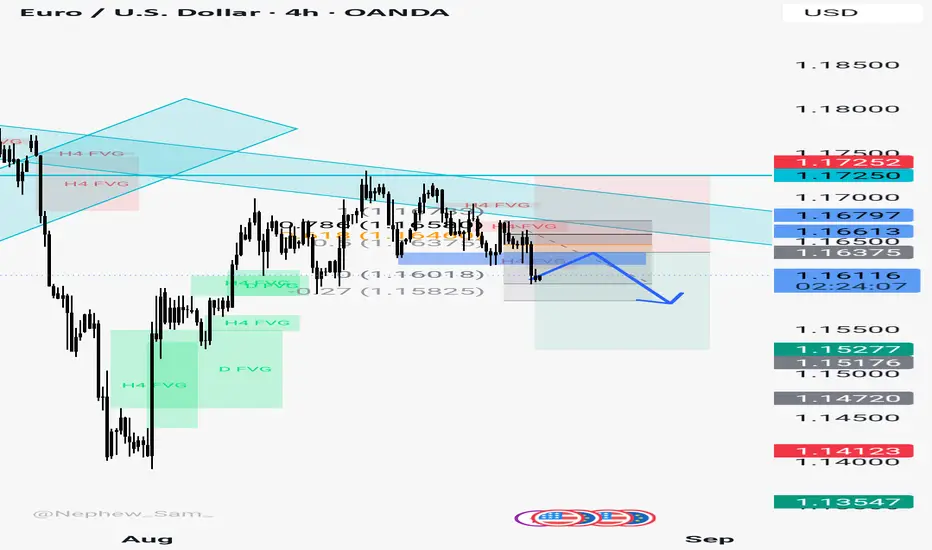

EUR/USD 4H Short Continuation Setup

Bearish Trend Channel ✅ | FVG + Supply Zone 📦 | Fib Rejection 🔻

📊 Market Context:

✅ Weekly: Still bullish but momentum slowing

✅ Daily: Now bearish after confirmed break of structure

✅ 4H: Clean bearish structure — lower highs and lower lows developing

Price is respecting a bearish trend channel and continues to reject from key supply zones and imbalances, setting up a strong short continuation play.

---

📉 Current Price Action:

Price rejected hard from the 0.618–0.786 retracement zone

It tapped into a 4H FVG (red box) and respected the upper boundary of the descending channel

A lower high has now formed, and price has dropped back into the range around 1.1610–1.1600

A minor bullish FVG has formed, but the expectation is that this will be filled and price will break lower

---

🔁 Fibonacci Confluence:

0.618 = 1.1646

0.786 = 1.1658

These levels perfectly align with the 4H supply zone and trendline resistance, which price respected and rejected

---

📦 Fair Value Gaps (FVGs):

✅ Bearish FVG around 1.1646–1.1658 was filled and respected

✅ Current price action is forming another bearish FVG, suggesting continued imbalance to the downside

✅ Bullish FVG at 1.1582 (marked) could be first target and liquidity draw

---

📐 Structure Outlook:

Price is forming lower highs and showing rejection wicks

Trendline and supply zone remain unbroken

All signs point to continued bearish pressure unless invalidated

---

🎯 Short Targets:

TP1: 1.1582 – previous low and bullish FVG

TP2: 1.1527 – key liquidity and demand

TP3: 1.1472 – deeper FVG zone and structure base

---

📌 Summary:

EUR/USD is offering a strong short continuation setup. After rejecting the Fib retracement, FVG, and trendline, price is now forming bearish structure with a lower high confirmed. As long as 1.1725 holds, we expect downside continuation into 1.1582–1.1472 levels.

Bearish Trend Channel ✅ | FVG + Supply Zone 📦 | Fib Rejection 🔻

📊 Market Context:

✅ Weekly: Still bullish but momentum slowing

✅ Daily: Now bearish after confirmed break of structure

✅ 4H: Clean bearish structure — lower highs and lower lows developing

Price is respecting a bearish trend channel and continues to reject from key supply zones and imbalances, setting up a strong short continuation play.

---

📉 Current Price Action:

Price rejected hard from the 0.618–0.786 retracement zone

It tapped into a 4H FVG (red box) and respected the upper boundary of the descending channel

A lower high has now formed, and price has dropped back into the range around 1.1610–1.1600

A minor bullish FVG has formed, but the expectation is that this will be filled and price will break lower

---

🔁 Fibonacci Confluence:

0.618 = 1.1646

0.786 = 1.1658

These levels perfectly align with the 4H supply zone and trendline resistance, which price respected and rejected

---

📦 Fair Value Gaps (FVGs):

✅ Bearish FVG around 1.1646–1.1658 was filled and respected

✅ Current price action is forming another bearish FVG, suggesting continued imbalance to the downside

✅ Bullish FVG at 1.1582 (marked) could be first target and liquidity draw

---

📐 Structure Outlook:

Price is forming lower highs and showing rejection wicks

Trendline and supply zone remain unbroken

All signs point to continued bearish pressure unless invalidated

---

🎯 Short Targets:

TP1: 1.1582 – previous low and bullish FVG

TP2: 1.1527 – key liquidity and demand

TP3: 1.1472 – deeper FVG zone and structure base

---

📌 Summary:

EUR/USD is offering a strong short continuation setup. After rejecting the Fib retracement, FVG, and trendline, price is now forming bearish structure with a lower high confirmed. As long as 1.1725 holds, we expect downside continuation into 1.1582–1.1472 levels.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.