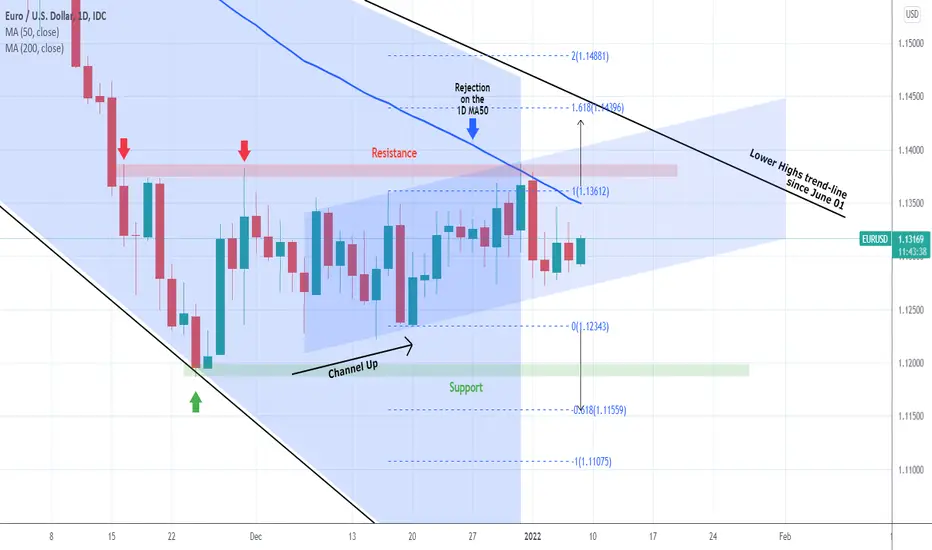

The pair has stayed sideways on a 50 day time-frame (since November 16) but bullish on Higher Highs and Higher Lows (since December 15) hence forming a Channel Up. My outlook is unchanged and ahead of the Nonfarm Payrolls today, the market has the catalyst that will introduce liquidity and help break-out.

On December 31, EURUSD got rejected exactly on the 1D MA50 (blue trend-line), which as I've mentioned multiple times in the past, is the current Resistance on any upside break-out attempts. As long as it holds, a test of the 1.11875 Support is likely. If it breaks however, I expect an immediate push toward the 1.618 Fibonacci extension level at 1.14395, which will make direct contact also with the Lower Highs trend-line since June 01. Above that level, we can claim that the long-term bullish sentiment will return. On the other hand, a break below 1.12345, will most likely also break the 1.11875 Support and target the -0.618 Fib extension at 1.11560.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

On December 31, EURUSD got rejected exactly on the 1D MA50 (blue trend-line), which as I've mentioned multiple times in the past, is the current Resistance on any upside break-out attempts. As long as it holds, a test of the 1.11875 Support is likely. If it breaks however, I expect an immediate push toward the 1.618 Fibonacci extension level at 1.14395, which will make direct contact also with the Lower Highs trend-line since June 01. Above that level, we can claim that the long-term bullish sentiment will return. On the other hand, a break below 1.12345, will most likely also break the 1.11875 Support and target the -0.618 Fib extension at 1.11560.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.