Hey tradomaniacs,

we start of with some fundamentals.

Since Joe Biden put pressure on Jerome Powell and the FED to fight the inflation we`ve seen a drastic turnaround regarding to FEDs monetary policy and Jerome Powells articulation in front of press/media, probably because he`d love to get a second time in office.

For a longer time we`ve seen a "clash of interests" as Joe Biden had more than 50 Million Dollars invested in stocks, which is probably one of the reasons why he`d not chose to fight inflation too early until he had to admit that he and the FED have underestimated the impact of their decisions and so inflation, which has been way higher than expected. (Probably a "mistake" worth the profit he made)

However, since the the market has got its highly awaited hawkish tones from the FED the US-Dollar-Rally does not seem to stop due to tapering, an accelaration of it, and expected rate-hikes this year.

The question is still how other Central-Banks such as the European Central-Bank will react and how this is going to affect exchange rates.

Can you imagine that central banks will cause the risk of a popping bubble with a tighter monetary policy?

Thomas M. Hoenig, President of the Federal Reserve Bank of Kansa (1991 - 2011) once said "he was worried primarily that the Fed was taking a risky path that would deepen income inequality, stoke dangerous asset bubbles and enrich the biggest banks over everyone else. He warned that it would suck the FED into a money-printing quadmire that the central bank would not be able to escape without destabilizing the entire financial system."

Inflation:

The market faces two problems:

1. To not get sucked into a financial asset bubble that is ripe to implode.

2. The imperatice to outpace structurally rising inflation.

- Too much liquidity creates inflation which crimps the real economy.

- Too much inflation demands removal of that liquidity which futher catalyzes the economic downturn.

Almost all Real yields (Change of value - inflation) are negative, even though the market prices in higher rates in the near future, hence bonds are no alternative.

Gold doesn`t know what to do as higher rates in the future are usually not very good for metals which are free of interest.

As long as fundamentals don`t change we might see a continuation of a strong US-DOLLAR and so a falling EURO.

Technical aspects:

Weekly: Double-Top breakout which is not finished yet.

Daily: Consolidation towards trendline.

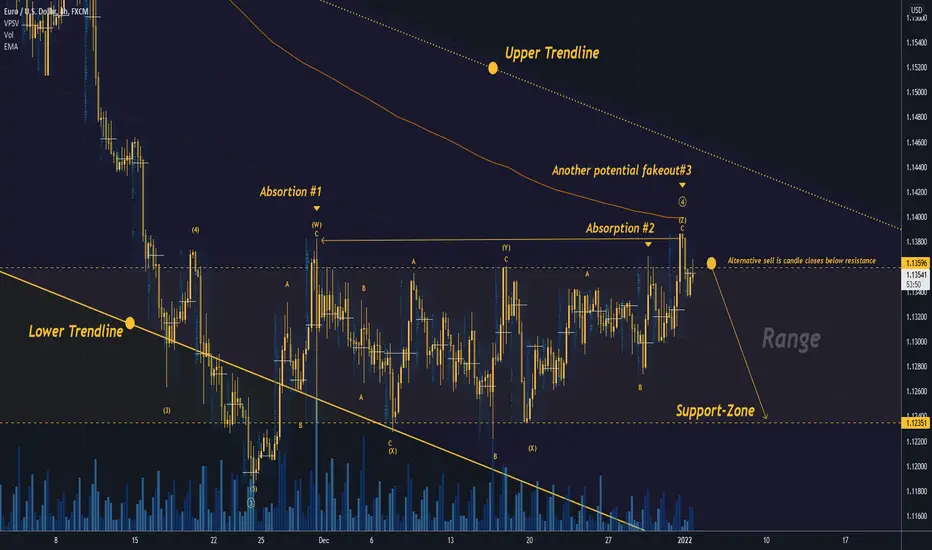

4-Hour: Consolidation with fakeouts to the top-side. (Keep in mind the low liquidity due to holidays)

Weekly Chart:

Daily Chart:

How do you think do we gonna start into the new year? Share your opinion =)

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

we start of with some fundamentals.

Since Joe Biden put pressure on Jerome Powell and the FED to fight the inflation we`ve seen a drastic turnaround regarding to FEDs monetary policy and Jerome Powells articulation in front of press/media, probably because he`d love to get a second time in office.

For a longer time we`ve seen a "clash of interests" as Joe Biden had more than 50 Million Dollars invested in stocks, which is probably one of the reasons why he`d not chose to fight inflation too early until he had to admit that he and the FED have underestimated the impact of their decisions and so inflation, which has been way higher than expected. (Probably a "mistake" worth the profit he made)

However, since the the market has got its highly awaited hawkish tones from the FED the US-Dollar-Rally does not seem to stop due to tapering, an accelaration of it, and expected rate-hikes this year.

The question is still how other Central-Banks such as the European Central-Bank will react and how this is going to affect exchange rates.

Can you imagine that central banks will cause the risk of a popping bubble with a tighter monetary policy?

Thomas M. Hoenig, President of the Federal Reserve Bank of Kansa (1991 - 2011) once said "he was worried primarily that the Fed was taking a risky path that would deepen income inequality, stoke dangerous asset bubbles and enrich the biggest banks over everyone else. He warned that it would suck the FED into a money-printing quadmire that the central bank would not be able to escape without destabilizing the entire financial system."

Inflation:

The market faces two problems:

1. To not get sucked into a financial asset bubble that is ripe to implode.

2. The imperatice to outpace structurally rising inflation.

- Too much liquidity creates inflation which crimps the real economy.

- Too much inflation demands removal of that liquidity which futher catalyzes the economic downturn.

Almost all Real yields (Change of value - inflation) are negative, even though the market prices in higher rates in the near future, hence bonds are no alternative.

Gold doesn`t know what to do as higher rates in the future are usually not very good for metals which are free of interest.

As long as fundamentals don`t change we might see a continuation of a strong US-DOLLAR and so a falling EURO.

Technical aspects:

Weekly: Double-Top breakout which is not finished yet.

Daily: Consolidation towards trendline.

4-Hour: Consolidation with fakeouts to the top-side. (Keep in mind the low liquidity due to holidays)

Weekly Chart:

Daily Chart:

How do you think do we gonna start into the new year? Share your opinion =)

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

Note

EUR/USD 👉 If you took the trade in the shorter time-frame with a tight stop-loss you should be cautious now as we approached a strong support-zone with a high potential of a reversal.

This zone has been a locale demand-zone during the entire consolidation with longer accumulations, which makes it interesting for bears to save profits. As we had no retracement yet, it could get even more likely to see a bounce up to give bears more attractive opportunities to stack short-positions.

if you trade long-term, it might not really matter as you probably use a wide stop-loss.

Good moment to hedge short-positions if confirmed for daytraders.🙏

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.