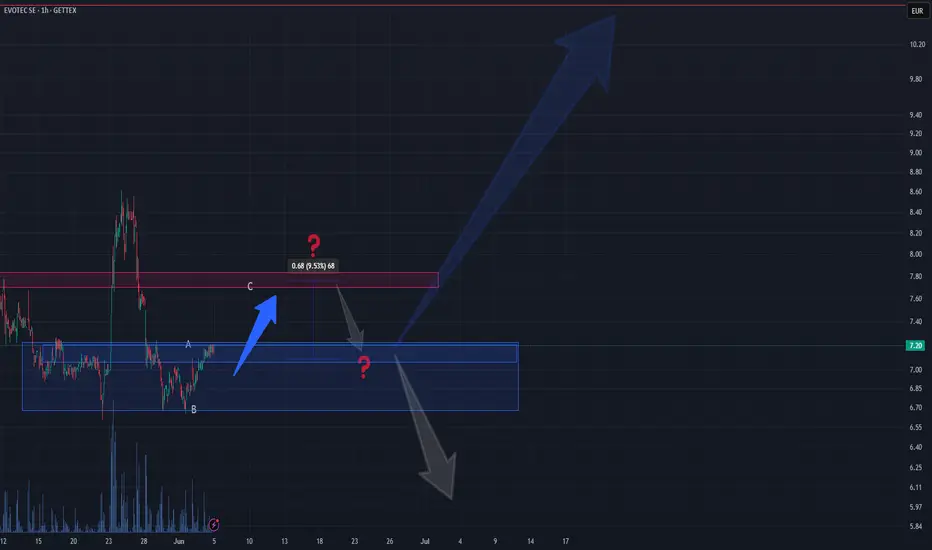

After the sharp rejection from 8.50 EUR, price printed a three-leg corrective

move that bottomed at 6.50 EUR. The climb from 6.70 EUR is unfolding as an

A-B-C zigzag rather than an impulsive five-wave rally.

Wave map

• Wave A: 6.70 → 7.20 EUR

• Wave B: 7.20 → 6.90 EUR (deep, time-consuming pullback)

• Wave C: now advancing toward 7.70 – 7.80 EUR (first supply)

Key zones

• **Buy box (demand)** 7.05 – 7.25 EUR ↳ ideal entry for wave-C continuation

• **Sell box (supply)** 7.70 – 7.80 EUR ↳ completion area of the zigzag

• Extension target 11.00 EUR ↳ only if 7.80 EUR clears on high momentum

Expectations

The pair of gray arrows on the chart illustrate two scenarios:

1. **Fast resolution** – price tags 7.70 – 7.80 EUR, exhausts wave C, and rolls

back into the 7.20 / 6.90 EUR pocket to start a larger-degree decline.

2. **Time burn** – price drifts sideways inside the blue range, building

structure before a final wave C pop; result is the same retest of demand.

Bias remains bullish toward 7.70 EUR while the 7.05 EUR floor holds, but the

move is classified as corrective, not impulsive; once complete, a return to

range-low support is favored.

move that bottomed at 6.50 EUR. The climb from 6.70 EUR is unfolding as an

A-B-C zigzag rather than an impulsive five-wave rally.

Wave map

• Wave A: 6.70 → 7.20 EUR

• Wave B: 7.20 → 6.90 EUR (deep, time-consuming pullback)

• Wave C: now advancing toward 7.70 – 7.80 EUR (first supply)

Key zones

• **Buy box (demand)** 7.05 – 7.25 EUR ↳ ideal entry for wave-C continuation

• **Sell box (supply)** 7.70 – 7.80 EUR ↳ completion area of the zigzag

• Extension target 11.00 EUR ↳ only if 7.80 EUR clears on high momentum

Expectations

The pair of gray arrows on the chart illustrate two scenarios:

1. **Fast resolution** – price tags 7.70 – 7.80 EUR, exhausts wave C, and rolls

back into the 7.20 / 6.90 EUR pocket to start a larger-degree decline.

2. **Time burn** – price drifts sideways inside the blue range, building

structure before a final wave C pop; result is the same retest of demand.

Bias remains bullish toward 7.70 EUR while the 7.05 EUR floor holds, but the

move is classified as corrective, not impulsive; once complete, a return to

range-low support is favored.

Trade closed: target reached

💼 Professional market insights & charts:

cakirinsights.com/

cakirinsights.com/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💼 Professional market insights & charts:

cakirinsights.com/

cakirinsights.com/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.