover if price fails to hold.

Key Resistance:

1.1607: Major resistance and local top (double rejection zone).

Critical Support Zones:

1.15540: Minor structural support — a decisive level for intraday direction.

1.15261 & 1.14807: Unfilled FVG zones and liquidity pools that may get targeted if the price breaks lower.

🎯 Trade Setup Ideas

📘 Scenario A – BUY from 1.15540 support (bullish continuation)

Entry: 1.15540 (upon bullish candle confirmation or strong bounce)

Stop Loss: 1.15200

Take Profits: 1.15850 → 1.16070 → 1.16300+

✅ Ideal if European sentiment remains positive or if USD weakens across the board.

📕 Scenario B – SELL if price breaks and retests 1.15540

Entry: 1.15540 (after a breakdown + rejection retest)

Stop Loss: 1.15720

Take Profits: 1.15261 → 1.14807 → possibly 1.1450

✅ Best used if USD gains strength or EUR shows weakness after economic releases.

🧠 Market Psychology

The market is currently reactive to any shift in tone from ECB and Fed, causing price whipsaws near key zones.

Smart traders will avoid chasing breakouts and instead focus on reaction zones like 1.15540 for confirmation-based trades.

Watch for fakeouts, as institutional players may be hunting liquidity before choosing direction.

📌 Final Thoughts

EURUSD is in a sensitive zone, and 1.15540 is the intraday pivot. Holding above could trigger a push toward 1.1607 and higher. But failure to hold would likely attract sellers toward the 1.1480–1.1450 liquidity range.

🎯 Discipline is key. Avoid emotional entries. Let the market come to your level — and execute only with confirmation.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.