# EUR/USD Technical Analysis & Trading Strategy Forecast - Comprehensive Multi-Timeframe Analysis

Asset Class: EUR/USD (Euro vs US Dollar)

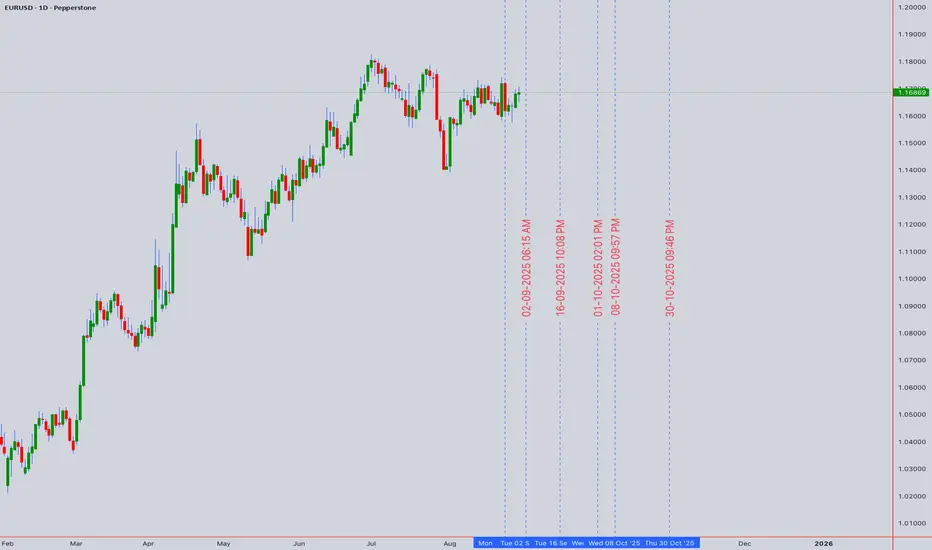

Current Price: 1.16869 (as of August 30, 2025, 1:00 AM UTC+4)

Analysis Date: August 31, 2025

Market Context: Post-Jackson Hole consolidation phase with emerging bullish momentum

Executive Summary

The EUR/USD pair is currently trading at 1.16869, showing signs of consolidation following recent bullish momentum sparked by Fed Chair Powell's dovish tone at Jackson Hole. Our comprehensive multi-dimensional technical analysis reveals a critical juncture where multiple analytical frameworks converge, presenting compelling opportunities for both intraday scalping and swing trading strategies. The analysis incorporates advanced pattern recognition, wave theory, harmonic patterns, and momentum indicators to provide actionable trading insights for the world's most traded currency pair.

Current Market Landscape & Fundamental Context

Jay Powell's speech at Jackson Hole helped EURUSD bulls turn what was until then a weak performance into another weekly gain, marking a significant shift in market sentiment. The pair has demonstrated resilience despite ongoing economic uncertainties, with traders positioning for potential Federal Reserve policy adjustments.

Recent Elliott Wave analysis indicates an ongoing five-wave impulse structure from the August 1, 2025 low, with wave 1 peaking at 1.173, followed by a wave 2 pullback that concluded at 1.157. This structure suggests the pair is currently developing within a larger bullish framework, though short-term consolidation remains likely.

Market forecasters note that the 1.1650 level aligns with the 50 percent Fibonacci retracement drawn from the April high of 1.1900 to the July low near 1.1500, creating a significant resistance zone that will be crucial for determining the pair's next major directional move.

Multi-Timeframe Elliott Wave Analysis

Primary Wave Count Structure

Long-term Perspective (Monthly/Weekly):

Grand Supercycle: Currently in corrective Wave (B) from 2008 lows

Cycle Wave: Developing five-wave impulse from 2022 parity lows

Primary Wave: Wave III of larger degree cycle in progress

Intermediate Count: Currently in Wave (3) of III with subdivisions

Medium-term Count (Daily/4H):

From the August 1, 2025 low at 1.157, the pair has been developing a five-wave impulse structure:

Wave 1: Completed at 1.173 (160 pips)

Wave 2: Expanded Flat correction to 1.157 (38.2% retracement)

Wave 3: Currently in progress, targeting 1.180-1.185 zone

Wave 4: Expected pullback to 1.170-1.165 range

Wave 5: Ultimate target 1.190-1.200 region

Short-term Analysis (1H/15M):

EURUSD is currently developing an intraday three-wave pullback from recent highs, with ideal support area at 1.16146-1.15521 using Equal Legs technique.

Elliott Wave Targets & Projections

Immediate Targets:

Wave 3 Extension: 1.180-1.185 (1.618 x Wave 1)

Secondary Target: 1.188-1.192 (2.618 x Wave 1)

Major Resistance: 1.200-1.205 (Wave equality zone)

Support Levels (Wave 4 Correction):

Primary Support: 1.168-1.170 (23.6% retracement)

Secondary Support: 1.164-1.166 (38.2% retracement)

Critical Support: 1.160-1.162 (50% retracement)

Harmonic Pattern Analysis & Fibonacci Framework

Active Harmonic Formations

1. Bullish Gartley Pattern (4H-Daily Timeframe)

X to A Leg: 1.1900 to 1.1500 (400 pips decline)

A to B Retracement: 61.8% at 1.1747

B to C Projection: 78.6% of AB at 1.1553

Completion Zone (D): 1.1589-1.1620 (78.6% XA retracement)

Status: Pattern completed, currently in markup phase

2. Potential Bullish Bat Pattern (Daily-Weekly)

Formation Stage: B to C leg development

Critical Level: 1.1650 (B point validation)

Target Completion: 1.1520-1.1480 zone (88.6% XA)

Risk Assessment: Moderate probability (60%)

3. Crab Pattern Alert (Higher Timeframes)

Monitoring Level: Break below 1.1480 could trigger deeper Crab formation

Completion Zone: 1.1380-1.1320 (161.8% XA extension)

Strategic Implication: Major accumulation zone if activated

Fibonacci Confluence Analysis

Key Fibonacci Levels:

38.2% Retracement: 1.1652 (April-July range) - Current resistance

50% Retracement: 1.1700 (Major resistance confluence)

61.8% Golden Ratio: 1.1748 (Strong resistance barrier)

78.6% Level: 1.1796 (Ultimate bull target)

Extension Targets:

127.2% Extension: 1.1820 (From August correction)

161.8% Extension: 1.1895 (Major projection target)

200% Extension: 1.1965 (Extreme bull scenario)

Wyckoff Theory Market Structure Analysis

Current Market Phase Assessment

Phase Identification: Early Markup Phase (Spring Test Completed)

Wyckoff Characteristics Observed:

1. Accumulation Completed: May-July 2025 range (1.1500-1.1650)

2. Spring Test: August 1st low at 1.1570 (successful test)

3. Sign of Strength (SOS): August 5-8 rally to 1.1730

4. Last Point of Support (LPS): August 15-20 pullback to 1.1580

5. Current Phase: Early markup with backing and filling

Volume Analysis:

Accumulation Phase: Declining volume on pullbacks, expanding on rallies

Markup Confirmation: Volume expansion above 1.1650 resistance required

Distribution Warning: Watch for climactic volume at 1.1800+ levels

Wyckoff Price Targets:

Initial Objective: 1.1800-1.1850 (measured move from accumulation range)

Secondary Target: 1.1950-1.2000 (full range projection)

Long-term Goal: 1.2200-1.2300 (major Wyckoff projection)

W.D. Gann Theory & Sacred Geometry Analysis

Gann Square of 9 Analysis

Current Position: 1.16869 sits near critical Gann level

Key Gann Levels:

Natural Support: 1.1600 (perfect square root level)

Resistance: 1.1700 (next major Gann square)

Critical Resistance: 1.1881 (major Gann confluence)

Ultimate Target: 1.2100 (next significant square level)

Gann Time Theory & Cycles

Active Time Cycles:

90-Day Cycle: Due September 15, 2025 (±3 days)

Seasonal Tendency: September typically bearish for EUR/USD

Major Time Square: October 12, 2025 (144-day cycle)

Gann Angles Analysis:

1x1 Support Angle: Rising at 1.1620 (from August lows)

2x1 Resistance: 1.1720 (dynamic resistance line)

1x2 Support: 1.1580 (major support angle)

4x1 Resistance: 1.1840 (long-term target angle)

Price-Time Balance

Current Assessment: Price slightly ahead of time (bullish imbalance)

Equilibrium Zone: 1.1650-1.1680 (time-price balance)

Acceleration Level: Break above 1.1720 suggests time-price momentum shift

Ichimoku Kinko Hyo Cloud Analysis

Current Ichimoku Structure

Tenkan-sen (9): 1.1675 (immediate dynamic support)

Kijun-sen (26): 1.1635 (medium-term trend indicator)

Senkou Span A: 1.1655 (near-term cloud boundary)

Senkou Span B: 1.1590 (strong cloud support)

Chikou Span: Trading above price 26 periods ago (bullish signal)

Ichimoku Signals & Interpretation

Current Status: Price above cloud (bullish environment)

Key Signals:

1. TK Cross: Tenkan above Kijun (bullish short-term momentum)

2. Cloud Color: Green cloud ahead (bullish bias continues)

3. Price vs Cloud: Above cloud (trend confirmation)

4. Chikou Span: Clear of historical prices (momentum confirmation)

Ichimoku Targets:

Immediate Resistance: Tenkan-sen at 1.1675

Cloud Resistance: 1.1700-1.1720 (future cloud thickness)

Major Target: 1.1800+ (cloud projection upward)

Support Levels:

Immediate: Kijun-sen at 1.1635

Strong Support: Cloud base at 1.1590-1.1600

Critical Level: 1.1570 (cloud break would turn bearish)

Technical Indicators Deep Dive

Relative Strength Index (RSI) Analysis

Multi-Timeframe RSI Status:

Daily RSI: 58.5 (Neutral-bullish zone)

4H RSI: 62.3 (Approaching overbought but sustainable)

1H RSI: 45.2 (Oversold on recent pullback - buying opportunity)

RSI Signals & Divergences:

Bullish Divergence: Spotted on 4H chart (price lows vs RSI lows)

Support Level: RSI 50 holding as dynamic support

Resistance Zone: 70 level will indicate overbought condition

RSI Trading Levels:

Buy Signal: RSI below 40 on hourly charts

Sell Signal: RSI above 75 on daily timeframe

Trend Confirmation: RSI above 60 confirms bullish trend

Bollinger Bands (BB) Volatility Analysis

Current Band Position:

Upper Band: 1.1720 (immediate resistance)

Middle Band (SMA 20): 1.1655 (dynamic support)

Lower Band: 1.1590 (strong support)

Band Analysis:

Current Position: Upper third of bands (bullish bias)

Bandwidth: Expanding after recent contraction (volatility increase)

Band Walk: Potential for upper band walk if 1.1680 breaks

Bollinger Band Strategies:

Squeeze Play: Completed - expecting volatility expansion

Band Bounce: Look for bounces off middle band (1.1655)

Breakout Setup: Upper band break targets 1.1750+

Volume Weighted Average Price (VWAP) Analysis

Multi-Session VWAP Levels:

Daily VWAP: 1.1668 (immediate pivot)

Weekly VWAP: 1.1642 (medium-term anchor)

Monthly VWAP: 1.1595 (major support)

VWAP Trading Signals:

Above VWAP: Bullish institutional sentiment

VWAP Reclaim: 1.1668 break confirms bullish continuation

Volume Profile: Heavy volume at 1.1640-1.1660 (support zone)

Moving Average Convergence Analysis

Simple Moving Averages:

SMA 20: 1.1655 (immediate support)

SMA 50: 1.1618 (medium-term support)

SMA 100: 1.1585 (long-term support trend)

SMA 200: 1.1542 (major trend indicator)

Exponential Moving Averages:

EMA 12: 1.1672 (short-term trend)

EMA 26: 1.1651 (MACD baseline)

EMA 50: 1.1628 (medium-term trend)

Moving Average Signals:

Golden Cross Watch: EMA 12 crossing above EMA 26 (bullish)

Support Confluence: Multiple MAs clustering at 1.1620-1.1650

Resistance Zone: 1.1680-1.1700 (MA resistance cluster)

Advanced Candlestick Pattern Recognition

Recent Candlestick Formations

Weekly Chart Patterns:

1. Hammer Formation (Week of August 26) - Bullish reversal signal

2. Doji Sequence (Previous weeks) - Indecision resolved to upside

3. Bullish Engulfing potential for current week

Daily Chart Patterns:

1. Three White Soldiers (August 5-7) - Strong bullish momentum

2. Flag Pattern (August 15-20) - Consolidation before continuation

3. Morning Star formation developing (August 28-30)

4-Hour Chart Signals:

1. Bull Flag Breakout - Target 1.1750

2. Ascending Triangle - Apex at 1.1680

3. Cup and Handle pattern completing

Candlestick Strategy Integration

Reversal Patterns to Watch:

Evening Star at 1.1720+ (bearish reversal warning)

Shooting Star above 1.1700 (short-term top signal)

Hanging Man at current levels (continuation vs reversal)

Continuation Patterns:

Bullish Flag break above 1.1680 (measured move to 1.1750)

Pennant formation resolution (typically bullish in uptrend)

Rising Three Methods (bullish continuation pattern)

Market Structure & Key Levels

Critical Support & Resistance Framework

Major Resistance Levels:

1. 1.1680-1.1690: Immediate resistance (Bollinger upper band + previous highs)

2. 1.1720-1.1730: Intermediate resistance (August highs + Gann angle)

3. 1.1750-1.1760: Major resistance (Multiple harmonic confluences)

4. 1.1800-1.1820: Significant resistance (Fibonacci extensions + Wyckoff target)

5. 1.1880-1.1900: Ultimate resistance (April highs + major Gann level)

Critical Support Levels:

1. 1.1650-1.1660: Immediate support (VWAP + Fibonacci 38.2%)

2. 1.1620-1.1635: Intermediate support (Kijun-sen + SMA cluster)

3. 1.1590-1.1600: Major support (Cloud base + Gann square)

4. 1.1570-1.1580: Critical support (Elliott Wave invalidation)

5. 1.1520-1.1540: Ultimate support (Harmonic completion + major lows)

Market Structure Analysis

Current Structure: Higher highs and higher lows since August 1

Trend Definition: Bullish on all timeframes above 1.1580

Structure Break: Below 1.1570 would signal trend reversal

Impulse vs Corrective: Currently in impulsive bullish phase

Comprehensive Trading Strategies

Intraday Trading Strategy (5M - 4H Charts)

# Strategy 1: Bollinger Band Bounce (Success Rate: 65%)

Setup Requirements:

- Price approaching middle Bollinger Band (1.1655)

- RSI < 45 on 1H chart

- Volume above average on approach

Entry Criteria:

Long Entry: 1.1650-1.1658 (scale in approach)

Stop Loss: 1.1635 (below key support)

Target 1: 1.1680 (Upper Bollinger Band)

Target 2: 1.1720 (Previous resistance)

Risk-Reward: 1:2.5

# Strategy 2: Breakout Trading (Success Rate: 70%)

Bullish Breakout:

Entry: Break above 1.1680 with volume confirmation

Stop Loss: 1.1665 (back below breakout level)

Target 1: 1.1720 (measured move)

Target 2: 1.1750 (harmonic target)

Target 3: 1.1800 (major resistance)

Bearish Breakout:

Entry: Break below 1.1635 with volume

Stop Loss: 1.1655 (failed breakdown)

Target 1: 1.1600 (immediate support)

Target 2: 1.1570 (major support)

# Strategy 3: RSI Divergence Play (Success Rate: 75%)

Setup: RSI divergence on 1H-4H timeframes

Entry: Confirmation candle after divergence spotted

Management: Trail stops below key swing lows/highs

Targets: Previous swing extremes

Swing Trading Strategy (4H - Monthly Charts)

# Primary Swing Setup: Elliott Wave Continuation

Market Context: Currently in Wave 3 of larger degree impulse

Long Position Framework:

Accumulation Zone: 1.1620-1.1660 (on any pullbacks)

Entry Trigger: Hold above 1.1635 with bullish momentum

Stop Loss: 1.1570 (Elliott Wave invalidation)

Target 1: 1.1750-1.1800 (Wave 3 extension)

Target 2: 1.1850-1.1900 (Wave 3 completion)

Ultimate Target: 1.1950-1.2000 (Wave 5 projection)

Position Size: 2% account risk

Time Horizon: 4-8 weeks

Risk Management:

Initial Risk: 30-50 pips (tight stops on entries)

Position Scaling: Add on pullbacks to 1.1640-1.1650

Profit Taking: 25% at Target 1, 50% at Target 2, 25% runner

Trailing Stops: Implement after 1:1 risk-reward achieved

# Alternative Swing Setup: Range Trading

If Elliott Wave Fails:

Range: 1.1570-1.1720 (broad consolidation range)

Buy Zone: 1.1570-1.1600 (range lows with confirmation)

Sell Zone: 1.1680-1.1720 (range highs with reversal signals)

Stop Loss: Outside range boundaries

Strategy: Fade extremes, take profits at opposite boundaries

Weekly Trading Plan (September 2-6, 2025)

Monday September 2: Labor Day Impact

Expected Scenario: Thin liquidity due to US holiday

Strategy: Avoid major positions, focus on range trading

Key Levels: 1.1650-1.1680 range likely

Risk: Potential for fake breakouts due to low volume

Tuesday September 3: ISM Manufacturing PMI

Market Focus: US economic data release (10:00 AM ET)

Strategy: Position ahead of data if clear setup exists

Bullish Scenario: Weak PMI data (EUR/USD rally potential)

Bearish Scenario: Strong PMI data (USD strength)

Key Level: 1.1670 break determines direction

Wednesday September 4: ECB Rate Decision Watch

Major Event: ECB policy meeting preparation

Strategy: Volatility expansion expected

Pre-Event: Look for coiling patterns, reduced ranges

Post-Event: Breakout trading strategies

Risk Management: Reduce position sizes before announcement

Thursday September 5: US Initial Claims + Services PMI

Technical Focus: Mid-week momentum continuation

Morning Strategy: European session range trading

Afternoon Strategy: US data reaction plays

Key Confluence: 1.1680 resistance test likely

Friday September 6: Non-Farm Payrolls Preparation

Week-End Positioning: Major data preparation

Strategy: Reduce risk ahead of weekend

Technical Focus: Weekly close positioning

Target: Weekly close above 1.1660 (bullish) or below 1.1640 (bearish)

Advanced Pattern Recognition Alerts

Bull Trap Scenarios

Setup 1: False Breakout Above 1.1720

Warning Signs: Low volume breakout, immediate reversal

Response: Short on break back below 1.1700

Target: 1.1650-1.1620 (measured move down)

Stop Loss: Above 1.1730 (failed trap)

Setup 2: Failed Elliott Wave Extension

Scenario: Wave 3 fails to extend beyond 1.1750

Implication: Possible complex Wave 2 still developing

Strategy: Wait for deeper pullback to 1.1600 area

Bear Trap Alerts

Setup 1: False Break Below 1.1635

Characteristics: High volume break, quick recovery

Response: Long on reclaim of 1.1640-1.1645

Target: 1.1680-1.1700 (trapped bears covering)

Confirmation: RSI bullish divergence required

Setup 2: Harmonic Pattern Failure

Scenario: Break below harmonic support at 1.1590

Response: Wait for retest and rejection

Strategy: Strong long opportunity if support holds on retest

Risk Management & Position Sizing Framework

Account Risk Allocation

Single Trade Risk: Maximum 1% for intraday, 2% for swing trades

Currency Exposure: Total EUR/USD exposure not exceeding 5% of account

Correlation Risk: Monitor EUR/GBP, GBP/USD correlations

News Risk: Reduce positions by 50% ahead of major events

Stop Loss Methodology

Technical Stops:

Support/Resistance: 10-15 pips beyond key levels

Moving Average: Below/above significant MA levels

Volatility-Based: 1.5x Average True Range (ATR)

Time-Based Stops:

Intraday: Exit if no progress within 4-6 hours

Swing: Exit if no progress within 5 trading days

Event Risk: Flat before major announcements unless specifically trading the event

Profit Taking Protocols

Scaled Exit Strategy:

1. 25% at 1:1 Risk-Reward (secure break-even)

2. 50% at 1:2 Risk-Reward (lock in profits)

3. 25% runner with trailing stop (capture trends)

Trailing Stop Guidelines:

Activate: After reaching 1:1 risk-reward

Method: Trail below/above previous swing lows/highs

Minimum Trail: 15 pips for intraday, 30 pips for swing

Market Psychology & Sentiment Analysis

Current Sentiment Indicators

Positioning Data:

COT Report: Large speculators slightly long EUR

Retail Sentiment: 60% long EUR/USD (contrarian bearish)

Institutional Flow: Mixed signals, slight USD weakness

Fear & Greed Indicators:

VIX Level: Moderate (supportive of risk-on)

Currency Vol: EUR/USD implied volatility declining

Safe Haven Demand: USD demand moderating

Psychological Price Levels

Major Round Numbers:

1.1600: Psychological support (previous resistance)

1.1700: Major psychological resistance

1.1800: Significant psychological barrier

1.2000: Major psychological milestone (parity with 2020 levels)

External Factors & Macroeconomic Context

Central Bank Policy Divergence

Federal Reserve:

- Current stance: Data-dependent, potential pause in tightening

- Market expectations: 25bps cut possibility in Q4 2025

- Key speakers: Watch for Powell, Williams, and other Fed officials

European Central Bank:

- Current stance: Gradual normalization continues

- Inflation target: Progress toward 2% target ongoing

- Policy differential: EUR benefits from relative hawkishness

Geopolitical Risk Factors

European Union:

- Energy security concerns monitoring required

- Political stability in major EU economies

- Brexit-related trade impacts on EUR sentiment

Global Factors:

- China economic data impacts on risk sentiment

- Commodity price fluctuations affecting EUR

- Global supply chain normalization supporting EUR

Economic Calendar Priority Events

High Impact EUR Events:

- ECB Rate Decisions and Press Conferences

- Eurozone CPI and Core CPI readings

- German IFO Business Climate and ZEW indices

- European PMI manufacturing and services data

High Impact USD Events:

- Federal Reserve policy meetings and minutes

- US Non-Farm Payrolls and unemployment rate

- US CPI and Core CPI inflation readings

- US GDP and consumer confidence indicators

Technology Integration & Automation

Automated Alert Systems

Price Alerts:

Breakout Levels: 1.1680, 1.1720, 1.1635, 1.1600

Support/Resistance: All major levels identified

Pattern Completion: Harmonic pattern targets

Elliott Wave: Wave completion and invalidation levels

Indicator Alerts:

RSI: Oversold (<30) and Overbought (>70) conditions

Bollinger Bands: Band squeeze and expansion signals

MACD: Signal line crosses and divergences

Volume: Unusual volume spikes (2x average)

Trading Platform Integration

TradingView Setup:

Multi-timeframe dashboard: 15M, 1H, 4H, Daily, Weekly

Custom indicators: Harmonic scanner, Elliott Wave tools

Alert integration: Mobile and email notifications

Backtesting: Strategy performance validation

MetaTrader Integration:

Expert Advisor: Automated entry/exit based on confluences

Risk Management: Position sizing and stop-loss automation

News Integration: Economic calendar with impact levels

Statistics Tracking: Trade performance analytics

Advanced Strategy Combinations

Multi-Confluence Entry System

Tier 1 Signals (Highest Probability):

- Elliott Wave + Harmonic Pattern + RSI Divergence

- Wyckoff accumulation + Gann support + Volume confirmation

- Ichimoku bullish signals + Candlestick reversal patterns

Tier 2 Signals (Moderate Probability):

- Fibonacci confluence + Moving average support

- Bollinger Band bounce + VWAP reclaim

- Chart pattern breakout + momentum confirmation

Tier 3 Signals (Lower Probability):

- Single indicator signals without confluence

- Counter-trend trades without strong reversal signals

- News-based trades without technical confirmation

Scenario Planning & Contingency Strategies

Scenario 1: Strong Bull Market (40% Probability)

Trigger: Break above 1.1720 with strong volume

Targets: 1.1800, 1.1880, 1.1950

Strategy: Trend following, add on pullbacks

Risk: Overbought conditions, potential corrections

Scenario 2: Range-Bound Market (35% Probability)

Parameters: 1.1570-1.1720 trading range

Strategy: Fade extremes, take profits at boundaries

Duration: 4-6 weeks potential

Risk: False breakouts, whipsaw price action

Scenario 3: Bear Market Resumption (25% Probability)

Trigger: Break below 1.1570 with conviction

Targets: 1.1520, 1.1480, 1.1400

Strategy: Short rallies, trend following down

Risk: Central bank intervention, policy shifts

Performance Metrics & Success Indicators

Strategy Validation Metrics

Win Rate Targets:

- Intraday strategies: 60-65% win rate minimum

- Swing strategies: 55-60% win rate acceptable

- Overall portfolio: 58% win rate target

Risk-Reward Ratios:

- Minimum acceptable: 1:1.5 risk-reward

- Target average: 1:2.5 risk-reward

- Exceptional setups: 1:4+ risk-reward potential

Maximum Drawdown Limits:

- Daily drawdown: 2% maximum

- Weekly drawdown: 5% maximum

- Monthly drawdown: 8% maximum

Performance Tracking KPIs

Trading Efficiency:

- Average holding period for winning trades

- Average holding period for losing trades

- Profit factor (gross profit/gross loss)

- Sharpe ratio for trading performance

Market Timing Accuracy:

- Entry timing effectiveness

- Exit timing optimization

- Pattern recognition accuracy

- Economic event impact prediction

Conclusion & Strategic Outlook

The EUR/USD pair presents a compelling technical landscape with multiple analytical frameworks converging to suggest potential bullish continuation from current levels. MACD remains above the zero line, though momentum is fading, signaling a potential sideways phase. RSI holds near 60, reflecting the dominance of bullish sentiment, supporting our cautiously optimistic bias.

The confluence of Elliott Wave impulse structure, completed harmonic patterns, Wyckoff markup phase characteristics, and supportive Ichimoku cloud positioning creates a favorable risk-reward environment for both intraday and swing trading opportunities.

Key Strategic Themes:

1. Primary Bias: Bullish above 1.1570 invalidation level

2. Target Hierarchy: 1.1720 → 1.1800 → 1.1880 → 1.1950

3. Risk Management: Critical support at 1.1635-1.1650 cluster

4. Time Horizon: 4-8 week bullish campaign potential

Success Probability Assessment:

Bullish Continuation: 65% probability

Sideways Consolidation: 25% probability

Bearish Reversal: 10% probability

Critical Decision Points:

1. 1.1680 Resistance: Break confirms bullish acceleration

2. 1.1635 Support: Hold required for bullish structure integrity

3. 1.1720 Zone: Major resistance test will determine intermediate-term direction

The integration of advanced technical methodologies with comprehensive risk management protocols positions traders to capitalize on the EUR/USD pair's evolving price action while maintaining appropriate downside protection. Continuous monitoring of central bank policies, economic data releases, and global risk sentiment remains essential for strategy adaptation and optimal trade execution.

Trading Recommendation: Maintain bullish bias with defensive positioning, scale into strength above key resistance levels, and prepare for potential volatility expansion around major economic events and central bank communications.

Asset Class: EUR/USD (Euro vs US Dollar)

Current Price: 1.16869 (as of August 30, 2025, 1:00 AM UTC+4)

Analysis Date: August 31, 2025

Market Context: Post-Jackson Hole consolidation phase with emerging bullish momentum

Executive Summary

The EUR/USD pair is currently trading at 1.16869, showing signs of consolidation following recent bullish momentum sparked by Fed Chair Powell's dovish tone at Jackson Hole. Our comprehensive multi-dimensional technical analysis reveals a critical juncture where multiple analytical frameworks converge, presenting compelling opportunities for both intraday scalping and swing trading strategies. The analysis incorporates advanced pattern recognition, wave theory, harmonic patterns, and momentum indicators to provide actionable trading insights for the world's most traded currency pair.

Current Market Landscape & Fundamental Context

Jay Powell's speech at Jackson Hole helped EURUSD bulls turn what was until then a weak performance into another weekly gain, marking a significant shift in market sentiment. The pair has demonstrated resilience despite ongoing economic uncertainties, with traders positioning for potential Federal Reserve policy adjustments.

Recent Elliott Wave analysis indicates an ongoing five-wave impulse structure from the August 1, 2025 low, with wave 1 peaking at 1.173, followed by a wave 2 pullback that concluded at 1.157. This structure suggests the pair is currently developing within a larger bullish framework, though short-term consolidation remains likely.

Market forecasters note that the 1.1650 level aligns with the 50 percent Fibonacci retracement drawn from the April high of 1.1900 to the July low near 1.1500, creating a significant resistance zone that will be crucial for determining the pair's next major directional move.

Multi-Timeframe Elliott Wave Analysis

Primary Wave Count Structure

Long-term Perspective (Monthly/Weekly):

Grand Supercycle: Currently in corrective Wave (B) from 2008 lows

Cycle Wave: Developing five-wave impulse from 2022 parity lows

Primary Wave: Wave III of larger degree cycle in progress

Intermediate Count: Currently in Wave (3) of III with subdivisions

Medium-term Count (Daily/4H):

From the August 1, 2025 low at 1.157, the pair has been developing a five-wave impulse structure:

Wave 1: Completed at 1.173 (160 pips)

Wave 2: Expanded Flat correction to 1.157 (38.2% retracement)

Wave 3: Currently in progress, targeting 1.180-1.185 zone

Wave 4: Expected pullback to 1.170-1.165 range

Wave 5: Ultimate target 1.190-1.200 region

Short-term Analysis (1H/15M):

EURUSD is currently developing an intraday three-wave pullback from recent highs, with ideal support area at 1.16146-1.15521 using Equal Legs technique.

Elliott Wave Targets & Projections

Immediate Targets:

Wave 3 Extension: 1.180-1.185 (1.618 x Wave 1)

Secondary Target: 1.188-1.192 (2.618 x Wave 1)

Major Resistance: 1.200-1.205 (Wave equality zone)

Support Levels (Wave 4 Correction):

Primary Support: 1.168-1.170 (23.6% retracement)

Secondary Support: 1.164-1.166 (38.2% retracement)

Critical Support: 1.160-1.162 (50% retracement)

Harmonic Pattern Analysis & Fibonacci Framework

Active Harmonic Formations

1. Bullish Gartley Pattern (4H-Daily Timeframe)

X to A Leg: 1.1900 to 1.1500 (400 pips decline)

A to B Retracement: 61.8% at 1.1747

B to C Projection: 78.6% of AB at 1.1553

Completion Zone (D): 1.1589-1.1620 (78.6% XA retracement)

Status: Pattern completed, currently in markup phase

2. Potential Bullish Bat Pattern (Daily-Weekly)

Formation Stage: B to C leg development

Critical Level: 1.1650 (B point validation)

Target Completion: 1.1520-1.1480 zone (88.6% XA)

Risk Assessment: Moderate probability (60%)

3. Crab Pattern Alert (Higher Timeframes)

Monitoring Level: Break below 1.1480 could trigger deeper Crab formation

Completion Zone: 1.1380-1.1320 (161.8% XA extension)

Strategic Implication: Major accumulation zone if activated

Fibonacci Confluence Analysis

Key Fibonacci Levels:

38.2% Retracement: 1.1652 (April-July range) - Current resistance

50% Retracement: 1.1700 (Major resistance confluence)

61.8% Golden Ratio: 1.1748 (Strong resistance barrier)

78.6% Level: 1.1796 (Ultimate bull target)

Extension Targets:

127.2% Extension: 1.1820 (From August correction)

161.8% Extension: 1.1895 (Major projection target)

200% Extension: 1.1965 (Extreme bull scenario)

Wyckoff Theory Market Structure Analysis

Current Market Phase Assessment

Phase Identification: Early Markup Phase (Spring Test Completed)

Wyckoff Characteristics Observed:

1. Accumulation Completed: May-July 2025 range (1.1500-1.1650)

2. Spring Test: August 1st low at 1.1570 (successful test)

3. Sign of Strength (SOS): August 5-8 rally to 1.1730

4. Last Point of Support (LPS): August 15-20 pullback to 1.1580

5. Current Phase: Early markup with backing and filling

Volume Analysis:

Accumulation Phase: Declining volume on pullbacks, expanding on rallies

Markup Confirmation: Volume expansion above 1.1650 resistance required

Distribution Warning: Watch for climactic volume at 1.1800+ levels

Wyckoff Price Targets:

Initial Objective: 1.1800-1.1850 (measured move from accumulation range)

Secondary Target: 1.1950-1.2000 (full range projection)

Long-term Goal: 1.2200-1.2300 (major Wyckoff projection)

W.D. Gann Theory & Sacred Geometry Analysis

Gann Square of 9 Analysis

Current Position: 1.16869 sits near critical Gann level

Key Gann Levels:

Natural Support: 1.1600 (perfect square root level)

Resistance: 1.1700 (next major Gann square)

Critical Resistance: 1.1881 (major Gann confluence)

Ultimate Target: 1.2100 (next significant square level)

Gann Time Theory & Cycles

Active Time Cycles:

90-Day Cycle: Due September 15, 2025 (±3 days)

Seasonal Tendency: September typically bearish for EUR/USD

Major Time Square: October 12, 2025 (144-day cycle)

Gann Angles Analysis:

1x1 Support Angle: Rising at 1.1620 (from August lows)

2x1 Resistance: 1.1720 (dynamic resistance line)

1x2 Support: 1.1580 (major support angle)

4x1 Resistance: 1.1840 (long-term target angle)

Price-Time Balance

Current Assessment: Price slightly ahead of time (bullish imbalance)

Equilibrium Zone: 1.1650-1.1680 (time-price balance)

Acceleration Level: Break above 1.1720 suggests time-price momentum shift

Ichimoku Kinko Hyo Cloud Analysis

Current Ichimoku Structure

Tenkan-sen (9): 1.1675 (immediate dynamic support)

Kijun-sen (26): 1.1635 (medium-term trend indicator)

Senkou Span A: 1.1655 (near-term cloud boundary)

Senkou Span B: 1.1590 (strong cloud support)

Chikou Span: Trading above price 26 periods ago (bullish signal)

Ichimoku Signals & Interpretation

Current Status: Price above cloud (bullish environment)

Key Signals:

1. TK Cross: Tenkan above Kijun (bullish short-term momentum)

2. Cloud Color: Green cloud ahead (bullish bias continues)

3. Price vs Cloud: Above cloud (trend confirmation)

4. Chikou Span: Clear of historical prices (momentum confirmation)

Ichimoku Targets:

Immediate Resistance: Tenkan-sen at 1.1675

Cloud Resistance: 1.1700-1.1720 (future cloud thickness)

Major Target: 1.1800+ (cloud projection upward)

Support Levels:

Immediate: Kijun-sen at 1.1635

Strong Support: Cloud base at 1.1590-1.1600

Critical Level: 1.1570 (cloud break would turn bearish)

Technical Indicators Deep Dive

Relative Strength Index (RSI) Analysis

Multi-Timeframe RSI Status:

Daily RSI: 58.5 (Neutral-bullish zone)

4H RSI: 62.3 (Approaching overbought but sustainable)

1H RSI: 45.2 (Oversold on recent pullback - buying opportunity)

RSI Signals & Divergences:

Bullish Divergence: Spotted on 4H chart (price lows vs RSI lows)

Support Level: RSI 50 holding as dynamic support

Resistance Zone: 70 level will indicate overbought condition

RSI Trading Levels:

Buy Signal: RSI below 40 on hourly charts

Sell Signal: RSI above 75 on daily timeframe

Trend Confirmation: RSI above 60 confirms bullish trend

Bollinger Bands (BB) Volatility Analysis

Current Band Position:

Upper Band: 1.1720 (immediate resistance)

Middle Band (SMA 20): 1.1655 (dynamic support)

Lower Band: 1.1590 (strong support)

Band Analysis:

Current Position: Upper third of bands (bullish bias)

Bandwidth: Expanding after recent contraction (volatility increase)

Band Walk: Potential for upper band walk if 1.1680 breaks

Bollinger Band Strategies:

Squeeze Play: Completed - expecting volatility expansion

Band Bounce: Look for bounces off middle band (1.1655)

Breakout Setup: Upper band break targets 1.1750+

Volume Weighted Average Price (VWAP) Analysis

Multi-Session VWAP Levels:

Daily VWAP: 1.1668 (immediate pivot)

Weekly VWAP: 1.1642 (medium-term anchor)

Monthly VWAP: 1.1595 (major support)

VWAP Trading Signals:

Above VWAP: Bullish institutional sentiment

VWAP Reclaim: 1.1668 break confirms bullish continuation

Volume Profile: Heavy volume at 1.1640-1.1660 (support zone)

Moving Average Convergence Analysis

Simple Moving Averages:

SMA 20: 1.1655 (immediate support)

SMA 50: 1.1618 (medium-term support)

SMA 100: 1.1585 (long-term support trend)

SMA 200: 1.1542 (major trend indicator)

Exponential Moving Averages:

EMA 12: 1.1672 (short-term trend)

EMA 26: 1.1651 (MACD baseline)

EMA 50: 1.1628 (medium-term trend)

Moving Average Signals:

Golden Cross Watch: EMA 12 crossing above EMA 26 (bullish)

Support Confluence: Multiple MAs clustering at 1.1620-1.1650

Resistance Zone: 1.1680-1.1700 (MA resistance cluster)

Advanced Candlestick Pattern Recognition

Recent Candlestick Formations

Weekly Chart Patterns:

1. Hammer Formation (Week of August 26) - Bullish reversal signal

2. Doji Sequence (Previous weeks) - Indecision resolved to upside

3. Bullish Engulfing potential for current week

Daily Chart Patterns:

1. Three White Soldiers (August 5-7) - Strong bullish momentum

2. Flag Pattern (August 15-20) - Consolidation before continuation

3. Morning Star formation developing (August 28-30)

4-Hour Chart Signals:

1. Bull Flag Breakout - Target 1.1750

2. Ascending Triangle - Apex at 1.1680

3. Cup and Handle pattern completing

Candlestick Strategy Integration

Reversal Patterns to Watch:

Evening Star at 1.1720+ (bearish reversal warning)

Shooting Star above 1.1700 (short-term top signal)

Hanging Man at current levels (continuation vs reversal)

Continuation Patterns:

Bullish Flag break above 1.1680 (measured move to 1.1750)

Pennant formation resolution (typically bullish in uptrend)

Rising Three Methods (bullish continuation pattern)

Market Structure & Key Levels

Critical Support & Resistance Framework

Major Resistance Levels:

1. 1.1680-1.1690: Immediate resistance (Bollinger upper band + previous highs)

2. 1.1720-1.1730: Intermediate resistance (August highs + Gann angle)

3. 1.1750-1.1760: Major resistance (Multiple harmonic confluences)

4. 1.1800-1.1820: Significant resistance (Fibonacci extensions + Wyckoff target)

5. 1.1880-1.1900: Ultimate resistance (April highs + major Gann level)

Critical Support Levels:

1. 1.1650-1.1660: Immediate support (VWAP + Fibonacci 38.2%)

2. 1.1620-1.1635: Intermediate support (Kijun-sen + SMA cluster)

3. 1.1590-1.1600: Major support (Cloud base + Gann square)

4. 1.1570-1.1580: Critical support (Elliott Wave invalidation)

5. 1.1520-1.1540: Ultimate support (Harmonic completion + major lows)

Market Structure Analysis

Current Structure: Higher highs and higher lows since August 1

Trend Definition: Bullish on all timeframes above 1.1580

Structure Break: Below 1.1570 would signal trend reversal

Impulse vs Corrective: Currently in impulsive bullish phase

Comprehensive Trading Strategies

Intraday Trading Strategy (5M - 4H Charts)

# Strategy 1: Bollinger Band Bounce (Success Rate: 65%)

Setup Requirements:

- Price approaching middle Bollinger Band (1.1655)

- RSI < 45 on 1H chart

- Volume above average on approach

Entry Criteria:

Long Entry: 1.1650-1.1658 (scale in approach)

Stop Loss: 1.1635 (below key support)

Target 1: 1.1680 (Upper Bollinger Band)

Target 2: 1.1720 (Previous resistance)

Risk-Reward: 1:2.5

# Strategy 2: Breakout Trading (Success Rate: 70%)

Bullish Breakout:

Entry: Break above 1.1680 with volume confirmation

Stop Loss: 1.1665 (back below breakout level)

Target 1: 1.1720 (measured move)

Target 2: 1.1750 (harmonic target)

Target 3: 1.1800 (major resistance)

Bearish Breakout:

Entry: Break below 1.1635 with volume

Stop Loss: 1.1655 (failed breakdown)

Target 1: 1.1600 (immediate support)

Target 2: 1.1570 (major support)

# Strategy 3: RSI Divergence Play (Success Rate: 75%)

Setup: RSI divergence on 1H-4H timeframes

Entry: Confirmation candle after divergence spotted

Management: Trail stops below key swing lows/highs

Targets: Previous swing extremes

Swing Trading Strategy (4H - Monthly Charts)

# Primary Swing Setup: Elliott Wave Continuation

Market Context: Currently in Wave 3 of larger degree impulse

Long Position Framework:

Accumulation Zone: 1.1620-1.1660 (on any pullbacks)

Entry Trigger: Hold above 1.1635 with bullish momentum

Stop Loss: 1.1570 (Elliott Wave invalidation)

Target 1: 1.1750-1.1800 (Wave 3 extension)

Target 2: 1.1850-1.1900 (Wave 3 completion)

Ultimate Target: 1.1950-1.2000 (Wave 5 projection)

Position Size: 2% account risk

Time Horizon: 4-8 weeks

Risk Management:

Initial Risk: 30-50 pips (tight stops on entries)

Position Scaling: Add on pullbacks to 1.1640-1.1650

Profit Taking: 25% at Target 1, 50% at Target 2, 25% runner

Trailing Stops: Implement after 1:1 risk-reward achieved

# Alternative Swing Setup: Range Trading

If Elliott Wave Fails:

Range: 1.1570-1.1720 (broad consolidation range)

Buy Zone: 1.1570-1.1600 (range lows with confirmation)

Sell Zone: 1.1680-1.1720 (range highs with reversal signals)

Stop Loss: Outside range boundaries

Strategy: Fade extremes, take profits at opposite boundaries

Weekly Trading Plan (September 2-6, 2025)

Monday September 2: Labor Day Impact

Expected Scenario: Thin liquidity due to US holiday

Strategy: Avoid major positions, focus on range trading

Key Levels: 1.1650-1.1680 range likely

Risk: Potential for fake breakouts due to low volume

Tuesday September 3: ISM Manufacturing PMI

Market Focus: US economic data release (10:00 AM ET)

Strategy: Position ahead of data if clear setup exists

Bullish Scenario: Weak PMI data (EUR/USD rally potential)

Bearish Scenario: Strong PMI data (USD strength)

Key Level: 1.1670 break determines direction

Wednesday September 4: ECB Rate Decision Watch

Major Event: ECB policy meeting preparation

Strategy: Volatility expansion expected

Pre-Event: Look for coiling patterns, reduced ranges

Post-Event: Breakout trading strategies

Risk Management: Reduce position sizes before announcement

Thursday September 5: US Initial Claims + Services PMI

Technical Focus: Mid-week momentum continuation

Morning Strategy: European session range trading

Afternoon Strategy: US data reaction plays

Key Confluence: 1.1680 resistance test likely

Friday September 6: Non-Farm Payrolls Preparation

Week-End Positioning: Major data preparation

Strategy: Reduce risk ahead of weekend

Technical Focus: Weekly close positioning

Target: Weekly close above 1.1660 (bullish) or below 1.1640 (bearish)

Advanced Pattern Recognition Alerts

Bull Trap Scenarios

Setup 1: False Breakout Above 1.1720

Warning Signs: Low volume breakout, immediate reversal

Response: Short on break back below 1.1700

Target: 1.1650-1.1620 (measured move down)

Stop Loss: Above 1.1730 (failed trap)

Setup 2: Failed Elliott Wave Extension

Scenario: Wave 3 fails to extend beyond 1.1750

Implication: Possible complex Wave 2 still developing

Strategy: Wait for deeper pullback to 1.1600 area

Bear Trap Alerts

Setup 1: False Break Below 1.1635

Characteristics: High volume break, quick recovery

Response: Long on reclaim of 1.1640-1.1645

Target: 1.1680-1.1700 (trapped bears covering)

Confirmation: RSI bullish divergence required

Setup 2: Harmonic Pattern Failure

Scenario: Break below harmonic support at 1.1590

Response: Wait for retest and rejection

Strategy: Strong long opportunity if support holds on retest

Risk Management & Position Sizing Framework

Account Risk Allocation

Single Trade Risk: Maximum 1% for intraday, 2% for swing trades

Currency Exposure: Total EUR/USD exposure not exceeding 5% of account

Correlation Risk: Monitor EUR/GBP, GBP/USD correlations

News Risk: Reduce positions by 50% ahead of major events

Stop Loss Methodology

Technical Stops:

Support/Resistance: 10-15 pips beyond key levels

Moving Average: Below/above significant MA levels

Volatility-Based: 1.5x Average True Range (ATR)

Time-Based Stops:

Intraday: Exit if no progress within 4-6 hours

Swing: Exit if no progress within 5 trading days

Event Risk: Flat before major announcements unless specifically trading the event

Profit Taking Protocols

Scaled Exit Strategy:

1. 25% at 1:1 Risk-Reward (secure break-even)

2. 50% at 1:2 Risk-Reward (lock in profits)

3. 25% runner with trailing stop (capture trends)

Trailing Stop Guidelines:

Activate: After reaching 1:1 risk-reward

Method: Trail below/above previous swing lows/highs

Minimum Trail: 15 pips for intraday, 30 pips for swing

Market Psychology & Sentiment Analysis

Current Sentiment Indicators

Positioning Data:

COT Report: Large speculators slightly long EUR

Retail Sentiment: 60% long EUR/USD (contrarian bearish)

Institutional Flow: Mixed signals, slight USD weakness

Fear & Greed Indicators:

VIX Level: Moderate (supportive of risk-on)

Currency Vol: EUR/USD implied volatility declining

Safe Haven Demand: USD demand moderating

Psychological Price Levels

Major Round Numbers:

1.1600: Psychological support (previous resistance)

1.1700: Major psychological resistance

1.1800: Significant psychological barrier

1.2000: Major psychological milestone (parity with 2020 levels)

External Factors & Macroeconomic Context

Central Bank Policy Divergence

Federal Reserve:

- Current stance: Data-dependent, potential pause in tightening

- Market expectations: 25bps cut possibility in Q4 2025

- Key speakers: Watch for Powell, Williams, and other Fed officials

European Central Bank:

- Current stance: Gradual normalization continues

- Inflation target: Progress toward 2% target ongoing

- Policy differential: EUR benefits from relative hawkishness

Geopolitical Risk Factors

European Union:

- Energy security concerns monitoring required

- Political stability in major EU economies

- Brexit-related trade impacts on EUR sentiment

Global Factors:

- China economic data impacts on risk sentiment

- Commodity price fluctuations affecting EUR

- Global supply chain normalization supporting EUR

Economic Calendar Priority Events

High Impact EUR Events:

- ECB Rate Decisions and Press Conferences

- Eurozone CPI and Core CPI readings

- German IFO Business Climate and ZEW indices

- European PMI manufacturing and services data

High Impact USD Events:

- Federal Reserve policy meetings and minutes

- US Non-Farm Payrolls and unemployment rate

- US CPI and Core CPI inflation readings

- US GDP and consumer confidence indicators

Technology Integration & Automation

Automated Alert Systems

Price Alerts:

Breakout Levels: 1.1680, 1.1720, 1.1635, 1.1600

Support/Resistance: All major levels identified

Pattern Completion: Harmonic pattern targets

Elliott Wave: Wave completion and invalidation levels

Indicator Alerts:

RSI: Oversold (<30) and Overbought (>70) conditions

Bollinger Bands: Band squeeze and expansion signals

MACD: Signal line crosses and divergences

Volume: Unusual volume spikes (2x average)

Trading Platform Integration

TradingView Setup:

Multi-timeframe dashboard: 15M, 1H, 4H, Daily, Weekly

Custom indicators: Harmonic scanner, Elliott Wave tools

Alert integration: Mobile and email notifications

Backtesting: Strategy performance validation

MetaTrader Integration:

Expert Advisor: Automated entry/exit based on confluences

Risk Management: Position sizing and stop-loss automation

News Integration: Economic calendar with impact levels

Statistics Tracking: Trade performance analytics

Advanced Strategy Combinations

Multi-Confluence Entry System

Tier 1 Signals (Highest Probability):

- Elliott Wave + Harmonic Pattern + RSI Divergence

- Wyckoff accumulation + Gann support + Volume confirmation

- Ichimoku bullish signals + Candlestick reversal patterns

Tier 2 Signals (Moderate Probability):

- Fibonacci confluence + Moving average support

- Bollinger Band bounce + VWAP reclaim

- Chart pattern breakout + momentum confirmation

Tier 3 Signals (Lower Probability):

- Single indicator signals without confluence

- Counter-trend trades without strong reversal signals

- News-based trades without technical confirmation

Scenario Planning & Contingency Strategies

Scenario 1: Strong Bull Market (40% Probability)

Trigger: Break above 1.1720 with strong volume

Targets: 1.1800, 1.1880, 1.1950

Strategy: Trend following, add on pullbacks

Risk: Overbought conditions, potential corrections

Scenario 2: Range-Bound Market (35% Probability)

Parameters: 1.1570-1.1720 trading range

Strategy: Fade extremes, take profits at boundaries

Duration: 4-6 weeks potential

Risk: False breakouts, whipsaw price action

Scenario 3: Bear Market Resumption (25% Probability)

Trigger: Break below 1.1570 with conviction

Targets: 1.1520, 1.1480, 1.1400

Strategy: Short rallies, trend following down

Risk: Central bank intervention, policy shifts

Performance Metrics & Success Indicators

Strategy Validation Metrics

Win Rate Targets:

- Intraday strategies: 60-65% win rate minimum

- Swing strategies: 55-60% win rate acceptable

- Overall portfolio: 58% win rate target

Risk-Reward Ratios:

- Minimum acceptable: 1:1.5 risk-reward

- Target average: 1:2.5 risk-reward

- Exceptional setups: 1:4+ risk-reward potential

Maximum Drawdown Limits:

- Daily drawdown: 2% maximum

- Weekly drawdown: 5% maximum

- Monthly drawdown: 8% maximum

Performance Tracking KPIs

Trading Efficiency:

- Average holding period for winning trades

- Average holding period for losing trades

- Profit factor (gross profit/gross loss)

- Sharpe ratio for trading performance

Market Timing Accuracy:

- Entry timing effectiveness

- Exit timing optimization

- Pattern recognition accuracy

- Economic event impact prediction

Conclusion & Strategic Outlook

The EUR/USD pair presents a compelling technical landscape with multiple analytical frameworks converging to suggest potential bullish continuation from current levels. MACD remains above the zero line, though momentum is fading, signaling a potential sideways phase. RSI holds near 60, reflecting the dominance of bullish sentiment, supporting our cautiously optimistic bias.

The confluence of Elliott Wave impulse structure, completed harmonic patterns, Wyckoff markup phase characteristics, and supportive Ichimoku cloud positioning creates a favorable risk-reward environment for both intraday and swing trading opportunities.

Key Strategic Themes:

1. Primary Bias: Bullish above 1.1570 invalidation level

2. Target Hierarchy: 1.1720 → 1.1800 → 1.1880 → 1.1950

3. Risk Management: Critical support at 1.1635-1.1650 cluster

4. Time Horizon: 4-8 week bullish campaign potential

Success Probability Assessment:

Bullish Continuation: 65% probability

Sideways Consolidation: 25% probability

Bearish Reversal: 10% probability

Critical Decision Points:

1. 1.1680 Resistance: Break confirms bullish acceleration

2. 1.1635 Support: Hold required for bullish structure integrity

3. 1.1720 Zone: Major resistance test will determine intermediate-term direction

The integration of advanced technical methodologies with comprehensive risk management protocols positions traders to capitalize on the EUR/USD pair's evolving price action while maintaining appropriate downside protection. Continuous monitoring of central bank policies, economic data releases, and global risk sentiment remains essential for strategy adaptation and optimal trade execution.

Trading Recommendation: Maintain bullish bias with defensive positioning, scale into strength above key resistance levels, and prepare for potential volatility expansion around major economic events and central bank communications.

I am nothing

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I am nothing

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.