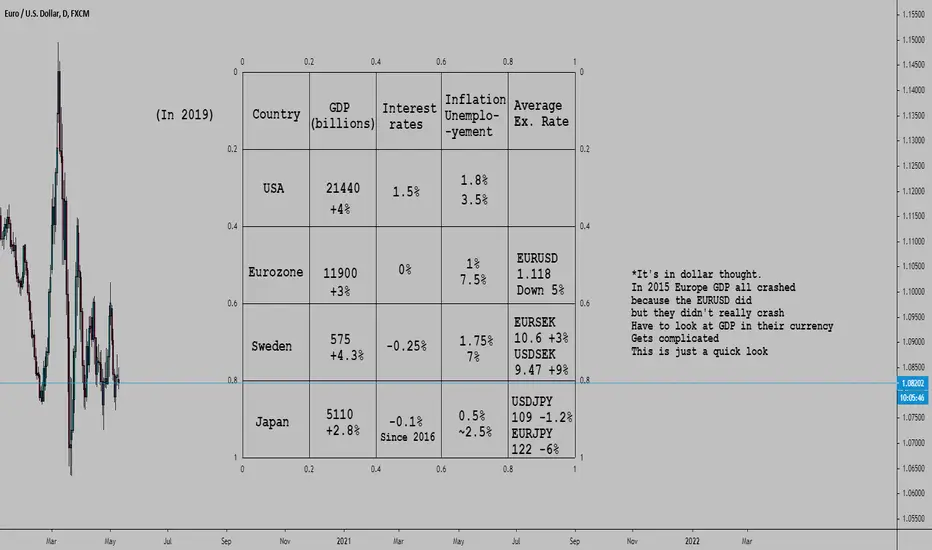

I thought this would be fun but there is too much to look at.

I think what central banks do is the main driver of price action.

In 2019 the USA real GDP growth was 2.4% Japan was just 0.65%, the USA raised their rates Japan didn't move.

And still USDJPY went up not down. In 2019 USA real GDP growth was 2.9% Japan 0.8%.

In 2018 USA inflation was 2.44% and Japan inflation was 0.98%. Exchange rate went down 1.5%.

This is so complex, so many variables, so many numbers! And nothing makes sense! Price goes the wrong direction!

The Forex market is random!

Nah I'm just kidding it's obvious.

And it was maybe predictable.

They're not the world reserve like the USA...

And then inflation went up, they stopped money printing, and then again, and recently they went for UNLIMIIIITED POOOOWELL.

I wonder if japanese selling BTC for Yen caused it to go up a bit in last years?

If all this money they print goes to coffers or goes to investing abroad, it won't create inflation in japan...

Lmao in 2013 "Haruhiko Kuroda, the Bank of Japan's new governor, described its stance as "monetary easing in an entirely new dimension"."

Lmao they said they would bazooka infinite money and bring money printing to a whole new dimension and double the money supply and retail traders went short USDJPY!

That's some stupidity from a whole other dimension!

dailyfx.com/forex/technical/ssi/usd-jpy/2013/08/15/Retail_Traders_Become_Less_Bullish_USDJPY_Despite_Rebound_from_Lows.html/amp

Nah I'm not buying it. Retail traders must be missing a few chromosomes or something. This ain't normal.

I'm not sure guys not sure but I think the BOJ might have meant they had for goal to devalue their currency when they said "we will bazooka infinite money like you have never seen brace yourselves we will bring monetary easing to a whole new dimension", I can't be sure but I think they might have had as goal to devalue their currency. Maybe. Just maybe it wasn't the best idea to take massive bullish bets on the yen.

They ended up going back to bullish thought. I wonder what day traders were doing. Probably nervously selling.

If I get bored out of my mind I'll go check calls & ideas on various sites.

Casual gambling wasn't as big back then. I need to find some technical analysts that did some really stupid things and got rekt.

Seems day traders got burned in the range and others too, only chads that buy high and sell low made lots of money.

Look at this central banker little troll face. Laughing as he prints limitless money:

theguardian.com/business/2013/apr/04/japan-bank-money-supply-inflation-deflation

Before that the US FED were doing their own QE. Basically 2009 to 2013.

The yen hasn't been interesting since 2017, USDJPY actually, EURJPY has been interesting.

In the 2000s the AUDJPY pair was interesting, japan savings were getting poured into the AUD.

In 2017+ USDJPY boring, but after the 1rst of April, japan savings were poured into crypto, not sure how much but sure had an impact.

I wonder what they put their money into other than crypto?

They were so beaten over deflation and totally gave up ever inflating their monetary base maybe that's why they said "screw it you guys can just use Bitcoin if you want".

With Bitcoin at least they won't have to worry about inflation... But what if the central banks held 99% of BTC supply and just release some of it when they feel like it, to try and grow inflation?

Imagine a central power owning almost all of the supply! 99%! Ye except now they can print infinite money so in other words they own 100% of the supply (99.9999999...).

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.