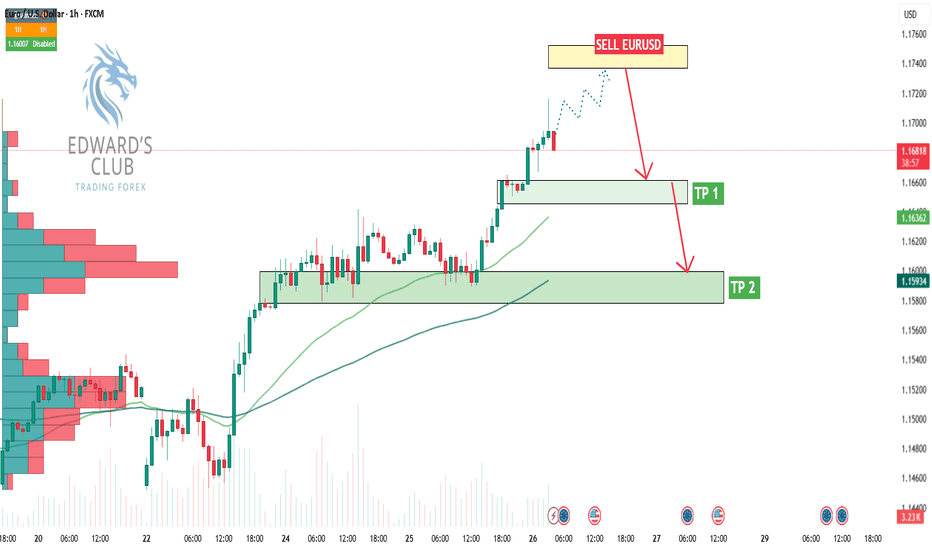

EURUSD continues to surge as technical and fundamental forces align. The pair has broken out of consolidation and is now trading within a clear ascending channel. Price is currently retracing into a well-defined demand zone around 1.1590 – 1.1600, where a potential bullish continuation is anticipated.

Supporting the move, dovish signals from Fed Chair Jerome Powell suggest the central bank may hold off on further rate hikes, weakening the USD. Meanwhile, euro demand is recovering as geopolitical tensions ease and European funds reduce dollar-based hedging. Technically, the 34 and 89 EMA offer dynamic support, reinforcing this area as a key re-entry point for buyers.

Targets for this bullish leg are set near 1.1687 (TP1) and 1.1748 (TP2), provided price holds above the short-term support.

Will EURUSD maintain this momentum or face resistance ahead? Let the chart guide your next move.

Supporting the move, dovish signals from Fed Chair Jerome Powell suggest the central bank may hold off on further rate hikes, weakening the USD. Meanwhile, euro demand is recovering as geopolitical tensions ease and European funds reduce dollar-based hedging. Technically, the 34 and 89 EMA offer dynamic support, reinforcing this area as a key re-entry point for buyers.

Targets for this bullish leg are set near 1.1687 (TP1) and 1.1748 (TP2), provided price holds above the short-term support.

Will EURUSD maintain this momentum or face resistance ahead? Let the chart guide your next move.

Trade active

Trade closed: target reached

Done TP 1 ✅You can get 7-10 Forex, XAUUSD, Bitcoin...signal every day

✅ Trading knowledge and answers to questions 24/7

✅Completely free.

👉Join by clicking the following link:

t.me/+6a8jSQbpr2tmYWFl

✅ Trading knowledge and answers to questions 24/7

✅Completely free.

👉Join by clicking the following link:

t.me/+6a8jSQbpr2tmYWFl

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅You can get 7-10 Forex, XAUUSD, Bitcoin...signal every day

✅ Trading knowledge and answers to questions 24/7

✅Completely free.

👉Join by clicking the following link:

t.me/+6a8jSQbpr2tmYWFl

✅ Trading knowledge and answers to questions 24/7

✅Completely free.

👉Join by clicking the following link:

t.me/+6a8jSQbpr2tmYWFl

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.