I have been right on my last 3 EU setups!! Here's another EU long trade coming up :D. Please like and follow <3 Also sorry bears :p

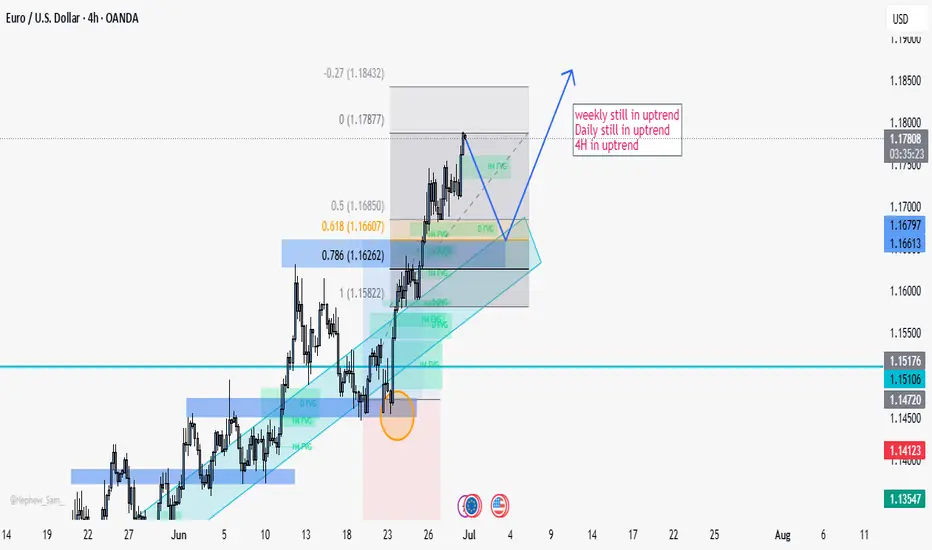

EUR/USD Long Continuation Setup (4H Chart)

Trend Confluence + FVG Imbalances + Fib Retracement

📊 Trend Context:

Weekly: Still in a strong uptrend ✅

Daily: Continues to print higher highs and higher lows ✅

4H: Bullish structure remains intact ✅

This multi-timeframe alignment confirms our bullish bias.

📈 Recent Price Action:

Price surged to the 1.17877 level before starting a pullback. The structure remains bullish as long as the retracement respects key levels.

📉 Retracement Zone (Golden Pocket):

We’re eyeing a healthy retracement into:

0.5 = 1.16850

0.618 = 1.16607

0.786 = 1.16262

This Fib zone overlaps with prior structure, forming a key demand zone.

📦 Fair Value Gaps (FVGs):

Multiple H4 and Daily FVGs sit between 1.1660 and 1.1626, making it a high-probability area for price to rebalance before another leg higher.

📐 Channel Support:

The ascending trend channel remains respected. Price is expected to retest the lower bound of this channel before continuing higher.

🎯 Bullish Targets:

TP1: Retest the high at 1.17877

TP2: Fib extension target at 1.18432 (-0.27 level)

🧠 Summary:

This is a textbook continuation play: a retracement into a Fib + FVG + structure confluence zone inside an uptrend on all major timeframes. Patience for a pullback entry around 1.1660–1.1620 can offer an excellent risk-to-reward opportunity for a continuation toward new highs.

EUR/USD Long Continuation Setup (4H Chart)

Trend Confluence + FVG Imbalances + Fib Retracement

📊 Trend Context:

Weekly: Still in a strong uptrend ✅

Daily: Continues to print higher highs and higher lows ✅

4H: Bullish structure remains intact ✅

This multi-timeframe alignment confirms our bullish bias.

📈 Recent Price Action:

Price surged to the 1.17877 level before starting a pullback. The structure remains bullish as long as the retracement respects key levels.

📉 Retracement Zone (Golden Pocket):

We’re eyeing a healthy retracement into:

0.5 = 1.16850

0.618 = 1.16607

0.786 = 1.16262

This Fib zone overlaps with prior structure, forming a key demand zone.

📦 Fair Value Gaps (FVGs):

Multiple H4 and Daily FVGs sit between 1.1660 and 1.1626, making it a high-probability area for price to rebalance before another leg higher.

📐 Channel Support:

The ascending trend channel remains respected. Price is expected to retest the lower bound of this channel before continuing higher.

🎯 Bullish Targets:

TP1: Retest the high at 1.17877

TP2: Fib extension target at 1.18432 (-0.27 level)

🧠 Summary:

This is a textbook continuation play: a retracement into a Fib + FVG + structure confluence zone inside an uptrend on all major timeframes. Patience for a pullback entry around 1.1660–1.1620 can offer an excellent risk-to-reward opportunity for a continuation toward new highs.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.