Many traders will talk about things like "Smart Money Concepts" (SMC) and think they have found something new.

The truth is, everything in trading stems back to Liquidity.

There is no "Algo" nobody is out to get you specifically. The market is always right, where you position yourself is your own choice.

I have written several posts on mechanical trading, recorded a number of streams. The more mechanical you can make the process, the less the emotions have a chance to kick your ass.

Let me give you a very simple method of being able to identify the ranges. Ignore the timeframes as this will work on any of them, on most instruments. (I say most, as some behave differently due to how it attracts liquidity). Lets assume high end crypto such as Bitcoin (BTC) and of course Forex in the general sense, stocks, commodities etc.

This is simple - only 2 rules.

You start by zooming out and giving yourself a general feel for the trend.

Let's say this looks to be an uptrend - we now need to understand the rules.

An opposing candle can simply be defined by a different colour. If the trend is up (Green) and we see a red candle - then it's an opposing candle.

The inverse is true, if we are down and the trend is Red. Then a Green candle would be opposing.

This is only half of the story. The second rule is a pullback candle or even a sequence of candles. This simply means either the very same opposing candle that doesn't make a new high or low (depending on the trend up not making fresh highs or down not taking new lows).

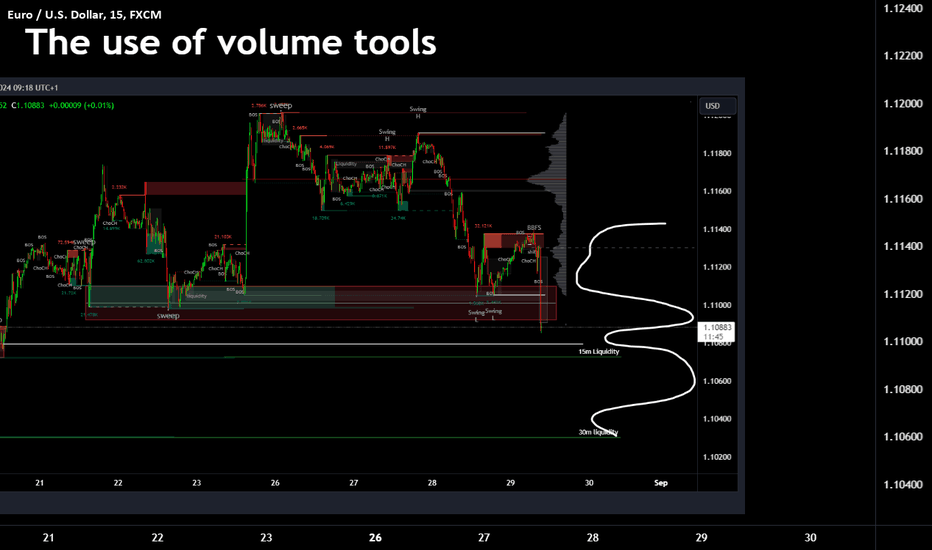

In this image, you can see we have in one candle both an opposing and pullback in one candle. This means we can now mark the high of the range. Working backwards to identify the swing range low.

This easy method means I can draw a range exactly the same and mechanically every single time.

Giving me a mechanical range.

We could then get a lot more technical by looking for liquidity, 50% of the range or places such as supply or demand areas.

But these are all for other posts.

For now, getting a range on the higher timeframes means you can work down and down into a timeframe you are likely to want to trade on.

These ranges will give clues to draws and runs of liquidity.

This will also help identify changes in the character and fresh breaks of structure.

Here's another post I posted on the mechanical structures and techniques.

More in the next post.

Have a great week!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

The truth is, everything in trading stems back to Liquidity.

There is no "Algo" nobody is out to get you specifically. The market is always right, where you position yourself is your own choice.

I have written several posts on mechanical trading, recorded a number of streams. The more mechanical you can make the process, the less the emotions have a chance to kick your ass.

Let me give you a very simple method of being able to identify the ranges. Ignore the timeframes as this will work on any of them, on most instruments. (I say most, as some behave differently due to how it attracts liquidity). Lets assume high end crypto such as Bitcoin (BTC) and of course Forex in the general sense, stocks, commodities etc.

This is simple - only 2 rules.

You start by zooming out and giving yourself a general feel for the trend.

Let's say this looks to be an uptrend - we now need to understand the rules.

An opposing candle can simply be defined by a different colour. If the trend is up (Green) and we see a red candle - then it's an opposing candle.

The inverse is true, if we are down and the trend is Red. Then a Green candle would be opposing.

This is only half of the story. The second rule is a pullback candle or even a sequence of candles. This simply means either the very same opposing candle that doesn't make a new high or low (depending on the trend up not making fresh highs or down not taking new lows).

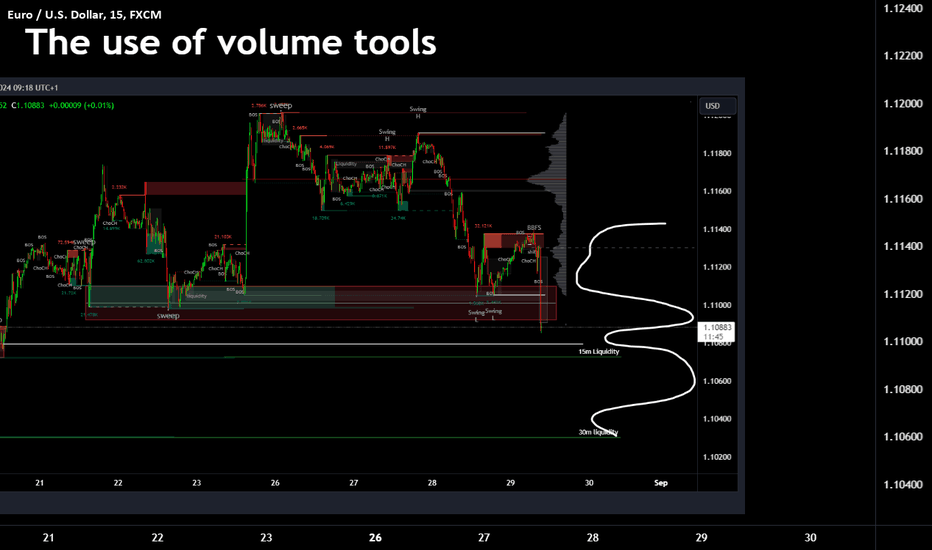

In this image, you can see we have in one candle both an opposing and pullback in one candle. This means we can now mark the high of the range. Working backwards to identify the swing range low.

This easy method means I can draw a range exactly the same and mechanically every single time.

Giving me a mechanical range.

We could then get a lot more technical by looking for liquidity, 50% of the range or places such as supply or demand areas.

But these are all for other posts.

For now, getting a range on the higher timeframes means you can work down and down into a timeframe you are likely to want to trade on.

These ranges will give clues to draws and runs of liquidity.

This will also help identify changes in the character and fresh breaks of structure.

Here's another post I posted on the mechanical structures and techniques.

More in the next post.

Have a great week!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

Discord Server for education and advanced techniques: discord.gg/5t3w47raHe

Masterclass Webinar: mayfairtradingevents.com

Prop firm partners (FTMO)

shorturl.at/hBEQ4

Masterclass Webinar: mayfairtradingevents.com

Prop firm partners (FTMO)

shorturl.at/hBEQ4

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Discord Server for education and advanced techniques: discord.gg/5t3w47raHe

Masterclass Webinar: mayfairtradingevents.com

Prop firm partners (FTMO)

shorturl.at/hBEQ4

Masterclass Webinar: mayfairtradingevents.com

Prop firm partners (FTMO)

shorturl.at/hBEQ4

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.