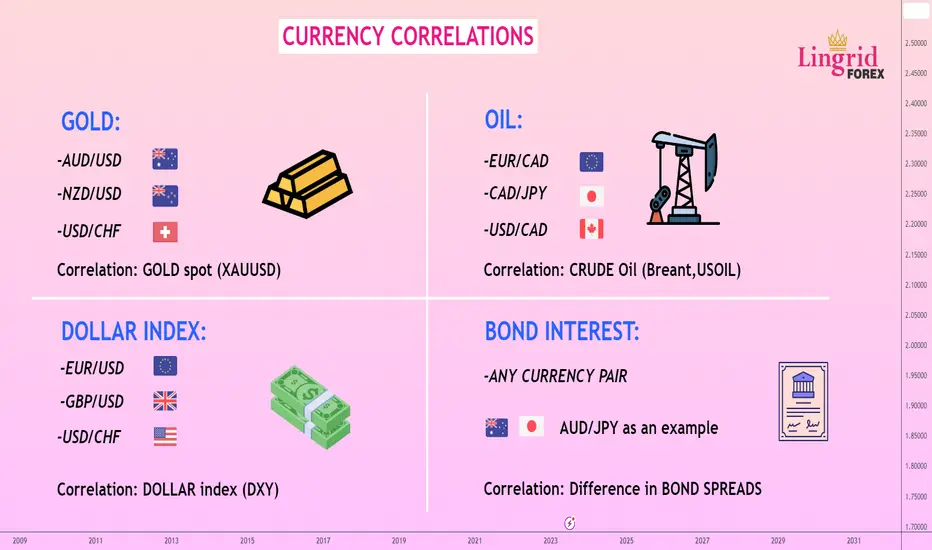

Correlation is a popular method for using one asset as a beacon for predicting another. Virtually all assets are influenced in one way or another by commodities. You can see it yourself right now, when a stunning increase in the price of gold led to the growth of the AUD. Thereby demonstrating an almost 100% correlation between gold and the AUD.

Examples of Correlations❇️

We'll look at some examples, which will help you better understand the influence of different assets on each other. Australia (AUD = Australian dollar) is the third largest gold producer in the world by volume. Australia sells several billion dollars’ worth of gold every year. As a result, gold and AUD/USD have a positive correlation. Gold appreciates, but the Australian dollar strengthens against the U.S. dollar. Gold falls, so does the AUD. According to statistics, the correlation between these two assets is over 80%.

Gold and AUD/USD

Let's talk now about the black gold a.k.a oil. This is nothing else than the blood of the economy, which flows through the veins of the world industry, being the main source of energy. One of the largest oil exporters in the world is Canada. Canada sells more than 4 million barrels per day only to the U.S. as its main supplier. As a result, if the U.S. increases its demand for Canadian oil, so does the demand for the Canadian dollar.

Canada is an export-oriented economy, where 85% of exports go to the US as a major trading partner. The USD/CAD is therefore entirely dependent on how consumers in the US respond to changes in oil prices. If the demand for goods in the U.S. rises, industrialists need more oil to ride on economic growth. If oil prices rise in the meantime, the USD/CAD exchange rate begins to fall (because the CAD is strengthening).

Conversely, if oil is not needed and the U.S. economy is slowing, demand for the CAD falls. In other words, oil has a negative correlation to USD/CAD, an appreciation of one asset causes the other asset to fall and vice versa.

UKOIL and USDCAD

Bond Spread ❇️

The bond spread is the difference between the interest rates on the bonds of two countries. It is on a similar spread that the carry trade strategy is based, which strongly influences many currencies. By tracking bond spreads and expectations of how key rates will change, you can get key fundamental signs that affect the exchange rate. As the interest spread between the currencies in a currency pair widens, the currency of the country that has the higher interest on government bonds strengthens against the one that has the lower interest.

BONDS and AUDJPY

The chart above on AUD/JPY shows us this perfectly. It shows the spread between 10-year U.S. and Australian government bonds from start of 2023. When the spread rose the AUD/JPY exchange rate rose nearly 12% from the low.

When the bond spread between Australian and Japanese bonds widens, institutional traders bet on the AUD/JPY going higher, why? Because that's how a carry trade works. But when the Reserve Bank of Australia began to increase key rates and the spread sharply widened, traders began to go "long" positions on AUD/JPY and the price, logically, began to rise.

Dollar Index ❇️

The dollar index gives a general idea about the strength or weakness of the dollar, for it can be regarded as a universal indicator. It's important to remember that the euro makes up more than 50% of the index, so EUR/USD is the main subject here. If you need to assess the dollar's condition in all dollar pairs the index is the best for that. How similar are they really? EURUSD up and DXY down. Many traders continually check the DXY, not only for its correlations but also for its divergence with the EUR/USD.

DXY and EURUSD

If the dollar is the base currency (first in a currency pair, say, USD/*), then the dollar index and the currency pair will go in the same direction;

If the dollar is the quoted currency (*/USD), then the index and the currency pair will go in different directions.

Correlation analysis is fascinating. Everything in the world is correlated, so currencies, various economic indicators, government bonds and commodities. The essence of bonds is simple: everyone needs money, the government constantly borrows against its securities, and the greater the demand for those securities, the more desirable the national currency. However, if this pattern shows a negative correlation, and the increased demand for bonds does not lead to an increase in the currency, then other factors come into play, such as the state of the global and national economies, the discrepancy in key rates between countries .

Examples of Correlations❇️

We'll look at some examples, which will help you better understand the influence of different assets on each other. Australia (AUD = Australian dollar) is the third largest gold producer in the world by volume. Australia sells several billion dollars’ worth of gold every year. As a result, gold and AUD/USD have a positive correlation. Gold appreciates, but the Australian dollar strengthens against the U.S. dollar. Gold falls, so does the AUD. According to statistics, the correlation between these two assets is over 80%.

Gold and AUD/USD

Let's talk now about the black gold a.k.a oil. This is nothing else than the blood of the economy, which flows through the veins of the world industry, being the main source of energy. One of the largest oil exporters in the world is Canada. Canada sells more than 4 million barrels per day only to the U.S. as its main supplier. As a result, if the U.S. increases its demand for Canadian oil, so does the demand for the Canadian dollar.

Canada is an export-oriented economy, where 85% of exports go to the US as a major trading partner. The USD/CAD is therefore entirely dependent on how consumers in the US respond to changes in oil prices. If the demand for goods in the U.S. rises, industrialists need more oil to ride on economic growth. If oil prices rise in the meantime, the USD/CAD exchange rate begins to fall (because the CAD is strengthening).

Conversely, if oil is not needed and the U.S. economy is slowing, demand for the CAD falls. In other words, oil has a negative correlation to USD/CAD, an appreciation of one asset causes the other asset to fall and vice versa.

UKOIL and USDCAD

Bond Spread ❇️

The bond spread is the difference between the interest rates on the bonds of two countries. It is on a similar spread that the carry trade strategy is based, which strongly influences many currencies. By tracking bond spreads and expectations of how key rates will change, you can get key fundamental signs that affect the exchange rate. As the interest spread between the currencies in a currency pair widens, the currency of the country that has the higher interest on government bonds strengthens against the one that has the lower interest.

BONDS and AUDJPY

The chart above on AUD/JPY shows us this perfectly. It shows the spread between 10-year U.S. and Australian government bonds from start of 2023. When the spread rose the AUD/JPY exchange rate rose nearly 12% from the low.

When the bond spread between Australian and Japanese bonds widens, institutional traders bet on the AUD/JPY going higher, why? Because that's how a carry trade works. But when the Reserve Bank of Australia began to increase key rates and the spread sharply widened, traders began to go "long" positions on AUD/JPY and the price, logically, began to rise.

Dollar Index ❇️

The dollar index gives a general idea about the strength or weakness of the dollar, for it can be regarded as a universal indicator. It's important to remember that the euro makes up more than 50% of the index, so EUR/USD is the main subject here. If you need to assess the dollar's condition in all dollar pairs the index is the best for that. How similar are they really? EURUSD up and DXY down. Many traders continually check the DXY, not only for its correlations but also for its divergence with the EUR/USD.

DXY and EURUSD

If the dollar is the base currency (first in a currency pair, say, USD/*), then the dollar index and the currency pair will go in the same direction;

If the dollar is the quoted currency (*/USD), then the index and the currency pair will go in different directions.

Correlation analysis is fascinating. Everything in the world is correlated, so currencies, various economic indicators, government bonds and commodities. The essence of bonds is simple: everyone needs money, the government constantly borrows against its securities, and the greater the demand for those securities, the more desirable the national currency. However, if this pattern shows a negative correlation, and the increased demand for bonds does not lead to an increase in the currency, then other factors come into play, such as the state of the global and national economies, the discrepancy in key rates between countries .

💰FREE FOREX signals in Telegram: bit.ly/3F4mrMi

🚀FREE CRYPTO signals in Telegram: t.me/cryptolingrid

🌎WebSite: lingrid.org

🚀FREE CRYPTO signals in Telegram: t.me/cryptolingrid

🌎WebSite: lingrid.org

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💰FREE FOREX signals in Telegram: bit.ly/3F4mrMi

🚀FREE CRYPTO signals in Telegram: t.me/cryptolingrid

🌎WebSite: lingrid.org

🚀FREE CRYPTO signals in Telegram: t.me/cryptolingrid

🌎WebSite: lingrid.org

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.