First, let's have a Fundamental Analysis of EURUSD(

EURUSD).

EURUSD).

The EURUSD rate is influenced by several key fundamental factors:

1. Divergent Economic Indicators:

United States: Recent data indicates a robust labor market, with job growth maintaining momentum. This strength supports the U.S. dollar, as investors anticipate potential monetary policy tightening by the Federal Reserve to manage inflationary pressures.

Eurozone: Conversely, the Eurozone faces economic challenges, including unexpected inflation acceleration and declining industrial production, particularly in Germany. These factors may constrain the European Central Bank's (ECB) ability to adjust interest rates, potentially weakening the euro.

2. Central Bank Policies:

Federal Reserve (Fed): The Fed's recent communications suggest a cautious approach to interest rate adjustments, balancing economic growth with inflation control. The prospect of maintaining or increasing rates could further bolster the U.S. dollar.

European Central Bank (ECB): The ECB is grappling with rising inflation amidst a struggling economy. This scenario complicates policy decisions, as increasing rates to combat inflation might hinder economic recovery, thereby exerting downward pressure on the euro.

3. Geopolitical Developments:

The U.S. administration's recent tariff threats have introduced uncertainties in global trade. Such actions typically lead investors to seek safe-haven assets, benefiting the U.S. dollar due to its perceived stability.

In summary, the EURUSD is currently experiencing downward pressure, driven by stronger U.S. economic performance, proactive Federal Reserve policies, and geopolitical factors favoring the U.S. dollar. Conversely, the Eurozone's economic difficulties and the ECB's constrained policy options contribute to a weaker euro. These dynamics suggest a potential continuation of the EURUSD's bearish trend in the near term.

--------------------------------------

Now, let's analyze the EURUSD chart in terms of Technical Analysis.

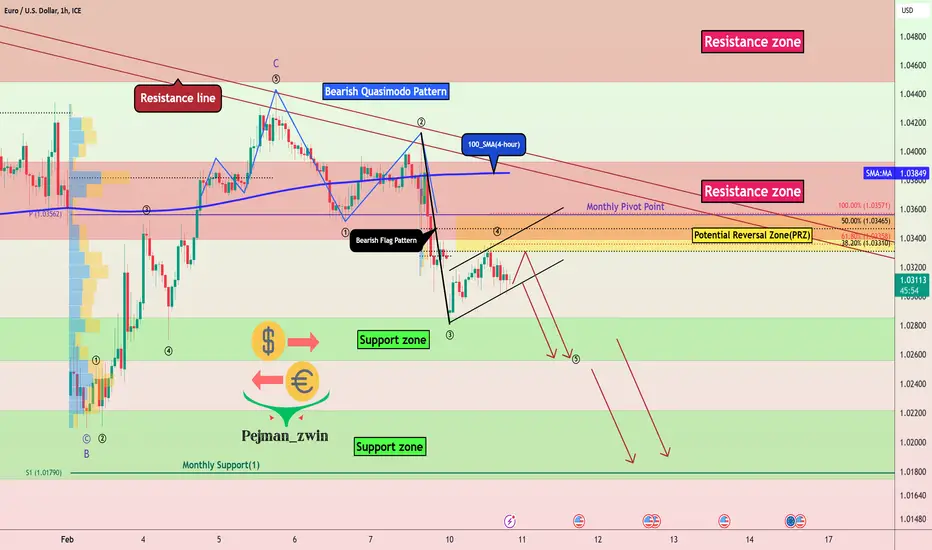

EURUSD is moving near the Resistance zone($1.039-$1.033), Potential Reversal Zone(PRZ), 100_SMA(4-hour), Monthly Pivot Point, and Resistance lines. Each of these items is considered a good resistance for EURUSD.

In terms of Price Action, if we look at the EURUSD chart in the 1-hour time frame, we can see the Bearish Quasimodo Pattern, which is one of the reasons for EURUSD's fall.

Educational Note: The Bearish Quasimodo Pattern is a price action reversal pattern that signals a potential downtrend. It forms when the price creates a higher high (HH) followed by a lower low (LL) and a lower high (LH), breaking the market structure.

From the point of view of Classical Technical Analysis, it seems that EURUSD has managed to form a Bearish Flag Continuation Pattern. It is a good sign for the continuation of the downward trend of EURUSD.

Educational Note: The Bearish Flag Pattern is a continuation pattern that signals the continuation of a downtrend. It consists of a sharp downward move (flagpole) followed by a consolidation phase in a small upward-sloping channel (flag). A breakdown from the flag confirms the pattern, indicating further price decline.

According to the theory of Elliott waves, according to the volume of the previous movement, it seems that EURUSD is completing wave 4, and it is possible that we are still in the main wave 3 even with a further fall.

I expect EURUSD to fall to at least the Support zone($1.0285-$1.0255) after entering the PRZ or after breaking the lower line of the ascending channel of the bearish flag pattern, and if this zone is broken, we should expect to fall to the next Support zone($1.0222-$1.0175) and Monthly Support(1).

Note: If EURUSD touches $1.03700, we can expect more dumps.

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S.Dollar Analyze (EURUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

The EURUSD rate is influenced by several key fundamental factors:

1. Divergent Economic Indicators:

United States: Recent data indicates a robust labor market, with job growth maintaining momentum. This strength supports the U.S. dollar, as investors anticipate potential monetary policy tightening by the Federal Reserve to manage inflationary pressures.

Eurozone: Conversely, the Eurozone faces economic challenges, including unexpected inflation acceleration and declining industrial production, particularly in Germany. These factors may constrain the European Central Bank's (ECB) ability to adjust interest rates, potentially weakening the euro.

2. Central Bank Policies:

Federal Reserve (Fed): The Fed's recent communications suggest a cautious approach to interest rate adjustments, balancing economic growth with inflation control. The prospect of maintaining or increasing rates could further bolster the U.S. dollar.

European Central Bank (ECB): The ECB is grappling with rising inflation amidst a struggling economy. This scenario complicates policy decisions, as increasing rates to combat inflation might hinder economic recovery, thereby exerting downward pressure on the euro.

3. Geopolitical Developments:

The U.S. administration's recent tariff threats have introduced uncertainties in global trade. Such actions typically lead investors to seek safe-haven assets, benefiting the U.S. dollar due to its perceived stability.

In summary, the EURUSD is currently experiencing downward pressure, driven by stronger U.S. economic performance, proactive Federal Reserve policies, and geopolitical factors favoring the U.S. dollar. Conversely, the Eurozone's economic difficulties and the ECB's constrained policy options contribute to a weaker euro. These dynamics suggest a potential continuation of the EURUSD's bearish trend in the near term.

--------------------------------------

Now, let's analyze the EURUSD chart in terms of Technical Analysis.

EURUSD is moving near the Resistance zone($1.039-$1.033), Potential Reversal Zone(PRZ), 100_SMA(4-hour), Monthly Pivot Point, and Resistance lines. Each of these items is considered a good resistance for EURUSD.

In terms of Price Action, if we look at the EURUSD chart in the 1-hour time frame, we can see the Bearish Quasimodo Pattern, which is one of the reasons for EURUSD's fall.

Educational Note: The Bearish Quasimodo Pattern is a price action reversal pattern that signals a potential downtrend. It forms when the price creates a higher high (HH) followed by a lower low (LL) and a lower high (LH), breaking the market structure.

From the point of view of Classical Technical Analysis, it seems that EURUSD has managed to form a Bearish Flag Continuation Pattern. It is a good sign for the continuation of the downward trend of EURUSD.

Educational Note: The Bearish Flag Pattern is a continuation pattern that signals the continuation of a downtrend. It consists of a sharp downward move (flagpole) followed by a consolidation phase in a small upward-sloping channel (flag). A breakdown from the flag confirms the pattern, indicating further price decline.

According to the theory of Elliott waves, according to the volume of the previous movement, it seems that EURUSD is completing wave 4, and it is possible that we are still in the main wave 3 even with a further fall.

I expect EURUSD to fall to at least the Support zone($1.0285-$1.0255) after entering the PRZ or after breaking the lower line of the ascending channel of the bearish flag pattern, and if this zone is broken, we should expect to fall to the next Support zone($1.0222-$1.0175) and Monthly Support(1).

Note: If EURUSD touches $1.03700, we can expect more dumps.

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S.Dollar Analyze (EURUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Note

EURUSD has entered the Resistance zone($1.039-$1.033), Potential Reversal Zone(PRZ), and Time Reversal Zone(PRZ).

Position:

Position: Short

Entry Point: 1.03390 USD (Stop Limit Order)

Stop Loss: 1.03643 USD

Take Profit: 1.02993 USD

Risk-To-Reward: 1.57

Please don't forget to follow capital management ⚠️

Please pay attention to the style of opening the position.⚠️

Order cancelled

The position was Cancelled =EURUSD did not touch the Entry Point(EP).🎁Welcome than a 50% bonus(Low Spread)👉vtm.pro/Y3AV7r

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🎁Welcome than a 50% bonus(Low Spread)👉vtm.pro/Y3AV7r

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.