... for a 3.22/contract credit ... .

Metrics:

Probability of Profit: 50%

Max Profit: $322/contract

Max Loss: $278/contract

Theta: 1.71/contract

Delta: -7.06/contract

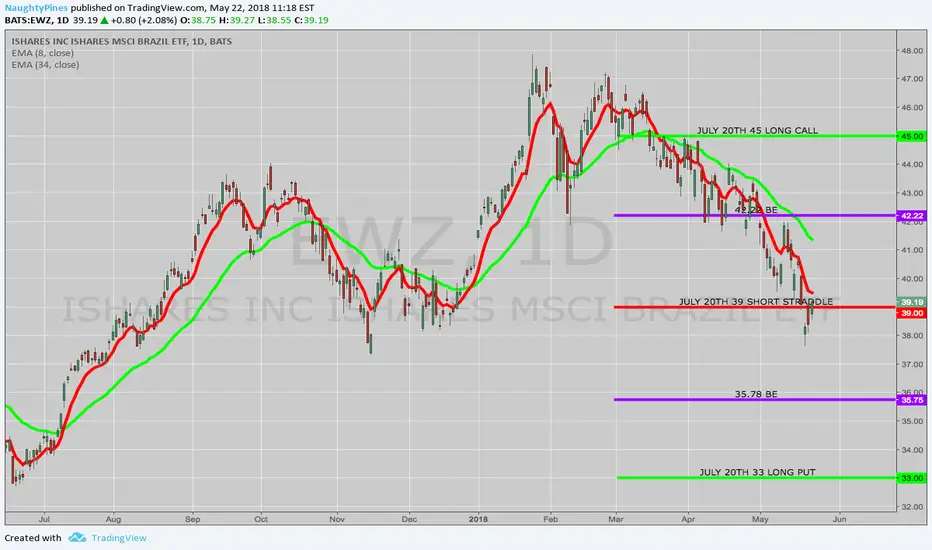

Break Evens: 35.78/42.22

Notes: With a background implied of around 31%, it's the highest vol exchange-traded fund out there. As with a short straddle, I'll look to manage the trade early (25% max). If vol comes way in, I'll take profit even earlier ... .

Metrics:

Probability of Profit: 50%

Max Profit: $322/contract

Max Loss: $278/contract

Theta: 1.71/contract

Delta: -7.06/contract

Break Evens: 35.78/42.22

Notes: With a background implied of around 31%, it's the highest vol exchange-traded fund out there. As with a short straddle, I'll look to manage the trade early (25% max). If vol comes way in, I'll take profit even earlier ... .

Trade active

Well, that escalated quickly ... . With price having caved in to around my BE at 35.78 almost immediately, will look to scratch this out at the earliest possible opportunity and re-up if the vol is there.Trade active

The call side is closing in on worthless (.05) with this down move, so I'll be taking that side off at the earliest possible opportunity. At this point, not much can be done with the put side; I've already looked at rolling out for a debit to August and selling the same call side against (the 39/45) as I had on in July, but I won't receive enough credit for that such the whole deal is a "net credit package." The other options are to (a) wait with fingers crossed that it erases part of this down move and then either close it out for a smaller loss or look at rolling out for duration at that point and then sell a call side against; (b) sell the long put back while it has some value and "go naked"; or (c) do something funky to finance the roll of the put side (e.g., sell a 20-delta IC or another fly) to bring in a credit to offset what it costs to roll the put side.Trade active

Taking the rolling to naked option while I can still get something for the long put: Covering the long put for a 1.16 credit and rolling the July 39 short straddle all the way out to the Nov 35 short straddle for a .97 credit; the long call is no bid, so I'll just let it expire worthless; scratch at 3.22 + .97 + 1.16 = 5.35. This results in a slightly long delta short straddle with BE's at 28.48/41.52. Ordinarily, I don't like to roll out this long in time, opting instead to roll out the tested side "as is" and sell the 30 delta oppositional side against in the next monthly and whittle away at cost basis over time, but wanted to keep the short straddle as a short straddle and get the setup net delta to something more neutral.Trade active

Rolling the Nov 35 call down to the Nov 34 call for a realized gain and a .36 credit (delta balancing somewhat so that I'm less long delta), so I'm now slightly inverted with a scratch point of 5.71.Trade active

Trying to be patient here and let the extrinsic piss out: current value of setup is 6.24/contract versus 5.71 scratch, so we're getting close. BE's are 28.76/40.24 currently, so plenty of room to be wrong and still make out ... .Trade active

Rolling the 35 short put to the 39 for a 1.16/contract credit; scratch at 6.87 with an inverted 34C/39P (a 5-wide).Trade active

Starting a new post for this long-in-the-tooth trade.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.