A beginner trader inevitably faces a number of mistakes that will cost him/her a lot of money. Many deposits will be lost as well as nerve cells through the trading journey. We usually pay for our trading mistakes with money and mental health. Don't you think the price is too high for that? If you try to avoid common trading mistakes, you’re going to have a good chance to save your money and your mental health.

Not adapting to market conditions

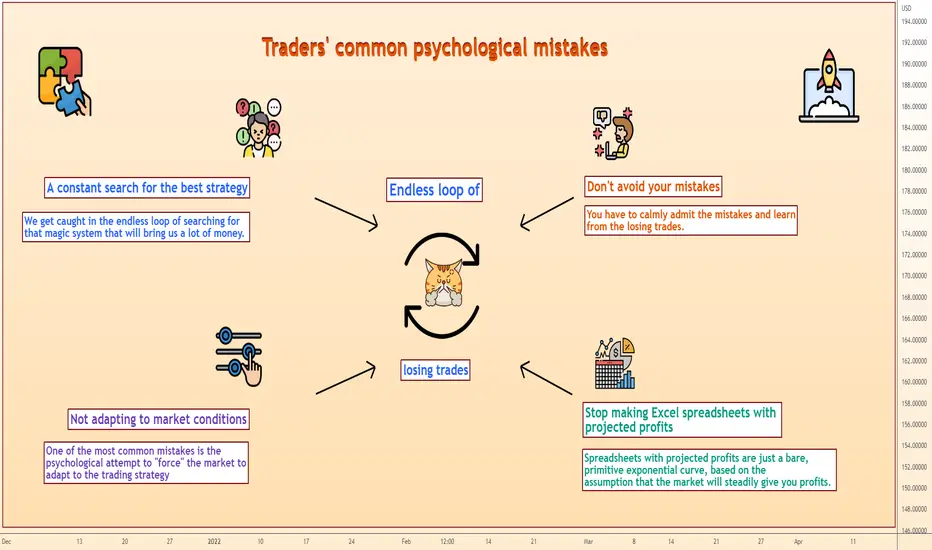

One of the most common mistakes is the psychological attempt to "force" the market to adapt to the trading strategy or system. How does this happen? A novice trader finds a trading strategy which seems to him profitable and effective. That moment trader immediately will be imprisoned by his own illusions, and he’ll lose any idea about the market in general. As we all know trading is a fight, a war. To be a consistently profitable trader you have to adapt to market conditions, not otherwise.

Let's say the RSI didn't work out in a particular trade? If your indicator leads to losing trades before opening another trade just stop for the moment and instead look at the big picture and understand this:

• Do you need it at all?

• In what market conditions does your indicator work?

• When is the best time to use it?

• What systems and strategies does it work best with, but with which it is not?

You need to be flexible and adapt continuously. The market in trend and consolidation are two different markets, and approaches to them should also be different as well. Adaptation and creating a flexible trading system is the right path to trading success.

A constant search for the best strategy

We get caught in the endless loop of searching for that magic system that will bring us a lot of money. And we lose so much time and energy trying to find next the best strategy. Do you know why strategies work for some people and not for others? The answer is experience. That's all. Without a trading experience, in the first days of using any strategy, you only have theory of probability, which is against you. Searching for the best strategy is always useless because you can't suddenly get the experience that was invested during the building of the strategy. Only with a set of experience can you get consistent results.

That is how by using only two moving averages, some people can make a fortune in the markets, but a beginner trader doesn't have the slightest chance. In any business, only professionals earn good money. And in trading most people for some reason decided that they do not need to work and study. Find one strategy which suits your personality and backtest it. Make it your own.

Don't avoid your mistakes

It hurts like hell to continually lose money, doesn't it? But that's what happens in trading, all the time. Especially in the first months, when there are so many losses that after six months there are only a few left.

The pain from losses is so great that people ignore mistakes and do not even want to look into them. And that is a fatal mistake. You've paid a money for a negative experience. So, to take the time to sort out the reasons why the trade didn't work out. Do it, or else this mistake will happen again and again! Until you lose it all. You should not be ashamed or think you are a stupid trader or something like that. You have to calmly admit the mistake and learn from the losing trades. Write and break it down in a diary, make some conclusions, and remember them.

Stop making Excel spreadsheets with projected profits

You're sitting there thinking like: "So, how much money am I going to earn if I let's say will make 100$ a day? It will be $500 in the week. If increase the lot size, a month will be so much, and after 1 year I am going to be a millionaire”.

It's only on paper, but we somehow manage to spend that money that doesn’t exist. When traders create those types of spreadsheets, they do not take into account the psychological factor at all. Factors such as:

• fear

• greed

• the stress of losing money.

There is none of this in the spreadsheets. There's just a bare, primitive exponential curve, based on the assumption that the market will steadily give you profits. The market is not a bank with guaranteed interest on a deposit. Reality will be so different from your spreadsheet that you will throw it in the trash very quickly. Spreadsheets with imaginary income bring only harm.

Conclusion

Trading can be a source of stable income, but "stable" just means positive deposit growth over a period of time. It is really possible to close each month with profits. But it may be, for example, from 0.01% of the capital at the beginning of the month to 100% or possibly more. And the first one will be more realistic than the second one. The art of the professional trader is to manage this percentage and increasing a positive mathematical expectation of each trade.

Do not set yourself goals in specific amounts; it will break you when you face your first failures, because there will be beautiful hypothetical figures in the spreadsheet, while the actual deposit will decrease, and this cognitive dissonance will destroy a beginner trader, because millions on the paper will never coincide with reality.

Not adapting to market conditions

One of the most common mistakes is the psychological attempt to "force" the market to adapt to the trading strategy or system. How does this happen? A novice trader finds a trading strategy which seems to him profitable and effective. That moment trader immediately will be imprisoned by his own illusions, and he’ll lose any idea about the market in general. As we all know trading is a fight, a war. To be a consistently profitable trader you have to adapt to market conditions, not otherwise.

Let's say the RSI didn't work out in a particular trade? If your indicator leads to losing trades before opening another trade just stop for the moment and instead look at the big picture and understand this:

• Do you need it at all?

• In what market conditions does your indicator work?

• When is the best time to use it?

• What systems and strategies does it work best with, but with which it is not?

You need to be flexible and adapt continuously. The market in trend and consolidation are two different markets, and approaches to them should also be different as well. Adaptation and creating a flexible trading system is the right path to trading success.

A constant search for the best strategy

We get caught in the endless loop of searching for that magic system that will bring us a lot of money. And we lose so much time and energy trying to find next the best strategy. Do you know why strategies work for some people and not for others? The answer is experience. That's all. Without a trading experience, in the first days of using any strategy, you only have theory of probability, which is against you. Searching for the best strategy is always useless because you can't suddenly get the experience that was invested during the building of the strategy. Only with a set of experience can you get consistent results.

That is how by using only two moving averages, some people can make a fortune in the markets, but a beginner trader doesn't have the slightest chance. In any business, only professionals earn good money. And in trading most people for some reason decided that they do not need to work and study. Find one strategy which suits your personality and backtest it. Make it your own.

Don't avoid your mistakes

It hurts like hell to continually lose money, doesn't it? But that's what happens in trading, all the time. Especially in the first months, when there are so many losses that after six months there are only a few left.

The pain from losses is so great that people ignore mistakes and do not even want to look into them. And that is a fatal mistake. You've paid a money for a negative experience. So, to take the time to sort out the reasons why the trade didn't work out. Do it, or else this mistake will happen again and again! Until you lose it all. You should not be ashamed or think you are a stupid trader or something like that. You have to calmly admit the mistake and learn from the losing trades. Write and break it down in a diary, make some conclusions, and remember them.

Stop making Excel spreadsheets with projected profits

You're sitting there thinking like: "So, how much money am I going to earn if I let's say will make 100$ a day? It will be $500 in the week. If increase the lot size, a month will be so much, and after 1 year I am going to be a millionaire”.

It's only on paper, but we somehow manage to spend that money that doesn’t exist. When traders create those types of spreadsheets, they do not take into account the psychological factor at all. Factors such as:

• fear

• greed

• the stress of losing money.

There is none of this in the spreadsheets. There's just a bare, primitive exponential curve, based on the assumption that the market will steadily give you profits. The market is not a bank with guaranteed interest on a deposit. Reality will be so different from your spreadsheet that you will throw it in the trash very quickly. Spreadsheets with imaginary income bring only harm.

Conclusion

Trading can be a source of stable income, but "stable" just means positive deposit growth over a period of time. It is really possible to close each month with profits. But it may be, for example, from 0.01% of the capital at the beginning of the month to 100% or possibly more. And the first one will be more realistic than the second one. The art of the professional trader is to manage this percentage and increasing a positive mathematical expectation of each trade.

Do not set yourself goals in specific amounts; it will break you when you face your first failures, because there will be beautiful hypothetical figures in the spreadsheet, while the actual deposit will decrease, and this cognitive dissonance will destroy a beginner trader, because millions on the paper will never coincide with reality.

90% accuracy in telegram

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

90% accuracy in telegram

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.